Bitcoin has recently faced resistance to $ 106,000, while the largest investors out of the market creates uncertainty in price movements. Balancing and decreasing leverage use of funding rates show that investors are cautious.

Can Bitcoin exceed $ 106,000 resistance?

Bitcoin is traded at $ 105,780 by gaining a value of 3.73 percent in the last 24 hours and 0.1 percent in the last week. However, it is difficult to overcome $ 106,148 resistance. Analyst Rek Capital says that BTC is in a triangular formation and that a one -day closing above this level can trigger the rise trend.

If this level cannot be passed, it is thought that BTC may experience a decrease similar to the corrections it has experienced after the sudden rise in the past. Especially the $ 101,165 level is seen as a critical support point. If this level is broken, a withdrawal of $ 91,070 or $ 87.325 may be possible.

Whale movements and market effect

Speed -top data show that there is a decrease in the number of large Bitcoin owners. According to Analyst Ali, about 70 whales, which have kept more than 1000 BTC since mid -December, left the market or made sales. This may indicate that large investors question market confidence or reorganize their portfolios.

In contrast, Bitcoin’s sensitivity to the US Federal Bank’s interest policies is reduced. According to centimeter data, BTC is now far from acting like high -risk technology shares and is seen as a more independent asset. However, the sales pressure of whales can increase price volatility in the short term.

Signals of indecision in the market

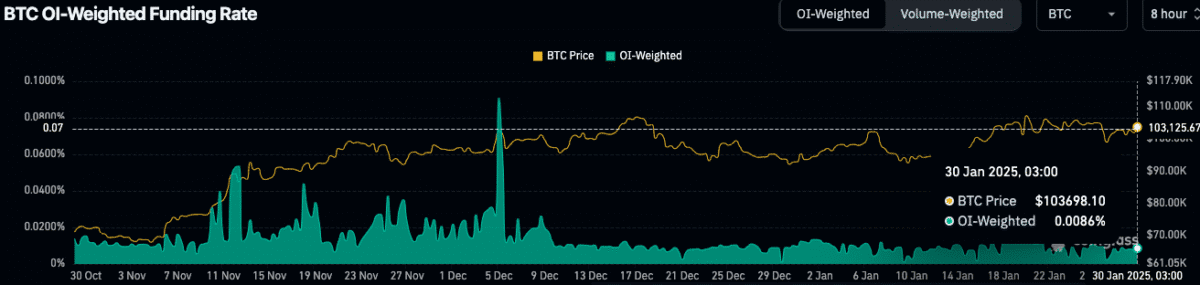

BTC’s funding rates reveal that investors are in search of direction as an indicator that measures the cost of leveraged transactions. At the beginning of December, the funding rates, which have a sharp rise with a price increase, are currently fixed at 0.008 levels.

On the other hand, open positions in BTC futures increased by 3.39 percent to $ 66.06 billion. The option volume increased by 11.68 percent to 3.45 billion dollars. Although the interest in the market continues, investors do not have a clear opinion on the direction of the price.

Break or correction for Bitcoin?

The most critical question for Bitcoin’s short -term movements is whether it can close daily $ 106.148. If this happens, the price of BTC can be expected to move towards $ 110,000.

However, if the resistance persists at this level, the BTC is likely to consolidate up to $ 101,000 or make a correction up to $ 91,000. Stabilization in whale movements and funding rates shows that investors closely monitor critical levels and are waiting for developments to determine the direction of Bitcoin.