Bitcoin (BTC) remained firmly within the range it has held for much of the past two weeks, trading as low as about $27,200 and as high as $28,400 Monday.

The largest cryptocurrency by market capitalization was recently trading at $27,500, down over 2% from 24 hours ago. BTC is up nearly 70% for the year after a buoyant first quarter in which investors grew more optimistic about inflation and other macroeconomic issues.

Yet BTC’s price has been unable to ride above $29,000 for more than a few, fleeting minutes in recent weeks as investors mull banking failures and fresh economic indicators that have been non-conclusive.

“Bitcoin needs a bullish catalyst to break above the $30,000 level, but until some significant use case argument is made, prices could consolidate around the mid-$20,000s,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in an email.

Ether (ETH), the second-largest cryptocurrency, also slid 0.2% Monday to hover around $1,787. ETH’s price jumped 48% in the first quarter. Among other altcoins, the meme-based dogecoin (DOGE) – long supported by Twitter CEO Elon Musk – surged 16.5% after the social media platform changed its logo to the dogecoin symbol from a blue bird. Payments provider Alchemy Pay’s native ACH token rose 7% after a Monday report that the company has received $10 million in investment from market maker DWF Labs at a $400 million valuation.

The CoinDesk Market Index, which measures overall crypto market performance, was up 0.1% for the day.

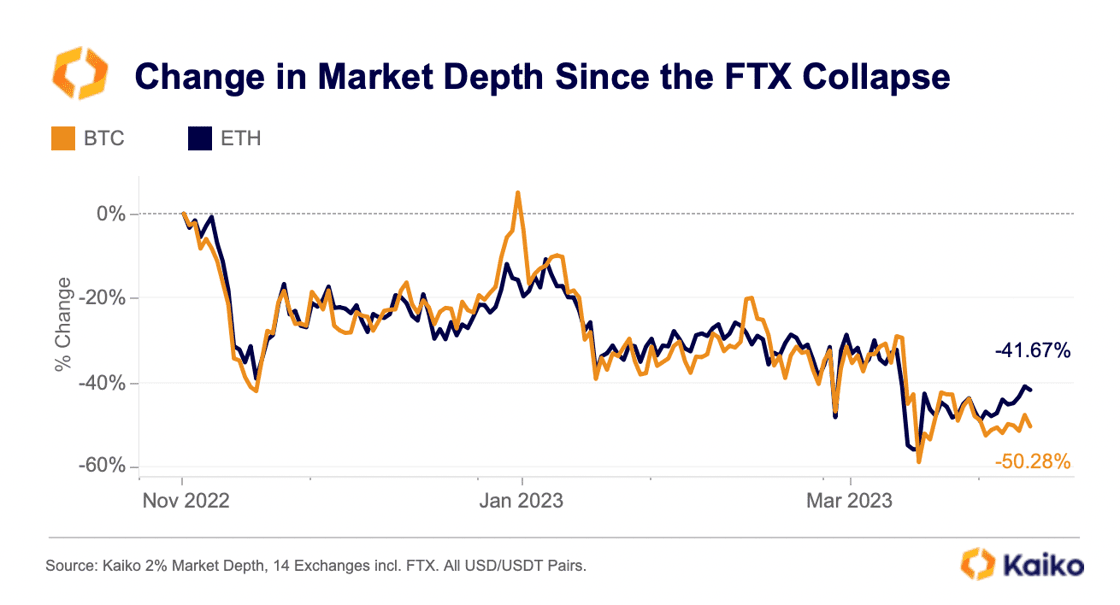

Meanwhile, market liquidity has continued to worsen. Crypto data firm Kaiko’s Monday report noted that both BTC and ETH’s 2% market depth, a metric for assessing liquidity conditions, has dropped by 50% and 41%, respectively, since the collapse of Alameda Research, the trading arm of embattled crypto exchange FTX last November – a so-called “Alameda gap.” The ongoing decline has followed exchange Binance’s announcement that it was curbing its zero-fee trading program, Kaiko said.

(Kaiko)

“Both assets (bitcoin and ether) have suffered in the aftermath of the FTX collapse and banking crisis, with fewer market makers supplying liquidity to order books,” the report said.

Equity markets were mixed Monday. The S&P 500 closed up 0.3%, while the Dow Jones Industrial Average (DJIA) rose by 0.9%. However, the tech-heavy Nasdaq was down 0.2%.

Recommended for you:

- Craig Wright v. Peter McCormack: Judge Rules McCormack Should Pay Around $1.1M in Costs

- CoinGecko’s Bobby Ong on the Metaverse

- NFTs Are Now Collateral for Secured Loans. Are You Legally Protected?

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Traditional market movements came after OPEC+ unexpectedly announced an oil production cut of over one million barrels a day, sending oil prices higher. Meanwhile, the Manufacturing Purchasing Managers’ Index (PMI) on Monday showed that U.S. manufacturing activity in March dropped to its lowest level in nearly three years.