Bearish Sentiment Grips Bitcoin Market Amidst Tech Concerns

Recent developments in the financial markets have led to a significant bearish sentiment surrounding Bitcoin (BTC). Wall Street’s tech-heavy Nasdaq futures have plummeted by 700 points, driven by rising apprehensions regarding the emerging Chinese artificial intelligence startup, DeepSeek. This company poses a formidable challenge to the technological supremacy of the United States, adding to the unease among investors.

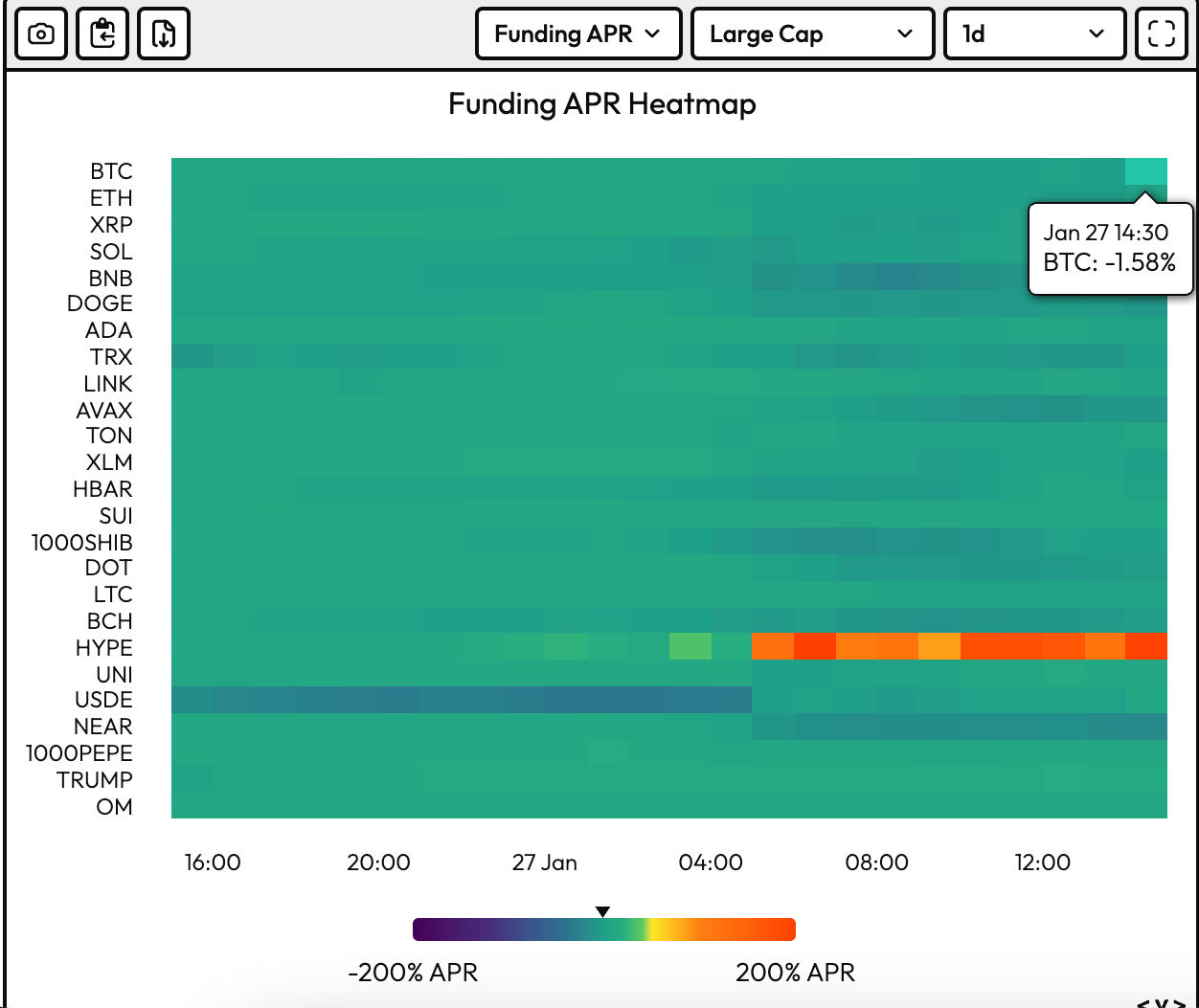

According to data from Velo Data, Bitcoin’s perpetual futures funding rates—periodic payments exchanged between long and short positions in perpetual futures contracts—have turned negative. This shift indicates a growing bearish outlook among traders, who are increasingly favoring short positions in anticipation of further declines in Bitcoin’s price.

The leading cryptocurrency has experienced a drop of over 3% since the early hours of trading in Asia, with prices dipping below $98,000 at one point, as reported by CoinDesk data. In parallel, futures linked to the Nasdaq index have also fallen by more than 3.5%, with tech giant NVIDIA, a key player in the AI sector, witnessing a staggering 10% decrease in pre-market trading.

“Today’s sell-off is particularly noteworthy, following President Donald Trump’s recent approval of a working group focused on cryptocurrency policy. However, this initiative notably refrained from confirming the establishment of a U.S. Bitcoin reserve,” commented Petr Kozyakov, co-founder and CEO of Mercuryo, in an email. “Additionally, the success of DeepSeek in the AI domain has rattled tech stocks, suggesting it may be feasible to develop AI models at a fraction of the cost of their U.S. counterparts.”

Despite the current bearish trend, historical data suggests that negative funding rate flips often signal local price bottoms. Moreover, there remains the possibility of a short squeeze, where bearish traders may be compelled to exit their positions, inadvertently exerting upward pressure on prices. However, it’s essential to note that the funding rate’s recent bearish shift is quite narrow, indicating that it may be premature to label shorting Bitcoin as an overcrowded trade at this point.