The “Bitcoin Family” has lost more than $1 million since BTC peaked in November 2021. But Didi Taihuttu from the family is on the rise as always.

Bitcoin Family lost $1 million in investments this year

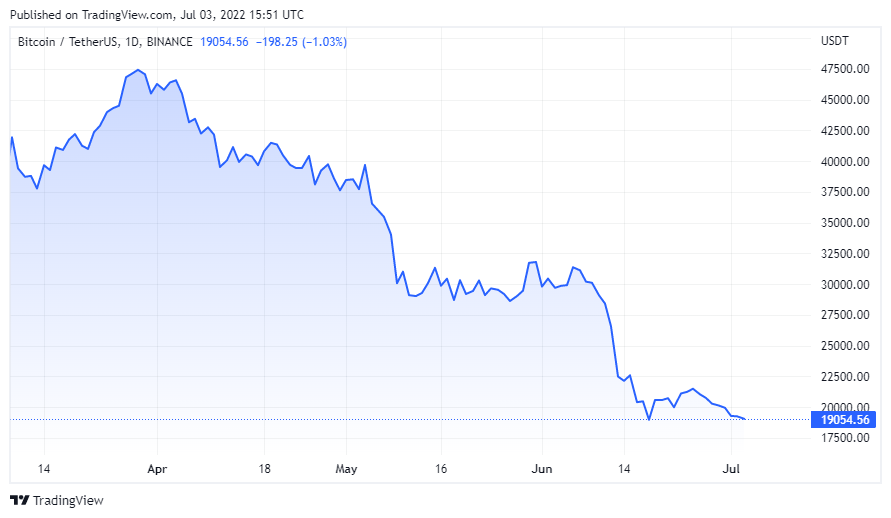

In 2017, Taihuttu, his wife and three daughters sold everything they owned. They invested a 2,500-square-foot house and almost all of their assets in Bitcoin. This decision came when the BTC price was around $900. Bitcoin is currently trading around $19,200. In the process, Taihuttu closed the Bitcoin position and then bought it again, then traded again at the appropriate moments. Speaking to CNBC, Taihuttu said that when the price dropped to $55,000 in late November, the family sold about 15% of their total Bitcoin investment.

The extremely volatile market comes at a cost to doing business in the cryptocurrency market. cryptocoin.com As you follow, over the past decade Bitcoin has experienced two prolonged periods of depressive prices before recovering. In the previous crypto winter in 2018, Bitcoin lost more than 80% of its value before it bounced back. Then, it hit an all-time high last year. Bitwise Asset Management chief investment officer Matt Hougan had this to say about the bear market in an interview:

There is still one aspect in crypto that we are waiting to see if another project will fail, whether the credit cascade will continue. If your time frame is a week, a month, or even a quarter, I still think there is significant volatility. If you have a time horizon measured in years, yes, this is a great opportunity to consider entering the market.

Early BTC investor Taihuttu predicts the coming years

Taihuttu, who analyzes the charts of the crypto market and tracks popular indicators such as the Mayer Multiple, thinks that in the current price cycle, Bitcoin will bottom between $15,000 and $20,000 before surging above $140,000 by 2025. According to Taihuttu, the current market is the “final moment of purchase”. The early BTC investor also told CNBC that his portfolio has gained more than 2,000% over the past six years.

Taihuttu’s investment strategy: the 70/30 rule

The Dutch family of five has traveled the world in the last six years. But after spending time in 40 countries, they decided to settle in Portugal with 0% tax on Bitcoin in Europe. Taihuttu’s latest project runs a Bitcoin bar on one of the most popular beaches in Lagos to “lead by example.”

However, the family has recently spent. They’ve had a rough few months as crypto prices plummeted and some of the most popular companies in the industry went bankrupt. The chaos frightened investors, wiping more than $2 trillion in value from the market in a matter of months. Individual investors who invested heavily in crypto projects lost a large portion of their savings. On Thursday, Bitcoin recorded its worst quarterly loss in over a decade.

The Dutch family of five follows what they call the 70/30 rule to stay “emotionally grounded” when faced with this level of volatility. At any given time, Taihuttus holds 70% of its Bitcoin investment in a cold wallet and 30% on exchanges.