New analysis says that Bitcoin price can only find support below $13,000 as its bottom level. Mark Mobius, founder of Mobius Capital Partners, has suggested that we will see new lows in 2023, contrary to Mike Novogratz’s $500,000 prediction.

Bankruptcies raised the bar to four digits

Bitcoin, Ethereum, and the cryptocurrency market in general have been in decline for over a year. The most important factor causing the decline was the tightening of the Fed monetary policy. However, the cryptocurrency market has witnessed the collapse of a number of high-profile companies since May. FTX’s bankruptcy dealt the second blow after Terra.

The bankruptcy of one of the largest centralized exchanges shrank the overall value of the market by 5% for about a week. Even Bitcoin advocates like Galaxy Digital CEO Mike Novogratz are now having to lower their expectations. Less than six months ago, Novogratz said that Bitcoin will reach $500,000 in the next five years.

However, the events around FTX force us to step back from these predictions. Novogratz is still keeping its $500,000 estimates up to date, but has pushed the maturity beyond five years. cryptocoin.com In his new statements, he said that he expects a 28x price increase for Bitcoin. Some analysts suggest that the new year will bring historic lows.

Bitcoin could test $10,000 in 2023

Mark Mobius, founder of Mobius Capital Partners, said that he expects tough times for Bitcoin. As reports of a possible bottom pile up, he thinks it is likely that BTC will test $10,000 in 2023. This is because FTX is building a wall between new investors and the market. Also, the bankruptcy of the exchange undermined platforms where investors generate passive income of 5% or more. Mobius says that a significant part of this ecosystem is based on FTX and now seems doomed:

Of course, there have been a number of offers offering interest rates of 5% or higher for crypto deposits, but many of the companies offering such rates went bankrupt, in part as a result of FTX. Therefore, as these losses increase, people become afraid of holding crypto money to earn interest.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

Analysts agree that Bitcoin price will see new lows

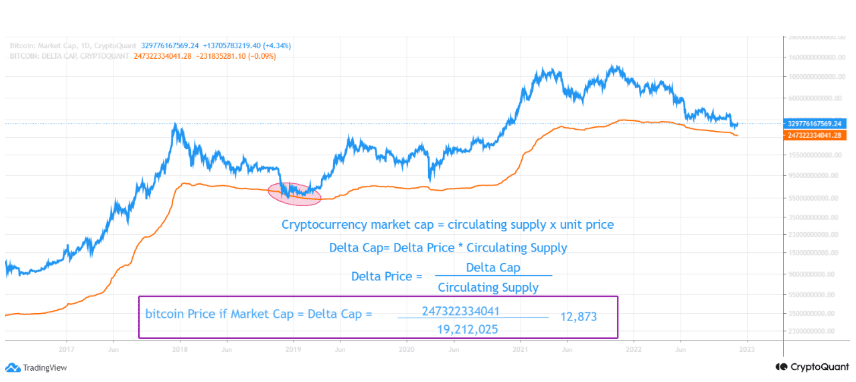

Similar to Mark Mobius, a crypto analyst from CryptoQuant recently revealed that Bitcoin’s delta price appears to be at $12,800. The delta price essentially functions as the probable price resulting from the difference between the realized cap and the average market value.

In other words, the analyst concluded that the Bitcoin price could drop further depending on the Delta price. BTC’s technical indicators also support the analyst’s predictions. Bollinger Bands on BTC’s daily chart show that the volatility of the crypto market leader is very low. In addition, the price is unlikely to rise as BTC has not broken the lower BB level.

BTC’s EMA is also a negative factor at the moment. This is because the 20 EMA cannot cover the 50 EMA. This makes the bearish move very possible.

Another thing to consider is the Bitcoin Reserve Risk, which is currently 0.00076. This is considered quite low and reflects that investor confidence in BTC is not at its peak. According to the CryptoQuant analyst, this is further proof that BTC’s previous drop below $16,000 is not the lowest point it will fall.