Bitcoin (BTC) has historically seen its price drop from its previous highs for over three years, with the most recent peak just seven months ago. The leading cryptocurrency suffered one of its most brutal crashes ever in 2022, and as we reported on Cryptokoin.com, the BTC price dropped below $20,000 in June after hitting $68,000 in 2021. June 2022 was the worst month for Bitcoin since September 2011, with its monthly losses reaching 40 percent. That said, current market sell-offs aren’t crashing Bitcoin and markets special to 2022 aren’t making them bearish. The leading cryptocurrency has experienced several crypto winters before and witnessed massive price crashes. Here are the 5 bear markets with the biggest collapses in BTC history…

1- Bitcoin fell from $32 to $0.01 in 2011 (June 2011–February 2013)

Bitcoin price broke the first major psychological resistance of $1.00 in late April 2011 to begin its first rally to $32 on June 8, 2011. The price reached as high as $32, however, the joy did not last long as Bitcoin later depreciated. The price remained at just $0.01 for several days. The sharp sell-off is largely due to the now-defunct Mt. Linked to security issues in Gox. The exchange saw 850,000 BTC stolen due to a security breach on its platform, raising major concerns about the security of Bitcoin stored on exchanges.

https://twitter.com/who_knows/status/82512464658432000

Bitcoin’s sudden crash in June 2011 has become a big part of Bitcoin history, with BTC losing around 99 percent of its value in a matter of days. Pre-2013 Bitcoin price is hard to follow compared to newer charts. Popular price tracking services, such as CoinGecko or CoinMarketCap, do not track Bitcoin prices before April 2013. Bobby Ong, COO of CoinGecko, said in a statement:

Bitcoin was in its infancy before 2013 and there weren’t many places trading Bitcoin at that time. We don’t get a lot of requests for pre-2013 data, so our platform doesn’t have a priority to review this period.

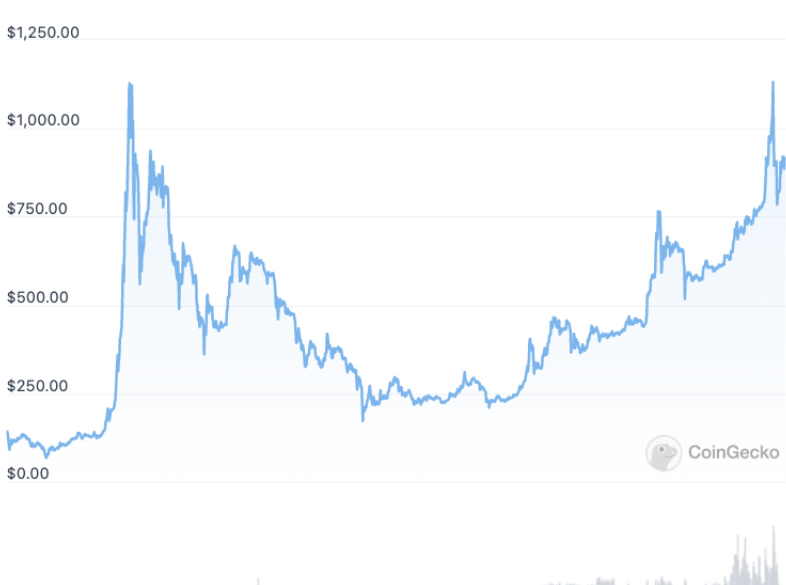

2: Bitcoin fell from $1,000 to below $200 in 2015 (November 2013–January 2017)

According to BTC price data, the price reached $100 in mid-April 2013 and then briefly continued to $1,000 in November 2013. Bitcoin entered a major bear market shortly after breaking $1,000 for the first time in its history, and a month later, the BTC price dropped below $700. The price drop began when the Chinese central bank and local financial institutions banned it from conducting BTC transactions in late 2013. The cryptocurrency continued to decline for the next two years, dropping by around $360 in April 2014 and then in January 2015. It went as low as $170.

The U.S. Commodity Futures Trading Commission claimed in late 2014 that “Bitcoin has the power of price manipulation,” and some major financial authorities have also expressed concerns about Bitcoin. The general perception around Bitcoin was mostly negative until August 2015, when the trend started a long-term reversal. Amid the strong bullish market, Bitcoin finally bounced back to the $1,000 price level in January 2017. This was the highest price recovery period of all time in Bitcoin history.

3: Bitcoin drops below $3,200 after hitting $20,000 in December 2017 (December 2017 – December 2020)

After BTC surged to $1,000 in January 2017, it continued to climb as high as $20,000 later that year. However, similar to Bitcoin’s previous historic peak of $1,000, the $20,000 victory was short-lived, as Bitcoin then plummeted and lost more than 60 percent of its value in a matter of months. As the Bitcoin market continued to shrink, 2018 quickly became known as the “crypto winter,” with BTC dropping to around $3,200 in December 2018. The crypto winter started with security issues at Coincheck, another Japanese cryptocurrency exchange. In January 2018, Coincheck suffered a massive hack that resulted in the loss of approximately $530 million in the NEM (XEM) cryptocurrency.

The bear market escalated further when tech giants like Facebook and Google banned cryptocurrency ads on their platforms in March and June 2018, respectively. Global crypto regulatory efforts have also contributed to the bear market, while the US Securities and Exchange Commission has rejected applications for funds traded on the BTC exchange.

4: BTC drops from $63,000 to $29,000 in 2021 (April 2021–October 2021)

The bear market dominated the crypto market until 2020, when Bitcoin not only returned to $20,000 but entered a massive bull run in April 2021, hitting over $63,000. Despite 2021 being one of the biggest years for Bitcoin and surpassing the $1 trillion market cap of the cryptocurrency, it has suffered a slight disadvantage. Shortly after breaking all-time highs in mid-April, Bitcoin pulled back slightly and its price eventually dropped as low as $29,000 in three months. The 2021 mini bear market came amid a growing media rumor suggesting that Bitcoin mining has an environmental, social and corporate governance (ESG) issue.

https://twitter.com/LinaSeiche/status/1406484262442835970

The FUD regarding the global ESG around Bitcoin worsened when Elon Musk’s electric car firm Tesla stopped accepting Bitcoin as payment in May, with CEO ESG voicing his concerns. Just three months later, Musk acknowledged that about 50 percent of Bitcoin mining runs on renewable energy. The bear market did not last long even as China began to put massive pressure on local mining farms. The uptrend returned at the end of July, and Bitcoin finally rallied to $68,000, its still unbroken all-time high posted in November 2021.

5: BTC drops below $20,000 from $68,000 in 2022

Bitcoin failed to exceed $70,000 and started to decline in late 2021. The cryptocurrency has slipped into a bear market since November last year, recording one of its biggest historical crashes in 2022. In June, the cryptocurrency dropped below $20,000 for the first time since 2020, creating extreme fear in the market. The ongoing bear market is largely attributed to the crisis of algorithmic stablecoins (i.e. TerraUSD Classic (USTC) stablecoin) designed to support a stable 1:1 peg to the US dollar through blockchain algorithms rather than equivalent cash reserves. USTC, once a major algorithmic stablecoin, lost the dollar in May.

The unbundling of USTC triggered a major panic over the broader crypto markets as it managed to become the third largest stablecoin in existence before the stablecoin collapsed. Terra’s collapse had a domino effect on the rest of the crypto market amid massive liquidations and uncertainty fueling a crisis in cryptocurrency lending. A number of global crypto lenders such as Celsius have had to suspend their withdrawals due to their inability to maintain liquidity in the brutal market conditions. It is not yet clear whether or when Bitcoin will be able to reach new highs.