Bitcoin’s MACD Indicator Signals Caution Amid Economic Turbulence

A momentum indicator that previously signaled Bitcoin’s (BTC) impressive post-election price rally has recently turned negative. This shift comes in the wake of President Donald Trump’s provocative tariff rhetoric, which poses risks to market stability. However, there’s no immediate cause for alarm.

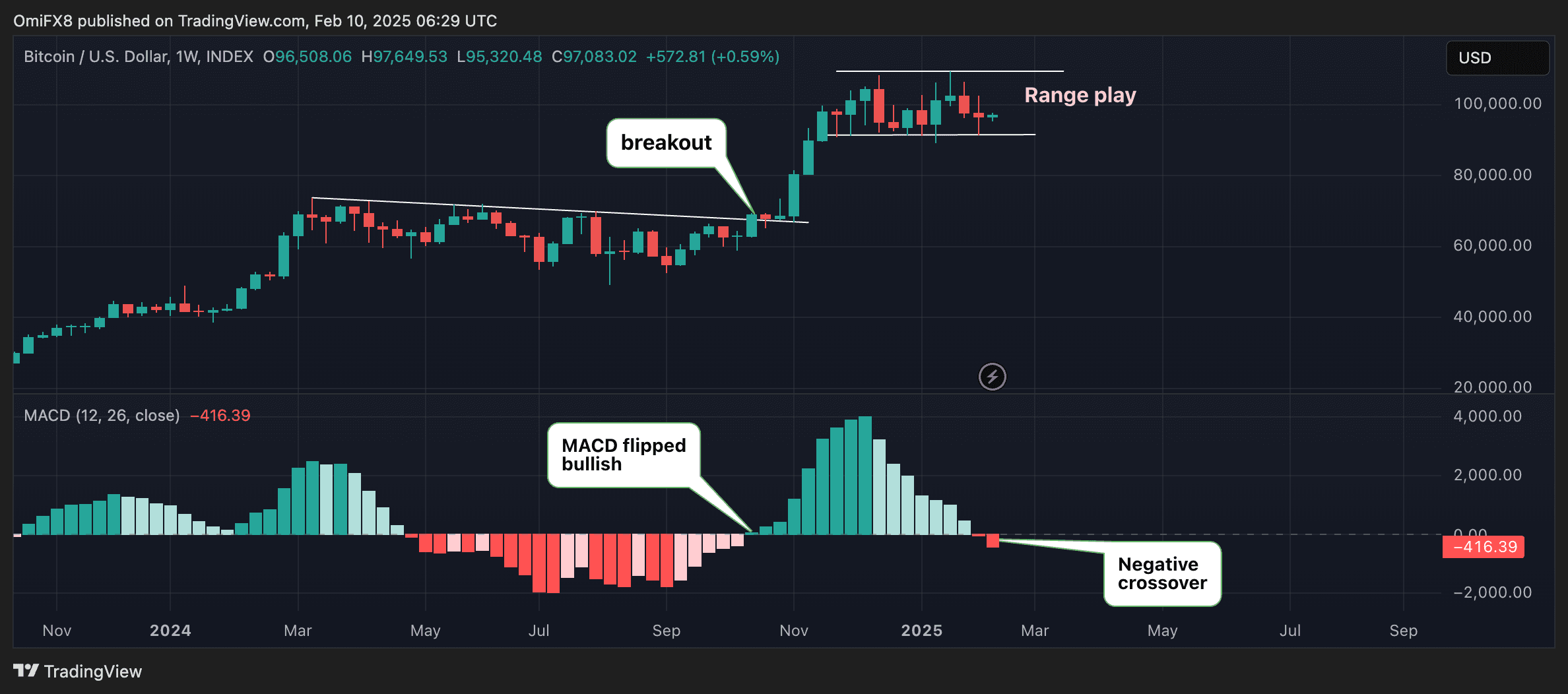

The indicator in question is the moving average convergence divergence (MACD) histogram, a tool commonly used to assess the strength and direction of price trends. It is computed by taking the difference between Bitcoin’s average price over the past 26 weeks and its average over the preceding 12 weeks. To further refine the signal, a nine-week average of the MACD is calculated, and the difference between the MACD and this signal line is represented visually as a histogram.

Currently, the MACD on Bitcoin’s weekly chart has dipped below the zero line, indicating a potential bearish shift in momentum. Conversely, crossovers above this zero line are interpreted as signals of a bullish trend. Notably, the MACD turned positive in mid-October, which fueled speculation of a potential rally toward the ambitious $100,000 mark, as previously reported by CoinDesk.

While the recent bearish MACD signal may raise concerns among bullish investors—particularly those who heavily rely on technical analysis—the current price action of BTC does not fully support this negative reading. At present, Bitcoin is trading within a broader range of $90,000 to $100,000, with its recent movements tightening to a narrower band between $95,000 and $100,000. This sideways trading behavior diminishes the impact of the MACD’s bearish crossover.

It’s crucial to understand that indicators are fundamentally based on price action rather than dictating it. Therefore, MACD signals require confirmation through actual price movements. The previous bullish signal in mid-October was validated by Bitcoin’s breakout from a prolonged trading range.

Tariff Threat and Rising Inflation Expectations

While the MACD’s current position may not be alarming just yet, several macroeconomic factors could introduce downside volatility, potentially pushing Bitcoin to test its long-standing support level near $90,000. A breach of this support could substantiate the new negative reading on the MACD, confirming a bearish momentum shift.

At the forefront of these macro concerns is President Trump’s tariff rhetoric, which, if enacted, might lead to elevated bond yields and a decline in risk assets. Trump announced plans to impose 25% tariffs on all steel and aluminum imports, with further metal duties expected to be revealed later this week. Additionally, he has hinted at implementing higher tariffs on a broad array of goods imported from the European Union later this month, according to analysts at UBS.

Recent data from the University of Michigan consumer sentiment survey revealed that the impending tariff threat is already negatively affecting consumer expectations regarding price pressures in the economy. Notably, inflation expectations for the upcoming year surged to 4.3% in February, up from 3.3% in January—the highest figure recorded since November 2023.

This environment of escalating inflation could deter the Federal Reserve from rapidly cutting interest rates. “Two-year inflation swaps have begun to reflect some risk premium associated with tariffs. Currently at 2.72%, they have reached new highs. The market seems to interpret the Fed’s stance as one of prolonged inaction: growth remains stable, and even if inflation drops to around 2%, the Fed may feel no urgency to adjust rates,” explained Alfonso Peccatiello, a noted financial commentator, on X. The upcoming U.S. Consumer Price Index (CPI) report for January is set to be released on February 12, further adding to the anticipation surrounding these economic developments.