According to CryptoQuant, daily Bitcoin inflows to centralized exchanges are lower today compared to previous US Election Days. This suggests that selling pressure around the event has potentially eased. However, legendary analyst Peter Brandt raises a red flag.

Bitcoin legend also confirmed the red flag!

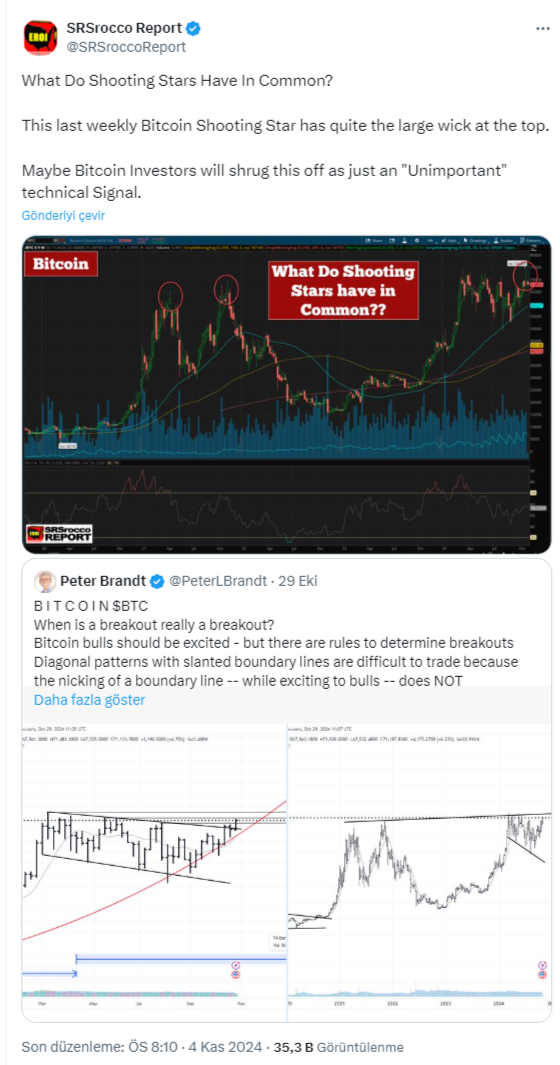

A recent Bitcoin price prediction has the crypto community worried. Because it marks a “shooting star” candlestick on Bitcoin’s weekly chart, signaling a bearish trend. Analysis shows that this candle has a large upper wick. This means that Bitcoin is about to reverse direction as it is trading around its historical peak. The “shooting star” pattern usually occurs when prices reach resistance levels. This indicates that buying momentum is slowing as selling pressure increases.

So, in technical analysis, a shooting star occurs when the price of an asset opens, rises sharply, and then pulls back to close near the opening level, leaving a large wick at the top. The latest shooting star pattern formed last week when Bitcoin (BTC) attempted to surpass its March high but fell short by less than one percent. This has left market players wondering whether the current rally is as strong as they are seeing.

This cautious view is also supported by Peter Brandt’s recent resharing of this forecast. cryptokoin.comAs you follow from, Brandt previously said that for a true Bitcoin breakout to occur, the price would need to close above $76,000 on the daily chart and be confirmed by the weekly close at midnight on Sunday. As a result, increasing bearish signals at previous high points are increasing concerns. Therefore, it shows that Bitcoin needs to consolidate further before a strong rally.

CryptoQuant: Selling pressure is probably decreasing!

According to CryptoQuant, Bitcoin inflows to centralized exchanges are significantly lower today compared to previous US elections. This potentially points to lower selling pressure around the election event. CryptoQuant Research Head Julio Moreno said the following on the subject:

The selling pressure on Bitcoin from traders and investors who transfer funds to the exchanges appears to be less than during the last elections and the beginning of 2024. Daily Bitcoin inflows to exchanges are currently around 45,000 BTC, down from a 2024 peak of 95,000 in March and 73,000 BTC before the 2020 US presidential election. Bitcoin’s relative strength against altcoins like Ethereum indicates that Bitcoin is preferred over other assets among investors, especially amid market uncertainty. (…) Bitcoin has outperformed most altcoins, indicating that investors are focusing specifically on Bitcoin rather than a broader spread across cryptocurrencies.