Crypto traders seem unperturbed by the escalating tensions in the Middle East, which threaten to add risks to the already murky global economic outlook.

That’s the message from the order flow in the bitcoin (BTC) and ether (ETH) options market, which shows a bias for selling options, a strategy aimed at profiting from low volatility or price turbulence.

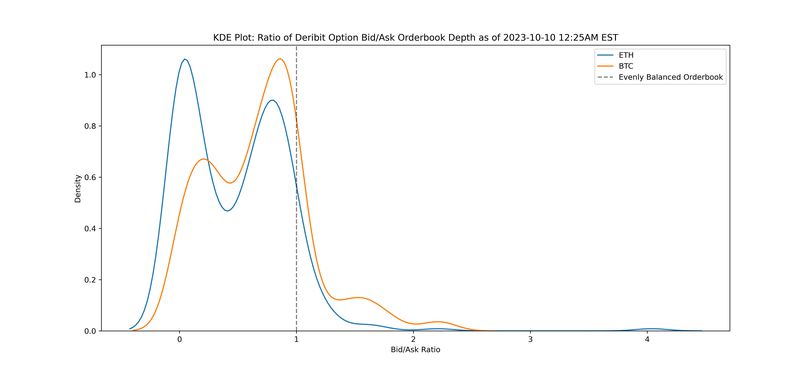

“On an aggregate basis, it becomes evident that Deribit option order books exhibit a bias towards selling volatility. This is indicated by the bid/ask ratio consistently leaning below one, where a ratio less than one suggests a preference for selling. In contrast, a ratio greater than one indicates a preference for buying,” crypto quant researcher Samneet Chepal told CoinDesk.

Options are derivative contracts that offer the purchaser the right to buy or sell the underlying asset at a preset price at a later date. A call provides the right to buy and a put offers the right to sell. Ask price is the price at which the seller is ready to sell and bid is the value at which the buyer is ready to purchase.

Deribit is the world’s largest crypto options exchange by open interest and trading volumes, controlling over 85% of the global activity in bitcoin and ether options.

Geopolitical events like the latest Israel-Palestine conflict, central bank actions and economic data announcements typically have traders buying options. The strategy is preferred on the premise that these events could trigger substantial market fluctuations.

The tensions in the Middle East couldn’t have come at a worse time. Several nations are already staring at stagflation, the worst possible outcome for risk assets, including cryptocurrencies.

Still, bitcoin and ether continue to trade largely steady. Bitcoin, the leading cryptocurrency by market value, has been locked in a narrow range of $27,000- $28,500 this month. Ether, meanwhile, remains stuck in the two-month range of $1,550- $1,750.

Ratios lean below 1, signaling a bias for volatility selling. (Samneet Chepal) (Samneet Chepal)

The chart shows the bid-ask order book depth ratio in bitcoin and ether options traded on Deribit as of early Asian hours. The below-1 ratio shows the order book quotes leaned more toward the asks, a bias for sell trades.

The data is consistent with the implied volatility (IV) meltdown in bitcoin and ether since the beginning of the year. The IV, which refers to investors’ expectations for price turbulence, is influenced by demand for options.