Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and other major altcoins had a turbulent start to the week as the new trading day opened with significant volatility. The market has witnessed notable corrections and gains, setting the tone for the coming week.

Bitcoin and altcoins are in the red zone

The week started with Bitcoin experiencing a 5% drop in a 24-hour period, falling as low as $41,300 before rising to $42,000. Ethereum and Solana followed suit, experiencing brief declines to $2,170 and $66, respectively, before recovering. Most of these fluctuations occurred in the hours before press time. It contributed to a red zone for major cryptocurrencies.

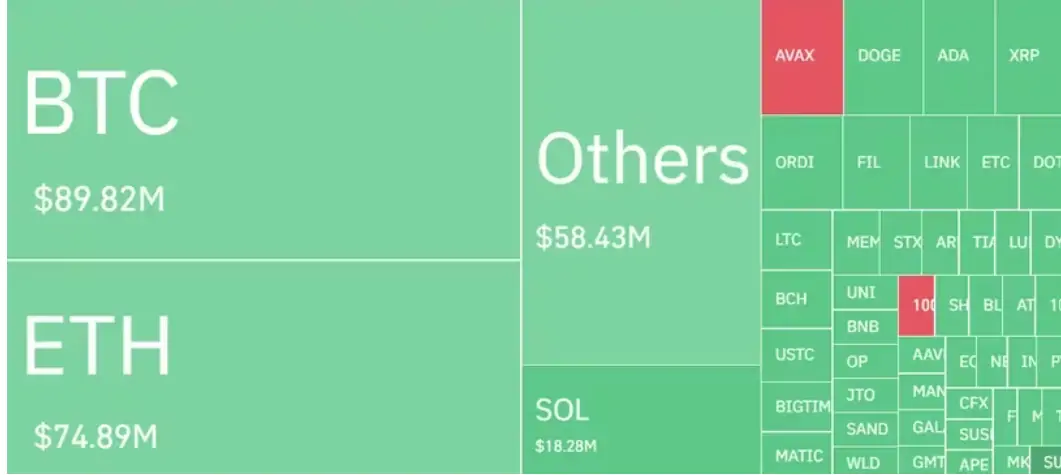

Greta Yuan, Head of Research at VDX in Hong Kong, attributed the market adjustment to better-than-expected nonfarm payrolls and lower unemployment. Coinglass data, which you can see in the image above, showed that Bitcoin and Ether witnessed liquidations of over $335 million, led by $89 million and $74 million respectively. Analysts such as Lucy Hu and Willy Woo pointed to rational profit taking and potential corrections linked to economic indicators.

What do experts say?

Willy Woo highlighted the possibility of a correction in Bitcoin prices to $39,700, citing the Bitcoin CME gap. This phenomenon occurs when a gap is left in Bitcoin’s price on the Chicago Mercantile Exchange, historically leading to a price pullback. Cryptocurrency analyst Michael Van de Poppe stated that there is a breakout in the Altcoin market value and suggested potential areas for a peak between $1.1-1.3 trillion.

The #Bitcoin CME Gap at 39.7k…

By my count 28 out of 30 gaps have been filled on CME daily candles (93%). The other unfilled gap is pictured in the lower left of this chart also. pic.twitter.com/EyccaJTTkr

— Willy Woo (@woonomic) December 7, 2023

The total #Altcoin market capitalization is breaking out after an 18-month sideways range.

Finally.

The next potential areas for a top are going to be between $1.1-1.3T. pic.twitter.com/ZcocL14LxV

— Michaël van de Poppe (@CryptoMichNL) December 10, 2023

EQI Bank Executive Director Eli Taranto warned of a potential low zone for Bitcoin in the coming weeks despite a stronger-than-expected employment report. He highlighted the impact of retail investors taking profits during the holiday season and underlined the anticipation surrounding upcoming ETFs.

Similarity between Amazon and Bitcoin

Additionally, a crypto analyst named TechDev offered an intriguing comparison between Bitcoin’s recent price movements and Amazon’s stock (AMZN) from a decade ago. Sharing a chart on X, TechDev highlighted structural similarities, including double tops and sudden parabolic moves to all-time highs. The analyst suggested that a rapid move from the current level to new highs would not be unusual, given historical structural similarities.

Here’s that time $AMZN retested its prior all-time-high with an expanded flat correction.

Just as $BTC did.

Then here’s a dissection of the structural similarities of both flats.

Green line is where $BTC has moved to since the chart.

A rapid move to new highs from

here would… pic.twitter.com/2DFJpss32X— TechDev (@TechDev_52) December 8, 2023

Throughout the week, the cryptocurrency market remained dynamic, influenced by global economic indicators, on-chain analysis and market sentiment. Traders and investors are preparing for potential corrections and developments in the broader financial environment.