Market Sentiment Reflected in Bitcoin’s Price Action

Technical charts, especially the formation of candlesticks, serve as a visual representation of market psychology, shedding light on trader sentiment and behavior. Since last Friday, at least two significant bitcoin (BTC) candles have emerged, suggesting a bullish momentum at multi-month lows, which may offer a glimmer of optimism for crypto enthusiasts.

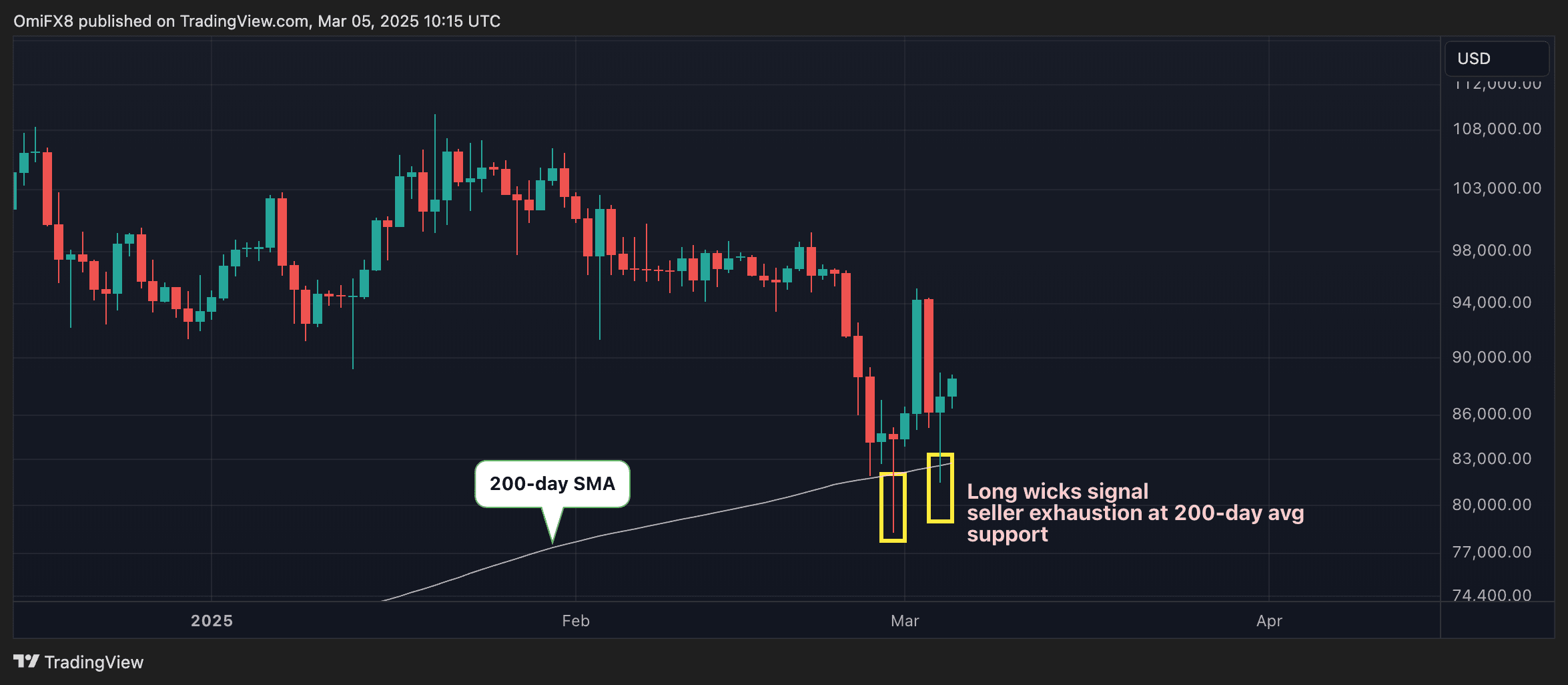

The accompanying chart illustrates how BTC’s price decline has recently stalled at the critical 200-day simple moving average (SMA) support level, with this stabilization occurring since last Wednesday. Notably, the daily candles for both Tuesday and Friday are of particular interest; each features small bodies accompanied by long lower wicks. This indicates a failure of the bears to maintain control below the 200-day SMA.

In practical terms, on both of these days, sellers attempted to push prices beneath this essential average but ultimately could not secure a definitive hold there. This failure is likely attributed to buyers stepping in to defend the support level, showcasing a potential shift in market dynamics.

Candles like these, which appear following a significant downtrend—as is the case with BTC—are often interpreted as indicators of a possible bullish reversal. Traders typically view this as evidence of diminishing selling pressure, which could lead to a renewed phase of bullish activity in the market.

As a result, BTC might experience a bounce back towards Sunday’s high of approximately $95,000, and a breach above this level could reignite traders’ focus on the coveted $100,000 mark. Conversely, if the price breaks below the 200-day SMA, it could signal deeper losses ahead, raising concerns for those invested in the cryptocurrency.