Bitcoin Faces Downside Pressure Amid Waning Demand

Bitcoin (BTC) recently rebounded from a dip to $93,000 on Tuesday, yet analysts at CryptoQuant warn that persistent downside pressure could push the cryptocurrency down further, potentially reaching $86,000. Several factors contribute to this bearish outlook, including diminishing demand, weakening blockchain activity, and a notable lack of liquidity inflows into the crypto market.

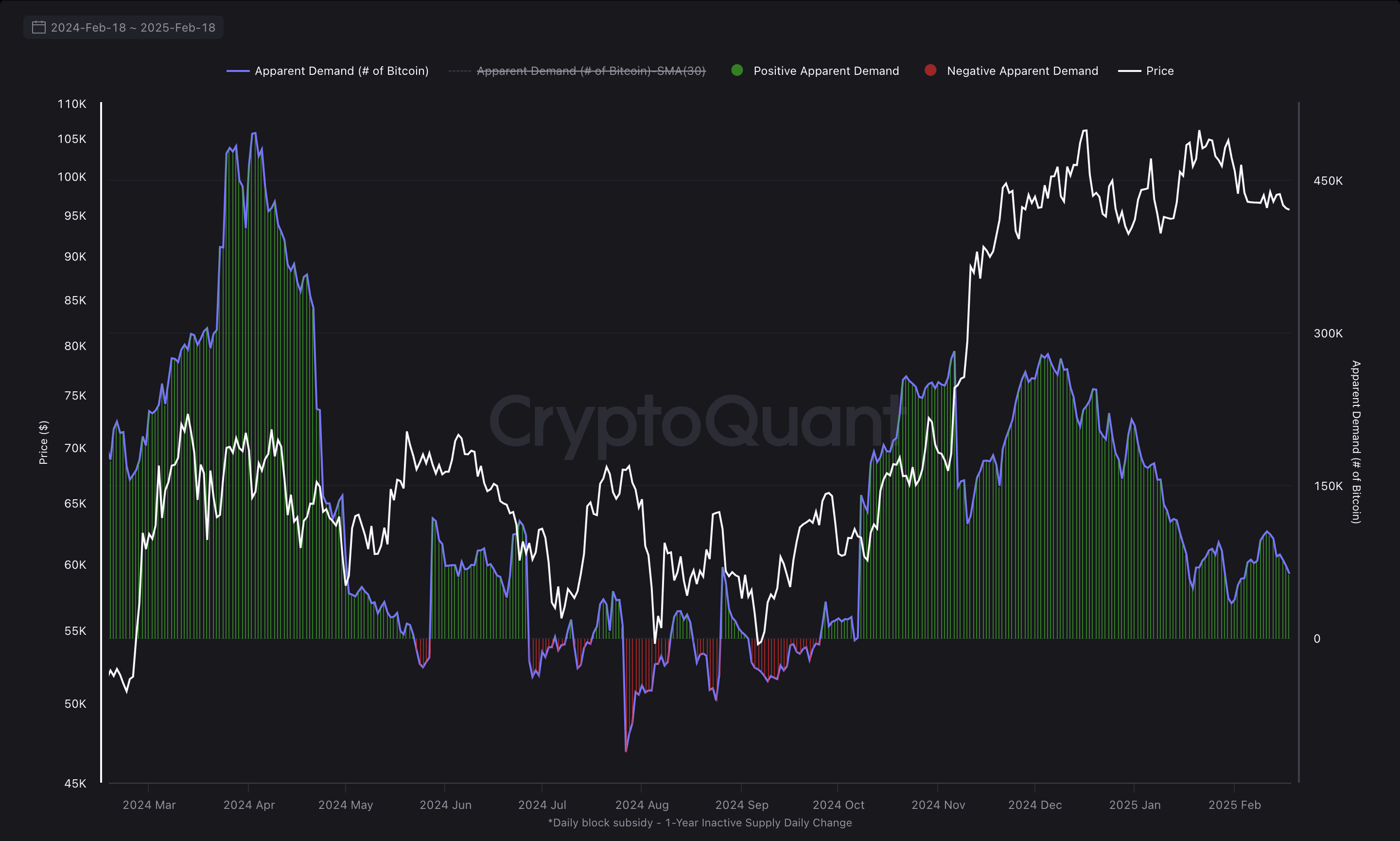

The initial surge in demand for Bitcoin observed in late 2024—fueled by optimism surrounding easing regulatory constraints following Donald Trump’s election win—now appears to be receding. According to CryptoQuant’s data, demand growth has plummeted to 70,000 BTC, a stark decline from the impressive peak of 279,000 BTC recorded on December 4.

