Bitcoin (BTC) and ether (ETH) shrugged off the latest data showing the U.S. job market remains stubbornly strong.

The decrease in U.S. jobless claims from 212,000 to 192,000 missed expectations of 205,000 and showed the jobs market remains overheated.

Unemployment claims remain almost identical to where they were in January, defying the U.S. Federal Reserve’s efforts to cool labor markets. Tight labor markets have historically kept wages high, which is a key inflationary factor. The central bank’s uncertainty in recent months about how to account for the strong jobs data as it considers interest rate hikes has roiled financial markets.

Meanwhile, the two largest crypto currencies by market cap have leveled off after climbing on Tuesday.

Ether has joined bitcoin in trading in a narrow range, a sign that the recent spate of volatility for both is beginning to wane. While still at levels last seen in August and November, the Average True Range (ATR) for both assets has begun a decline from their recent peaks.

Ether (TradingView)

The decline in ATR aligns with a reduction in trading volume. Volume can often indicate who has the loudest voice in the room among bullish and bearish investors.

While bulls certainly had the most to say between March 11 and March 14, early signs indicate they are beginning to go quiet.

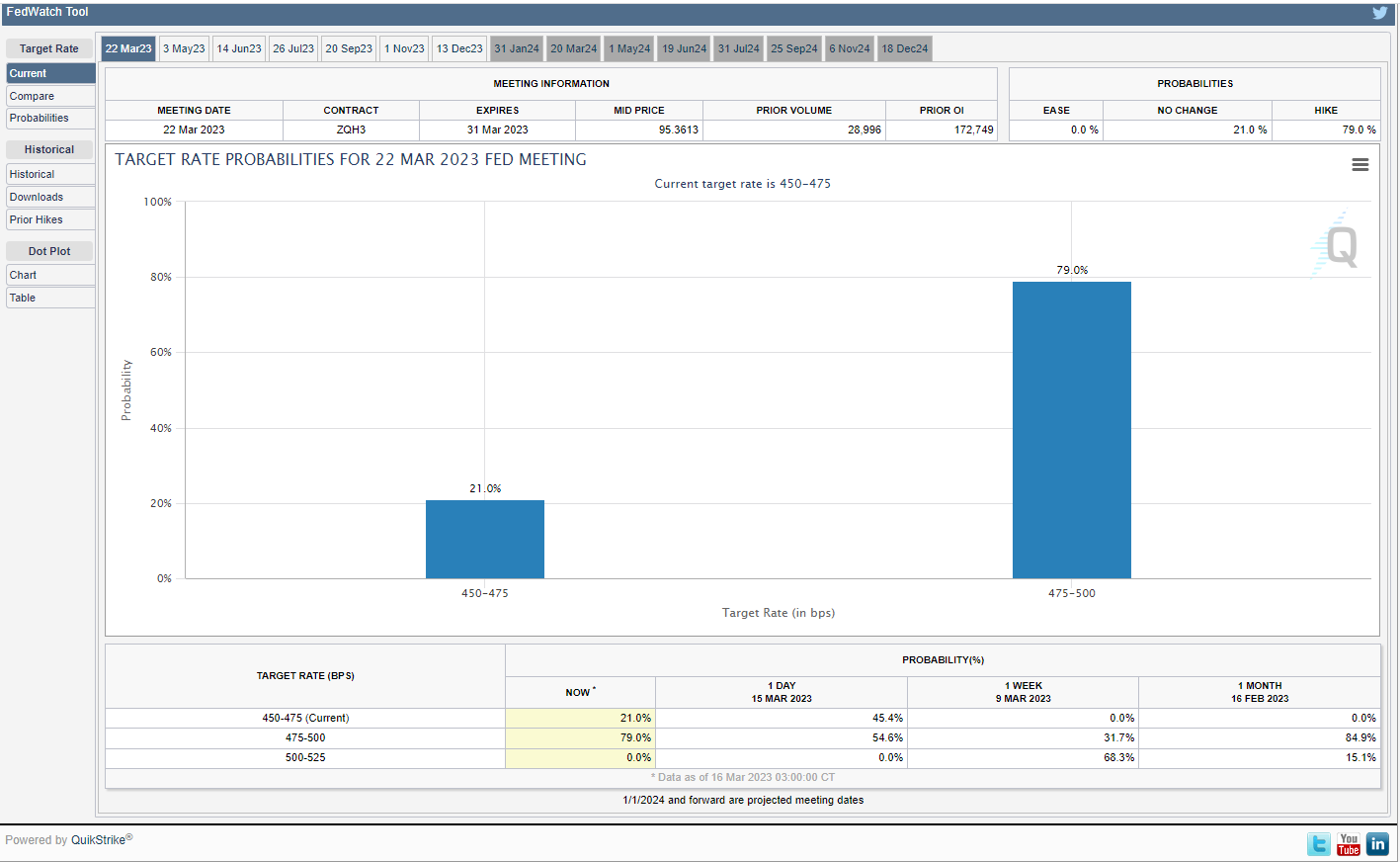

This contrasts to the rapid see-sawing of expectations for the Fed’s Federal Open Market Committee to raise interest rate hikes, and by how much. Over the most recent week the probability of a 50 basis point (bps) increase in interest rates has fluctuated from as low as 32% to today’s 79%.

CME FedWatch Tool (CME Group)

To be sure, the macroeconomic narrative remains important in the crypto space. But economic data doesn’t appear to be whipsawing the price of BTC and ETH at the moment. Neither do BTC and ETH appear to be tethered to the movement of traditional finance.

BTC and ETH’s correlations with the S&P 500, tech-heavy Nasdaq, and U.S. Dollar index have narrowed substantially.