Bitcoin (BTC) witnessed a strong almost 7% rise yesterday, breaking its long-standing sluggish performance. This sudden rise revived bullish sentiment in the cryptocurrency space and was attributed to the US District Court decision supporting Grayscale Investments in its battle against the US Securities and Exchange Commission (SEC). After this result, some data revealed that the amount of Bitcoin transferred to exchanges has increased. Here are the details…

Bitcoin community excited with Grayscale victory

cryptocoin.com As we reported, the U.S. District Court’s decision forced the SEC to launch a comprehensive review of its previous decision rejecting Grayscale’s proposal to convert its existing Bitcoin Trust into a full-fledged exchange-traded fund (ETF). This landmark development has brought new vitality to cryptocurrency markets, as market participants view the potential approval of a Bitcoin ETF as a pivotal moment for mainstream cryptocurrency adoption. However, amid the prevailing optimism, seasoned investors and analysts are warning of caution.

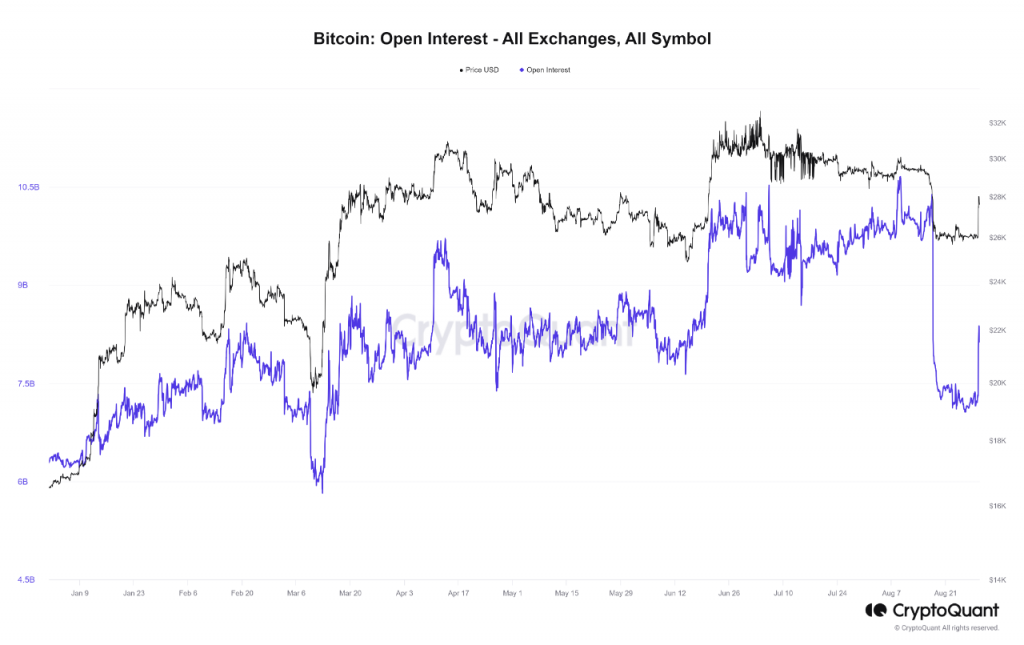

The increase in BTC’s value was accompanied by a staggering $1 billion increase in open interest, indicating an increase in futures contracts. Additionally, financing rates shifting into negative territory and short selling increasing adds an additional layer of complexity to current market dynamics. The emerging bullish trend in the market following the court decision contrasts with an environment ripe for speculative behavior and increased volatility. The combination of these factors shows that while the near future looks promising, it also carries an air of uncertainty. The same factors that cause optimism can contribute to unexpected market volatility in different circumstances.

Investors took action

It is particularly noteworthy that the current Bitcoin price is closely aligned with the cost base of short-term investors who entered the market around $27,900. This alignment of price and investor sentiment has increased sentiment in this range and potentially magnified market reactions in this region. Before the important decision, approximately 30,000 BTC worth $822 million with a market price of $27,400 were moved to addresses linked to centralized exchanges, according to data tracked by analysis firm Santiment.

Perhaps some traders predicted the price increase and prepared for the same situation in advance by moving the coins to the exchanges. Investors generally move their coins to exchanges when they want to liquidate their coins or use them as margin for derivative transactions. Therefore, an increase in stock market entries is often seen as a harbinger of price turbulence. Santiment echoed onchain analyst Ali Martinez’s comment as follows:

The stock market supply of Bitcoin increased significantly just before Grayscale’s victory over the SEC. It seems pretty obvious that there are forces that know about the inevitable increase in crypto market value as a result of this outcome.

📈 The exchange supply of #Bitcoin was boosted significantly just prior to #Grayscale's win over the #SEC. It looks quite clear that the powers that be knew of the inevitable boost in #crypto market capitalization as a result of this outcome. https://t.co/ARsnt7vsRM https://t.co/jFFPwk1CHD

— Santiment (@santimentfeed) August 29, 2023

CryptoQuant: Average inflow is at two-month high

Address-based onchain metrics are subject to some issues. Therefore, it is difficult to draw firm conclusions from them. Data tracked by South Korea-based CryptoQuant shows that the average inflow, or the amount of BTC transferred to exchanges per transaction, rose to 1,146, the highest level since June 21, as prices rose to $28,000. An increase in average inflow indicates that investors are sending a large number of coins in a transaction, which is a clue of potential selling pressure. However, this time this is not entirely the case, as average outflows have also increased to their highest levels in the last two months and the net balance held, especially on exchanges offering spot trading, has decreased. CryptoQuant said:

While reserves held on US-based spot exchanges continue to decrease, reserves on offshore exchanges offering derivatives trading continue to increase. This is a sign that derivatives and offshore exchanges are driving the current price action.