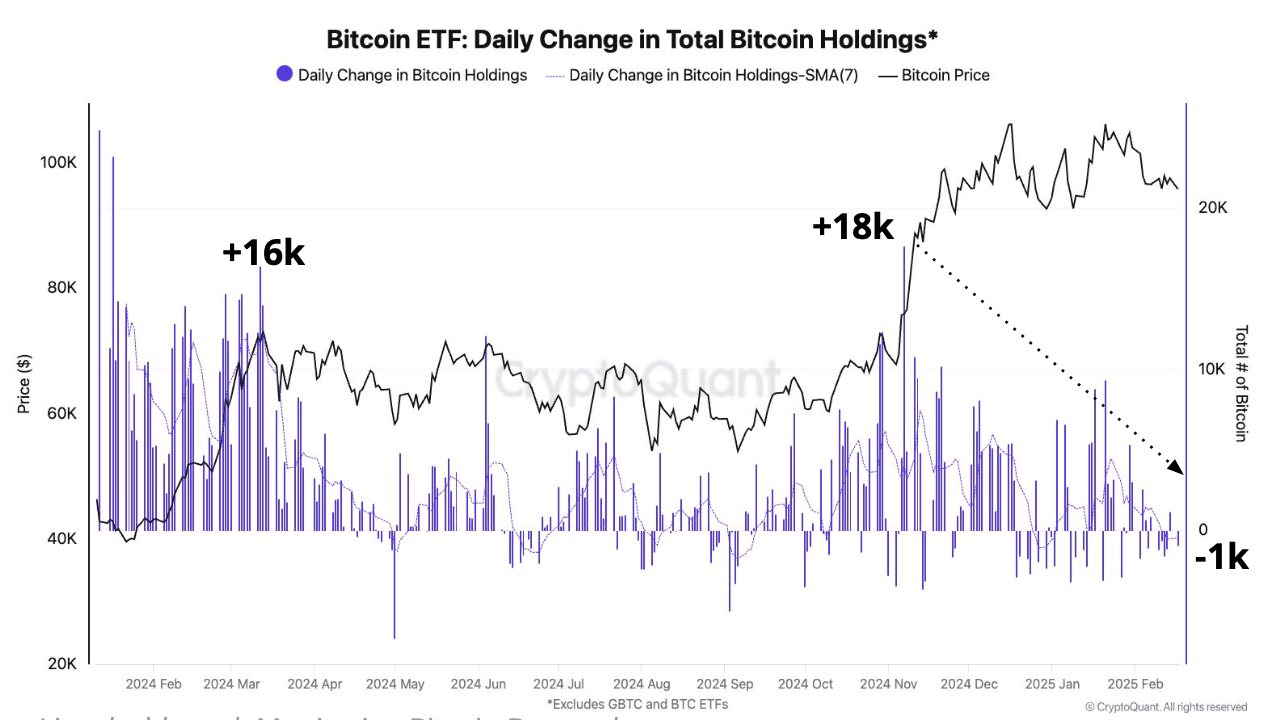

Moreover, inflows into spot Bitcoin exchange-traded funds (ETFs), which typically accompany Bitcoin’s rallies, have vanished, resulting in consistent net outflows over the past two weeks. This follows a period in November and December when daily purchases reached as high as 18,000 BTC.

In addition to the ETF trends, CryptoQuant’s Inter-exchange Flow Pulse, which monitors Bitcoin transfers between exchanges, highlights a decrease in BTC transactions directed towards Coinbase—often viewed as a key indicator of U.S. spot demand—falling below its 90-day moving average.

Another critical element impacting the market is the stagnation in stablecoin growth, which traditionally serves as a vital catalyst during crypto market rallies. Although the total market capitalization of stablecoins recently surpassed an all-time high of $200 billion, the rate of this expansion has significantly slowed down. The 60-day average change in USDT, the largest stablecoin by market cap, has plummeted by over 90% since mid-December, dropping from over $20 billion to just $1.5 billion. This slowdown suggests a lack of fresh capital entering cryptocurrency exchanges, which is crucial for sustaining upward price momentum.

Furthermore, muted blockchain activity on the Bitcoin network raises additional concerns for analysts. The Bitcoin Network Activity Index from CryptoQuant indicates that network activity has fallen to its lowest levels in a year. This metric is down by 17% from its peak in November 2024 and has dipped below its 365-day moving average for the first time since July 2021—coinciding with China’s crackdown on BTC mining. A decline in transaction volume signals a decrease in investor engagement and diminishing speculative interest in the market.

Could BTC Find a Bottom Soon?

After reaching a new all-time high of $109,000 in January—driven by optimism regarding Trump’s presidency—Bitcoin has struggled to maintain its value, lingering in a narrow trading range above $90,000. The broader sentiment in the cryptocurrency market has also been shaken by several controversial memecoin launches in recent weeks, including TRUMP memecoin and LIBRA, which have drained speculative capital and undermined investor confidence.

Trader Bob Loukas has noted that the sentiment reset is nearing completion as Bitcoin approaches the final stretch of its weekly cycle. While BTC may find a bottom in this corrective phase soon, it could potentially dip below the critical $90,000 range. Loukas remarked on social media, “It’s more a question of whether the bottom of the range (90k) can hold.” Regardless of the outcome, he emphasizes that the sentiment reset will occur regardless of price fluctuations.