Bitcoin showed a rapid recovery after recent fluctuations. Thus, it reached $ 102,000 again. Despite the sudden decreases in US stocks, Bitcoin continues to maintain its power. This movement proved the resistance power of the market. So, which developments will the future of the leader crypton depend on? Expert opinions and current analysis are as follows…

BitcoinThe price is recovering quickly

With the opening of the US stock exchange on January 27, Bitcoin (BTC) increased to $ 102,000. Thus, he alleviated a little bit of recent concerns. According to TradingView data, the BTC/USD parity increased by 4.6 %on Bitstamp and rose from 97,750.

This decline was triggered by the jolt created by the competition concerns of the Chinese Chatgpt rival Deepseek in US technology shares. The sales pressure that started in stocks caused a temporary decline in Bitcoin. However, this did not have a permanent negative effect. Crypto Chase, a popular crypto analyst, said that Bitcoin may still remain in the rise trend if the $ 95,000 levels are supported by evaluating the current situation.

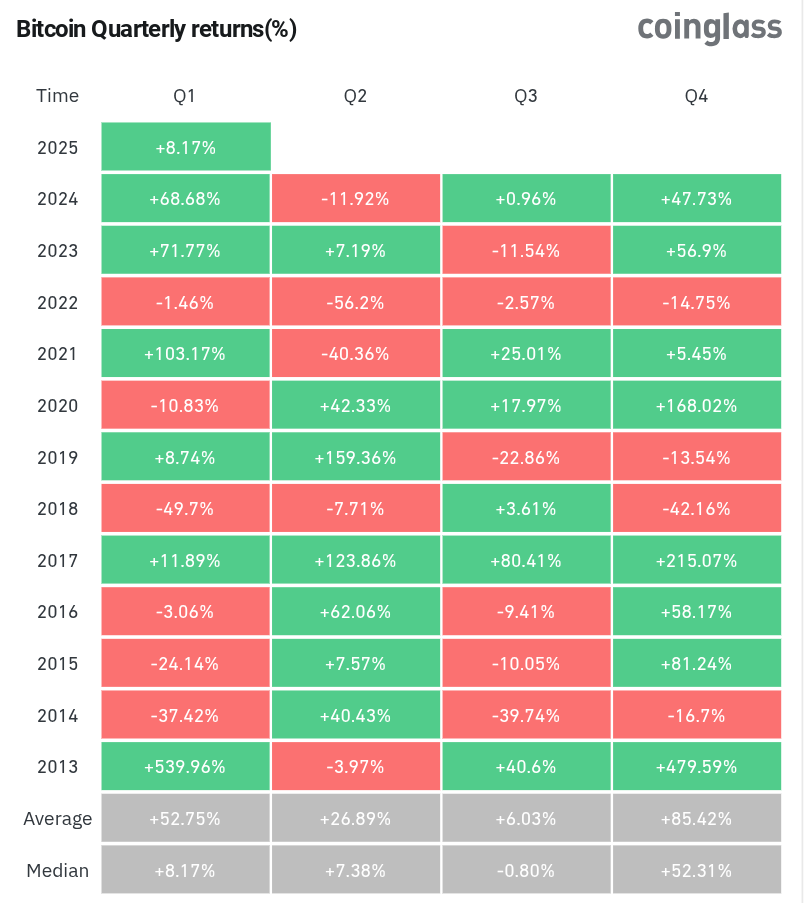

Some experts emphasize that these fluctuations in the crypto market will be considered as excessive reaction. Market analyst Caleb Franzen shared that the S&P 500 index provides 1.65 %return in 10 weeks. Based on this data, it is very close to the annual average performance. Bitcoin’s increase of 37 %in the same period revealed the dynamic structure of the crypto market once again.

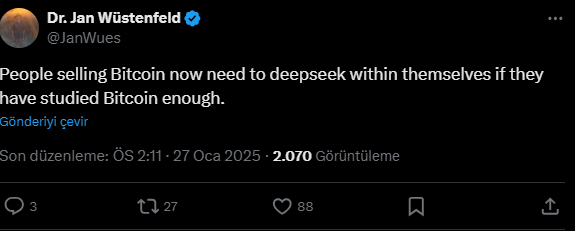

Melanion Greentech Chief researcher Jan Wüstenfeld criticizes Bitcoin’s sale for a non -market development. Analyst said investors should question Bitcoin’s potential fully.

Expectations for the Future

QCP Capital, a crypto investment company, analyzed the potential impacts on Bitcoin, not limited to Deepseek developments. The company underlined some events that will shape the markets in the long run. In particular, the US Central Bank’s statement on interest rates may be decisive on the market.

QCP Capital also described BTC’s current price movement as “relatively resistant”. Nevertheless, he added that the market did not expect a serious movement before March, and that the effect of the Federal Reserve on the BTC should be carefully monitored.

Bitcoin’s rapid recovery was an indication of resistance in the market. However, both macroeconomic developments and innovations in the crypto world will affect Bitcoin’s future movements. Investors should continue to monitor the market closely to turn such fluctuations into an opportunity.