Bitcoin follows a wavy course before the employment data to be announced in the USA. Markets are concerned that the employment figures that may come above expectations can put pressure on the BTC price. If the employment data is strong, it is thought that the Federal Reserve may keep interest rates high for a long time and this may be negatively reflected in risky assets such as Bitcoin.

US employment data pose a risk for Bitcoin

As of February 7, Bitcoin is traded at $ 97,000. BTC, which had a decline of 3.5 percent the previous day, could not recover despite the expectations of unemployment applications from the US.

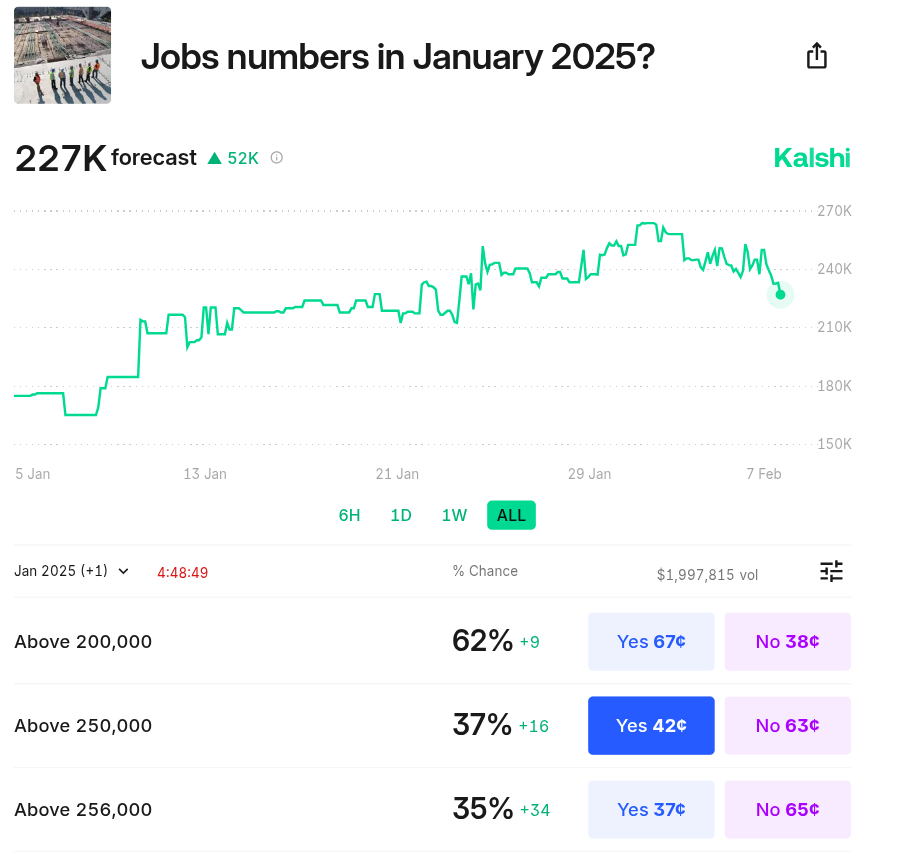

In the markets, the number of new jobs added in January may be far above official estimates. According to the estimation markets on the Kalshi platform, 238,000 new jobs have been added to the US economy. However, the probability of an increase in employment of over 300,000 is 28 percent.

