Bitcoin recently experienced a notable increase, raising almost $2,000 in 24 hours, reaching its highest price since June 8th. This positive development came after a period of disappointing price movements. The volatility resulted in significant liquidations, primarily affecting short positions accounting for around 80% of the total. Previous events such as lawsuits against major crypto exchanges, inflation data, and the Fed’s policy change had negatively impacted Bitcoin’s performance, causing it to drop to a three-month low. Here are the details…

Bitcoin is on the rise

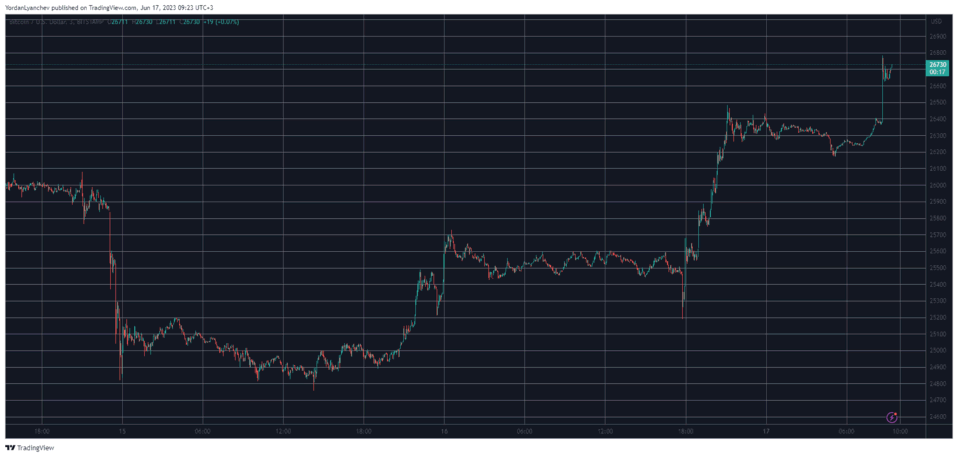

After several days of depressing price action, Bitcoin (BTC) has finally taken off. It has risen by almost $2,000 in the past 24 hours, reaching its highest value since June 8th. Not surprisingly, this resulted in millions of dollars worth of liquidation. Because short positions represent almost 80 percent. Bitcoin’s price performance has been rather weak after the SEC’s lawsuits against the two largest crypto exchanges, Binance and Coinbase, as well as the CPI figures released on Wednesday and the Fed backing off from its stance on rate hikes.

Recently, Bitcoin saw its lowest price in three months. Altcoins, on the other hand, suffered larger losses. The total crypto market cap has dropped by $130 billion in less than two weeks. However, the bulls finally have a pretty good reason to celebrate. In the past 24-48 hours, there have been very important developments for the entire market. After BlackRock applied for the Bitcoin Spot ETF, BTC saw some rebound and rose to $25,500 levels. Also, after a small retracement yesterday and a parallel drop to $25,200, the cryptocurrency has been on the rise. It reached a 9-day high at $26,800.

Altcoins also rose

Solana has managed to imitate BTC on a daily scale with most altcoins, with Polygon, Ethereum, Aptos, and Algorand gaining up to 9 percent. Altcoins mostly outperformed BTC. QNT managed to become the highest-growing altcoin among large-volume altcoins after a 20 percent increase. However, traders with short positions were most adversely affected by this development. The total value of liquidated positions was over $90 million on a 24-hour scale, with short traders responsible for more than $70 million (about 80 percent). According to Coinglass, Bitcoin and Ethereum have the largest share of the pie, with almost $50 million of the $90 million.