The BitMex co-founder envisions a process in which central banks around the world will likely be forced to spin quickly. In this perspective, he considers the course of the global economy. He also shares his views on how developments will affect gold and Bitcoin (BTC) prices.

“Central banks will have to print money”

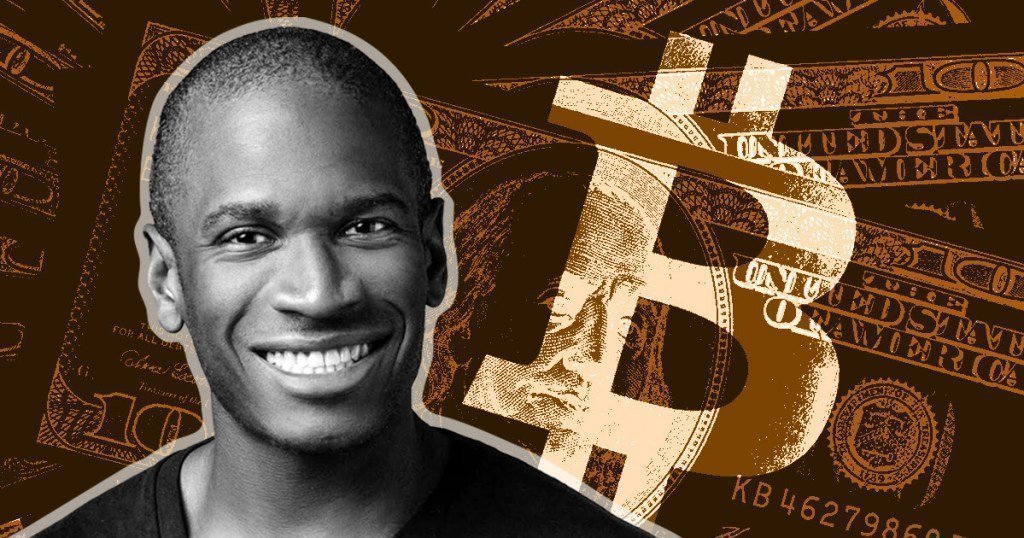

BitMex co-founder Arthur Hayes wrote a blog post on the global economic outlook. Hayes argues in his article that central banks will be forced to “print money” due to various economic pressures. He also notes that printing money, along with the prices of alternatives such as crypto and gold, will increase inflation. In his article titled ‘Contagion’, Arthur Hayes highlights the immediate challenges of the global economy following the decision of major central banks to tighten monetary policy. In this context, Hayes comments:

In recorded human and financial history, the worst affected markets have been government debt markets, with a bond market crash.

cryptocoin.com As you follow on , bond yields have risen to an unsustainable level in some markets with the introduction of quantitative tightening (QT). Last month, the BoE had to return to QE to quell rapidly rising bond yields. This caused multiple pension funds in the UK to go bankrupt.

Hayes argues that other central banks will eventually “feat” to similar measures to solve similar problems. For example, the ECB is already buying bonds for some of its weaker member countries. The EU in particular suffers from energy shortages due to Germany’s current energy policy. According to Hayes, this could harm Germany’s economic output and export position. Therefore, it is likely to cause countries with which it trades to stop buying their products, with the euro already weakening against the dollar. Hayes explains it this way:

Without cheap energy, Germany will have to look for ways to get rid of its problems. So, like every other country, it will issue more bonds to cover financial transfers. As Germany issues more bonds, its yields will skyrocket, as will the UK. Thus, the EU will extend its QE policy to Germany and all other bond markets within the union.

How will Bitcoin and gold prices be affected?

Hayes takes into account the thesis that most major central banks are ‘on the way’ towards yield curve control. From this, he says, ‘global risk assets’ such as gold and Bitcoin will benefit. He expresses his views as follows:

The gold and crypto markets are much smaller than the trillions of fiat currencies that will be printed. Given this situation, these non-dollar currency assets will appreciate.

However, the Federal Reserve is quite stubborn about its hawk stance. However, Hayes claims that even against the Falcon Fed, Bitcoin (BTC) will rise due to the joint efforts of other central banks. This is because it is an arbitrage opportunity for both Bitcoin and gold that will appear in the foreign exchange markets, ultimately increasing the dollar value of each. For this, Hayes makes the following statement:

This process will not happen immediately. If politicians put in place the necessary policies to please their constituents, none of this will happen in the bond markets.