Liquidity Hunt for BTC continues

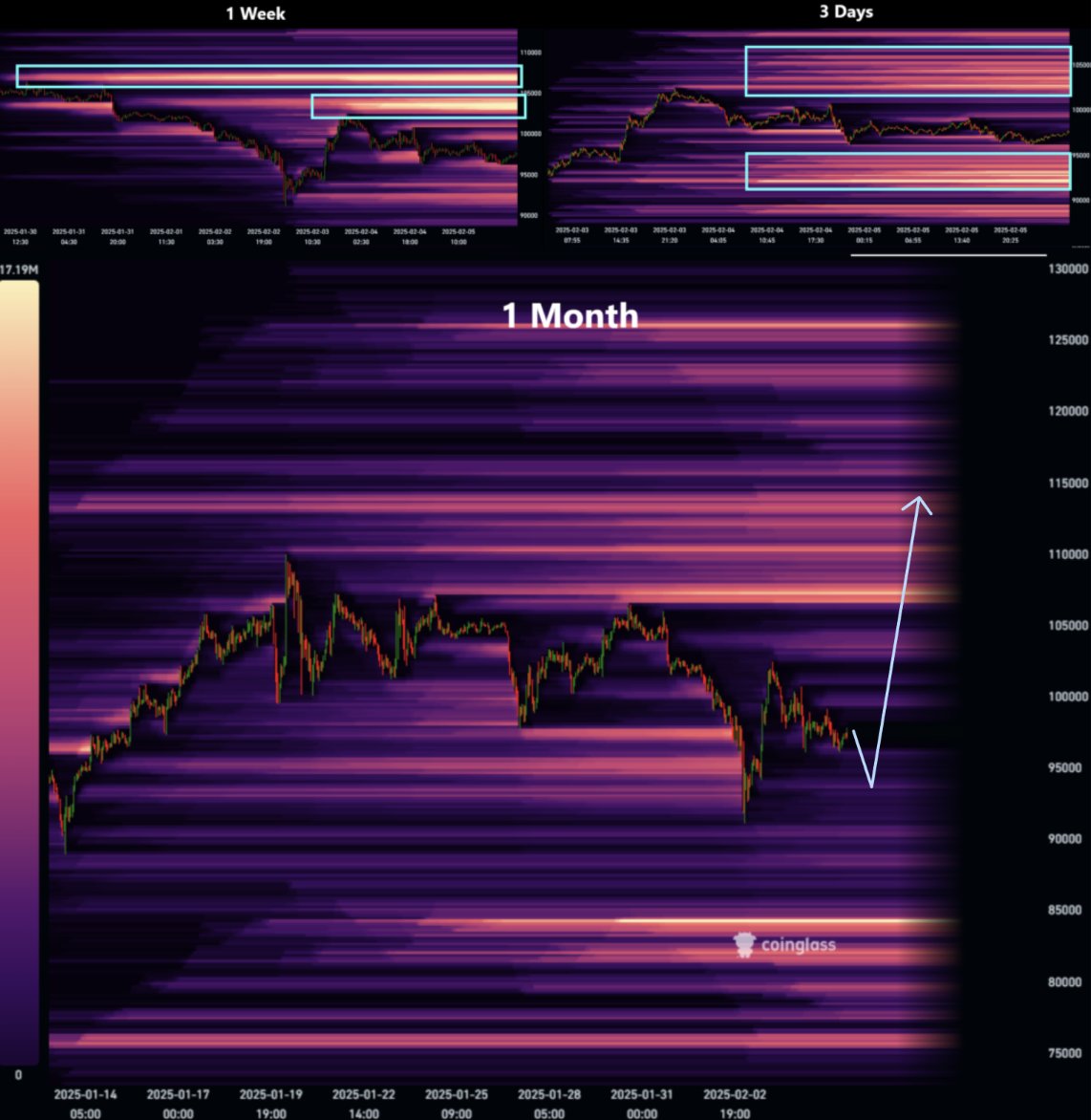

The price of BTC continues to move in a certain band in the short term. Analyst Mark Cullen said that Bitcoin had short -term liquidity accumulation at the current price level and said that there may be fluctuations in both directions before a major movement.

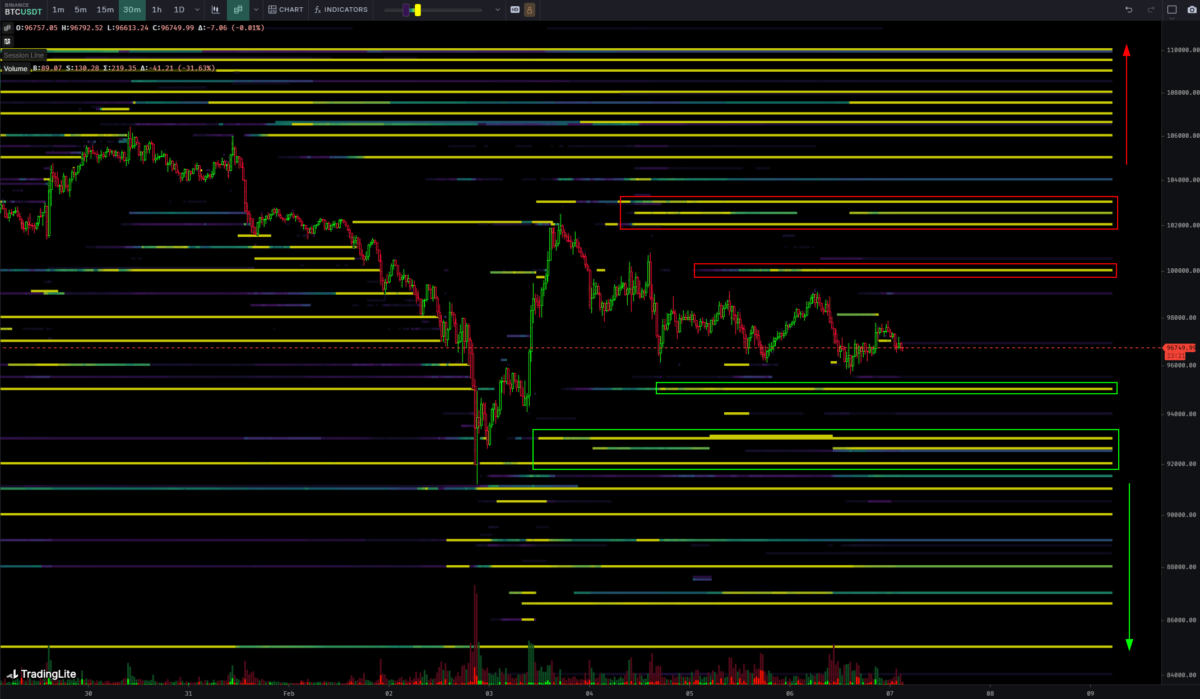

According to weekly data, there is a significant liquidity of $ 95,000. Cullen said that after a decrease in this level, BTC could move upwards again. If the market enters a negative price movement with employment data, it will be critical whether buyers are activated at $ 95,000.

Critical levels for Bitcoin

Other analyst Skew thinks that markets cannot perform a major price movement without a macroeconomic development. There is a similar congestion in the Binance Spot market, and the market predicts a price range of $ 95,000 to $ 100,000 for BTC.

The employment data to be announced in the USA can determine the short -term aspect of Bitcoin. If there is an increase in labor for more than expectations, the price of BTC may decrease up to $ 95,000. However, it will be clear whether the market will find strong support at this level in the coming days. For the time being, investors closely follow the Fed’s interest decisions and the developments in the US labor market.