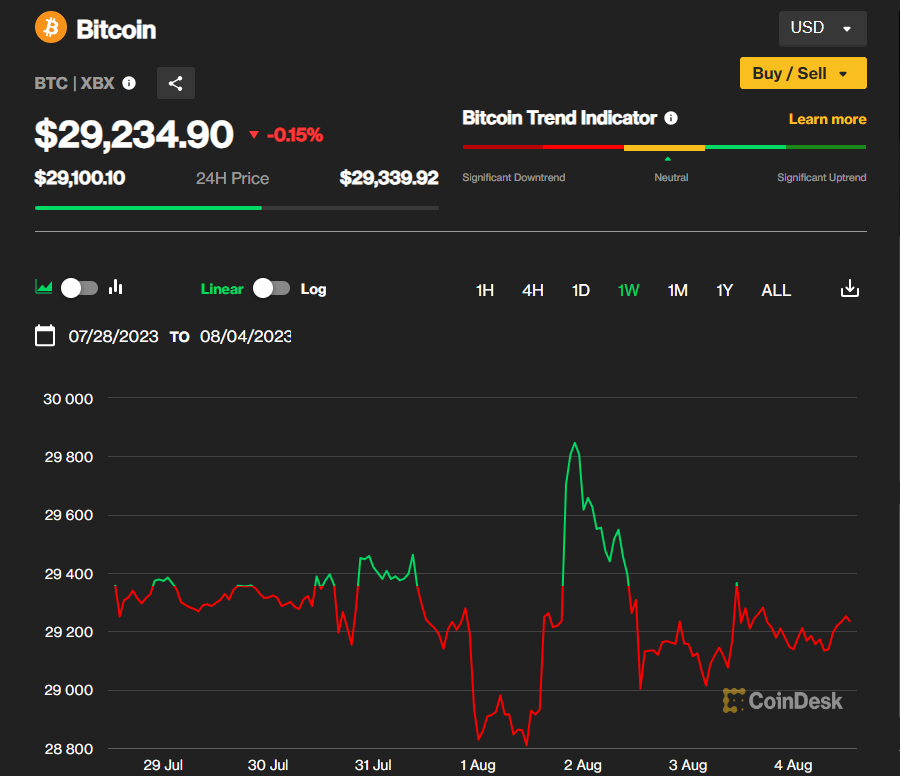

Excepting the drama around Curve Finance and its CRV token, major cryptocurrencies had a relatively uneventful week in regards to news and price movement..

While bitcoin (BTC) barely moved all week, the CoinDesk Market Index (CMI) fell 1.6% over the past five days, with more than 90% of its 183 constituents showing losses. That high percentage indicates weakening breadth within cryptos, even if the declines are relatively small.

Ether (ETH) added to its underperformance versus bitcoin this year, dropping 1.76% this week against bitcoin’s 0.3% decline. With five months remaining in 2023, BTC has risen 76%, while ETH has gained 54%.

Within the CMI, individual top performers came via the Culture and Entertainment Sector (CNE), despite the group as a whole declining 5% on the week. Yield Guild Games (YGG) rose 57%, while Origin Protocol (OGN), added a less pronounced, but still impressive 18%.

Among crypto assets with a market capitalization exceeding $1 billion, XDC Network (XDC) led the way, jumping 33.5% on the week.

For the year, XDC – a hybrid blockchain with a focus on global trade and finance – has risen 200%, taking the top spot amongst the $1 billion-plus market cap group.

What’s next for bitcoin and ether

Going into the next week, the obvious question is whether either of the two largest crypto will make moves out of their current trading ranges. From a technical vantage point, current indications are that prices are likely to stay flattish for the foreseeable future.

Bitcoin’s and ether’s relative strength index (RSI) readings of 46 and 45, respectively, are decidedly neutral and both are hovering near their respective 20-day moving averages.

There don’t appear to be many bearish indications either, which may give a measure of comfort to current holders. On-chain data has given no indication that either BTC or ETH are being moved onto exchanges, which can often precede a bearish move.

The week ahead in macro

The end of this week brought the July jobs report from the government. Though softer than economist forecasts, the news had little effect on bitcoin prices. Next week brings inflation data for July which could have an impact on market direction.

Forecasts are for both headline and core July CPI to have risen by 0.2% versus 0.2% gains for both gauges in June. The headline year-over-year rate is expected to rise to 3.3% from 3% and the yearly core rate is seen dipping to 4.7% from 4.8%.

Digital assets, however, have done a fair job recently of pricing in macro expectations. As long as the inflationary data comes in somewhere close to as expected, cryptos are likely to react mildly.