Recently, Bitcoin (BTC) prices are traded on a narrow band around $ 96,000 and the market is moving in an uncertain environment. Analysts point out that BTC may not be able to hold on current levels and the possibility of experiencing a deeper correction has increased. According to Cryptoquant’s data, demand is weakened, network activity has decreased, and liquidity entry decreases, while this is among the factors that can increase the downward pressure in Bitcoin’s price. Analysts predict that the levels of 86,000 dollars may be possible, but a possible bottom point in the market is to be completed and the market sensation change in Bitcoin is approached. Here is the critical Bitcoin estimation of the experts

86,000 dollars Bitcoin estimation

Bitcoin has been trading in a narrow band around 96,000 dollars in recent days, but analysts, according to Cryptoquant data, says there are some warning signs that BTC may decline to $ 86,000. According to experts, Bitcoin demand, network activity and liquidity conditions continue to remain weak, which creates more downward pressure on prices.

Bob Loukas, Bitcoin’s weekly cycle approached the end of the market’s sense of interest in the market is almost completed, he stressed. Although Bitcoin declined to $ 93,000 on Tuesday and had a rapid recovery, the downward pressure is still going on and the risk of withdrawing to $ 86,000 is at risk. Falling demand, weakened blockchain activity and lack of liquidity entry into the crypto currency market are among the factors that may cause BTC to fall further.

There is a decrease in BTC demand

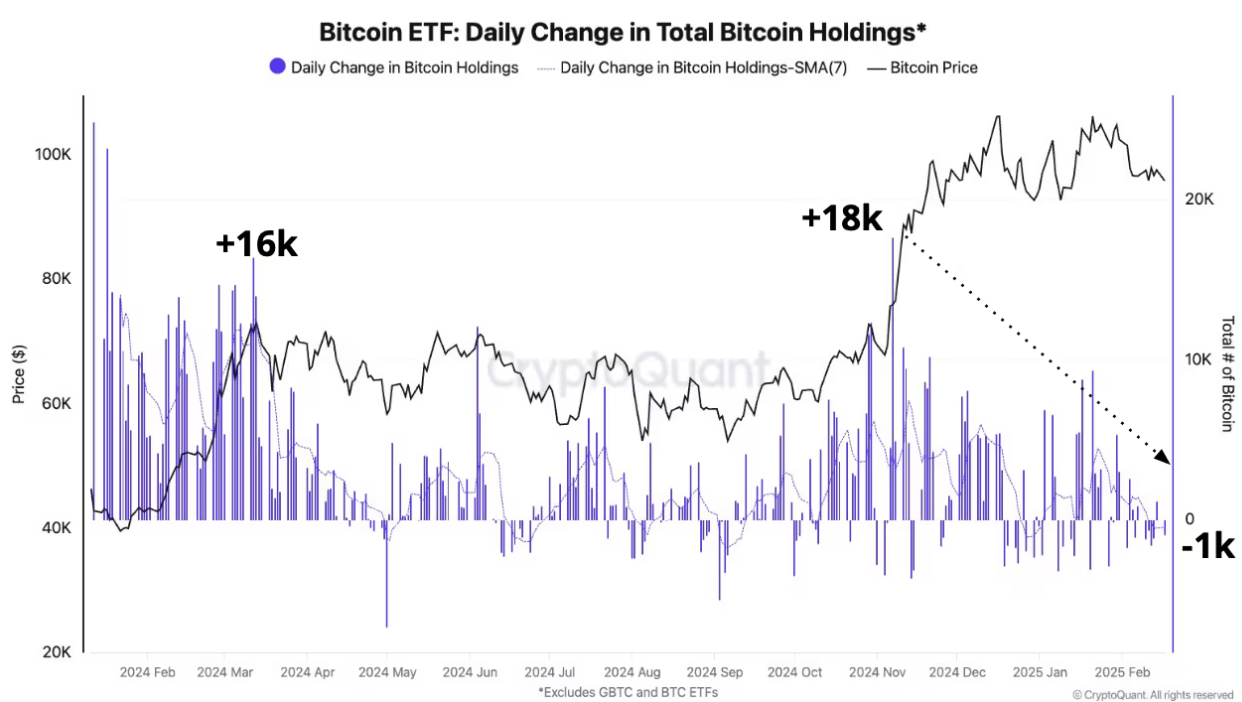

Towards the end of 2024, the demand for BTC has increased with the alleviation of regulation pressures with Trump’s election victory, and now this demand has declined. According to Cryptoquant data, demand growth rose to 279,000 BTC on December 4, while this figure has recently fell to 70,000 BTC. Investments in Bitcoin Spot ETFs (stock market investment fund) have also decreased. In November and December, 18,000 BTC purchases have been seen in ETFs, regular net outputs have been experienced for the last two weeks.

The Inter-Exchange Flow Pulse indicator of Cryptoquant also gives signals of weakness by the fact that BTC’s transfers to Coinbase, ie the US spot demand falls below the 90-day moving average. In addition, the growth of stablecoins is an important indicator as the main fuel of crypto market rally, but has recently lost speed. The increase in market value of the largest stablecoins, such as USDT (TETHER), has decreased by 90 %since mid -December.

Finally, the low trading volume in the Bitcoin network gives more warning signs than Cryptoquant analysts. Bitcoin’s network activity fell to the lowest level of a year and a decrease of 17 %compared to the summit in November 2024. This shows that investor interest and speculative demand are reduced. As we have reported as Kriptokoin.com, Bitcoin had reached $ 109,000 in January with the expectation of Donald Trump’s president, but since then it has been difficult to hold on top of $ 90,000.