Bitcoin kicked off a new week by sliding 1.4% to trade at around $21,640 as worried investors chewed over regulatory activity in the stablecoin sector and the next inflation report due Tuesday.

The largest cryptocurrency by market capitalization has fallen about 9% this month to lose roughly a quarter of its gains from a January surge. Some analysts are now predicting BTC will find support at $20,000 in upcoming weeks.

Early Monday, the New York Department of Financial Services ordered Paxos to stop minting new Binance USD tokens (BUSD), saying the token wasn’t being administered in a “safe and sound” manner. The order resulted in BUSD – a fiat-backed stablecoin with a 1:1 value against the U.S. dollar – falling to 0.9950 cents against its rival tether (USDT) on the Binance exchange, crypto data firm Kaiko noted.

Bitcoin (BTC) began sinking at the start of February, although its most significant drops have come over the past week after crypto exchange giant Kraken agreed to shutter its staking service in the U.S. and to pay a $30 million fine in a settlement with the U.S. Securities and Exchange Commission (SEC).

BTC had as recently as Feb. 1 changed hands above $24,000. Investors will be eyeing Tuesday’s consumer price index (CPI) to see if the U.S. Federal Reserve’s monetary policy has continued to chip away at inflation and to predict the size of the central bank’s next interest rate hike. The CPI dipped to 6.5% in December to continue downward momentum that has pleased riskier asset markets. But Fed governors remain concerned about over-tightening money supply and casting the economy into a deep recession.

“The news flow has been rather bearish for crypto and you can’t forget about tomorrow’s inflation report that could be hot and spell trouble for risky assets,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in a Monday note.

“If inflation comes in scorching hot, bitcoin could breach the key $20,000 level and target the $18,500 region,” Moya added.

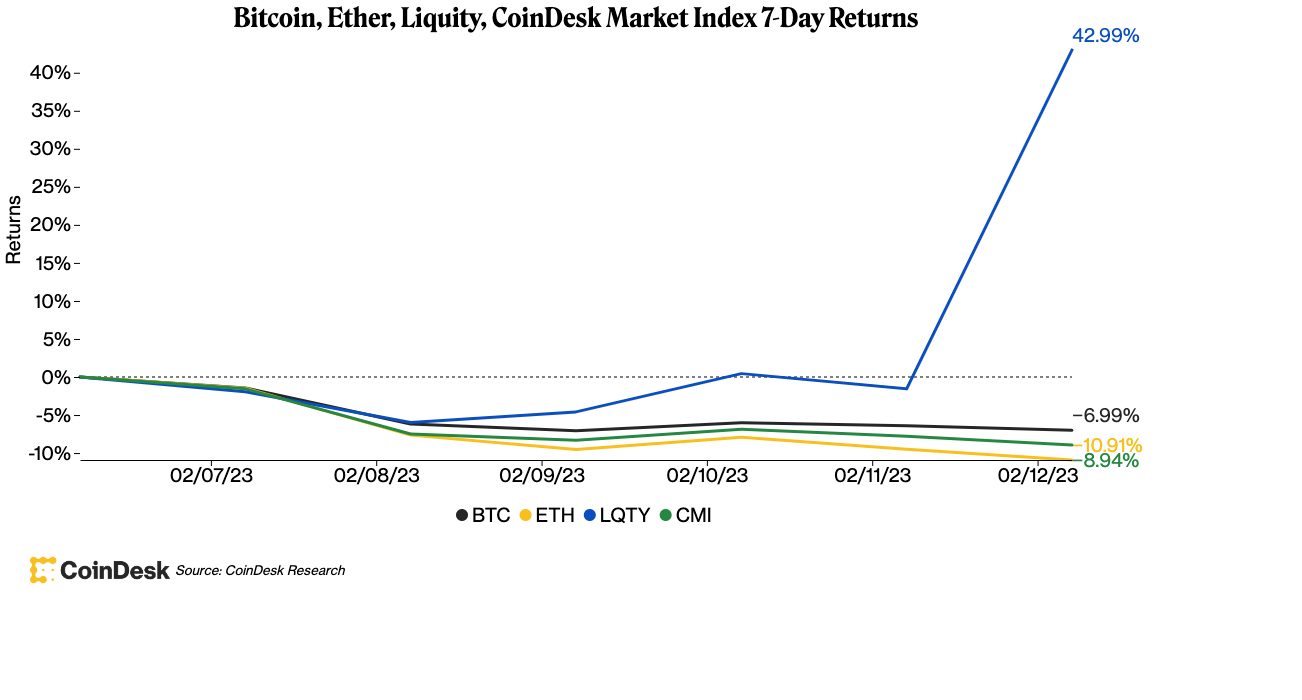

Ether (ETH) followed a similar pattern, declining 3.1% over the past 24 hours to recently trade at $1,490 – ETH’s lowest level in about a month. The CoinDesk Market Index (CMI) was down 2.8% for the day.

Bitcoin, Ether, Liquity, CoinDesk Market Index 7-Day Returns (CoinDesk Research)

Decentralized borrowing protocol Liquity was Monday’s biggest winner among over 160 assets in the CMI, with its native LQTY token surging 46% to trade at $1.01 from 69 cents from the previous day, same time.

The price jump followed Liquity’s integration with Aztec network, the privacy-focused zero-knowledge rollup on Ethereum where users can borrow its U.S. dollar-pegged stablecoin LUSD on layer 2 and save on gas fees, according to its announcement.