Known for his accurate Bitcoin predictions, Mike McGlone says that by the end of the year, the Fed will end interest rate hikes. Influenced by this, he predicts a rally in Bitcoin (BTC). He also notes that Bitcoin and gold will outperform other commodities in the coming year.

“Fed is nearing the end, BTC and gold will perform well”

cryptocoin.com As you follow, commodity asset classes such as Bitcoin and gold have been declining throughout this year. But Mike McGlone, senior commodity strategist at Bloomberg Intelligence, who we know as the Bitcoin master, says that these two asset classes will outperform all other commodities in the next decade. Check out this article for the analyst’s accurate predictions.

Last week, the Fed announced a 75 basis point rate hike for the third time in a row. According to reports, the Federal funds rate will likely rise to 4.3% by the end of 2022 and to 4.6% by early 2023. Therefore, analysts expect a 75 bps increase by November and a 50 bps increase in December. McGlone, on the other hand, thinks the end of the Fed’s aggressive monetary tightening is near. The analyst on the subject makes the following statement:

As the world moved towards recession, most central banks in history increased their interest rates. Low commodity and risk-asset prices may be the only way out, with deflationary effects that should drive up the price of gold and its digital version, Bitcoin.

But McGlone is confident that once the Fed’s tightening cycle ends, BTC and crypto will continue a bull trend after this massive pullback. Based on this, the analyst says:

It’s been a bad decade for commodities and an extremely good decade for BTC. It’s possible that 2022 will prove that high-priced treatment is more powerful than ever. Thus, it can support crypto. The Fed is nearing the end of a game. As such, risk versus reward is likely leaning towards maintaining the persistent uptrend, especially in Bitcoin against most commodities.

“Bitcoin is the best competitor to gold”

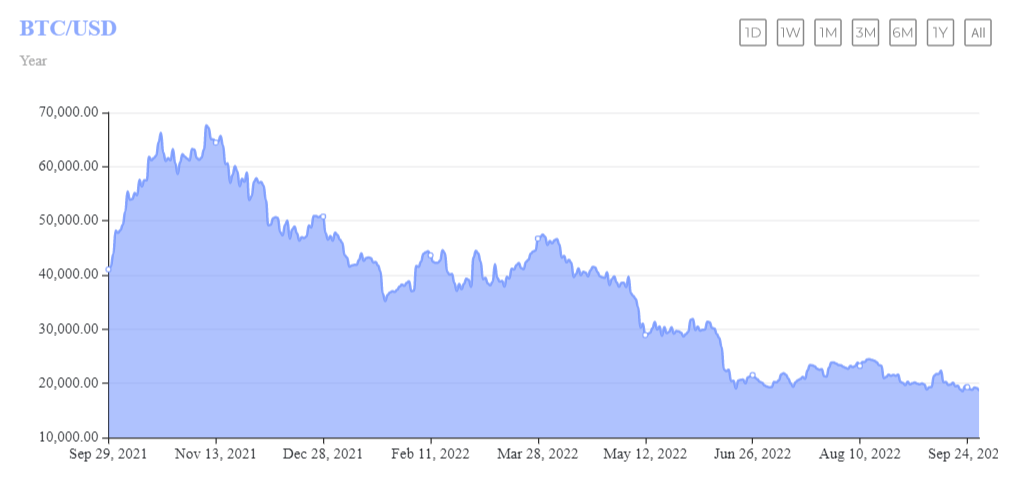

Interestingly, both Bitcoin and commodities are moving in the opposite direction so far in 2022. The commodity price skyrocketed with the Russian invasion of Ukraine. On the other hand, BTC and the broader crypto sector suffered huge losses. BTC slipped 70% from its ATH level of $69,000 last November.

However, the analyst says that BTC and crypto will gain momentum going forward. He also believes that commodities will give up their gains. The analyst adds that the Fed’s aggressive monetary tightening and supply-demand cycle will push commodities down. Explaining his views, McGlone comments:

The lowest ever crypto volatility against the Bloomberg Commodity Index (BCOM) indicates the resumption of Bitcoin’s trend to outperform. What is different for commodities is that crypto’s 260-day volatility has dropped to new lows. If history is a guide, Bitcoin volatility is more likely to recover compared to commodities as crypto moves to new highs.

The Bitcoin master is confident that Bitcoin will outperform in the long run to become a “high beta version of gold and US Treasuries.” In this regard, “The bitcoin-gold ratio first reached around 10x in 2017. “In a rapidly digitizing world, token crypto is the best competitor to the old hedge gold.”