While the cryptocurrency market continues its fluctuating course, some movements attract the attention of market players. Institutional Bitcoin owner MicroStrategy moved a large amount of BTC, on-chain analytics platform Lookonchain reported. This transfer took place recently and attracted great attention from the crypto community. So what’s behind this transfer?

Bitcoin giant transferred 1,652 BTC, sale?

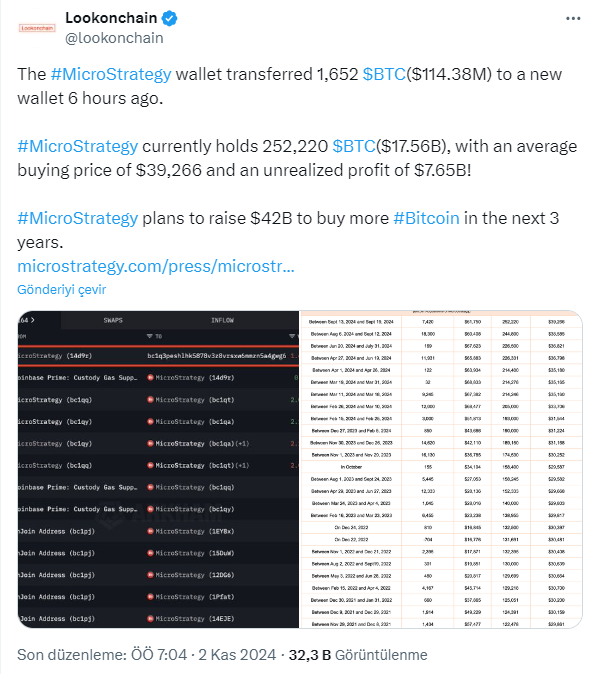

cryptokoin.comAs you follow from , the leading crypto Bitcoin was successful in maintaining its position above 70 thousand dollars. Bitcoin’s loss of altitude drags almost the entire market down. That’s why market players keep an eye on Bitcoin. MicroStrategy, known for its large Bitcoin assets, continues to make strategic moves to manage its digital assets. Analytics platform Lookonchain reported that MicroStrategy transferred 1,652 BTC worth $114.38 million to a new wallet.

However, there was no decrease in MicroStrategy’s Bitcoin stock. According to the BTC giant announced at the end of September, there is no change. Therefore, the latest move is most likely not a sign of a sell transaction. Lookonchain stated that MicroStrategy currently holds 252,220 BTC worth $17.56 billion. It also noted that the average purchase price was $39,266. In this case, the unrealized profit of the Bitcoin giant is around 7.65 billion dollars.

Source: X

Source: XMicroStrategy plans to increase its BTC stash!

Looking ahead, MicroStrategy has ambitious plans to further expand its Bitcoin holdings. This week, MicroStrategy announced plans to raise $42 billion in funding over the next three years to purchase more BTC. MicroStrategy prides itself as the largest publicly traded institutional holder of Bitcoin, with nearly $18 billion on its financials. Now MicroStrategy plans to increase its assets by selling up to $42 billion in stocks and fixed income instruments. MicroStrategy claims to have recruited banks to help it raise $42 billion through the sale of additional shares and fixed income to buy more Bitcoin, following transactions it made last year.

MicroStrategy says it has recruited a number of banks to sell stock in a market offering that could bring in $21 billion, and it also plans to sell fixed-income instruments that could return the same amount. It is noteworthy that MicroStrategy raised billions of dollars last year through the sale of shares to increase its Bitcoin stock. Meanwhile, BTC fell back after reaching $73,600 in the trading session on Tuesday. The leading cryptocurrency was traded at $69,147, down 3.27% in the last 24 hours. Based on 2020, Bitcoin has seen a meteoric rise so far. This resulted in an almost 2,000% gain in MicroStrategy share price.