Famous Bitcoin analyst Willy Woo talked about an altcoin giant under US control in his latest statements.

Bitcoin master says this altcoin is under US control

Known for his accurate predictions, the Bitcoin analyst suggested that the Ethereum network is under US control. On December 24, he reported that 69% of blocks have been OFAC compliant since Ethereum switched to PoS. OFAC is the US economic sanctions enforcement agency that seeks to play a role in cryptocurrency regulation. Ethereum’s percentage of compliance with OFAC abruptly increased from 9 to 51% from October. Woo claims that Ethereum-based dApps are by no means decentralized and transactions on Ethereum are not censorship resistant.

Is this right? Only 3 months after ETH goes PoS, 69% of blocks are OFAC compliant?

Meaning Ethereum is already under control by the US government.

This means all DeFi apps running on ETH are not decentralised finance. And transactions are not censorship resistant. pic.twitter.com/VqNWuTXepn

— Willy Woo (@woonomic) December 23, 2022

OFAC compatibility concerns MEV-Boost relays where the production of ETH blocks is outsourced. Along with the allegations made by Woo, the crypto community has been questioning how centralized Ethereum is for some time. Centralization concerns stem from large companies taking over a significant portion of Ethereum nodes. First, about 52% of Ethereum node operators are hosted by Amazon Web Services (AWS), a heavy infrastructure provider.

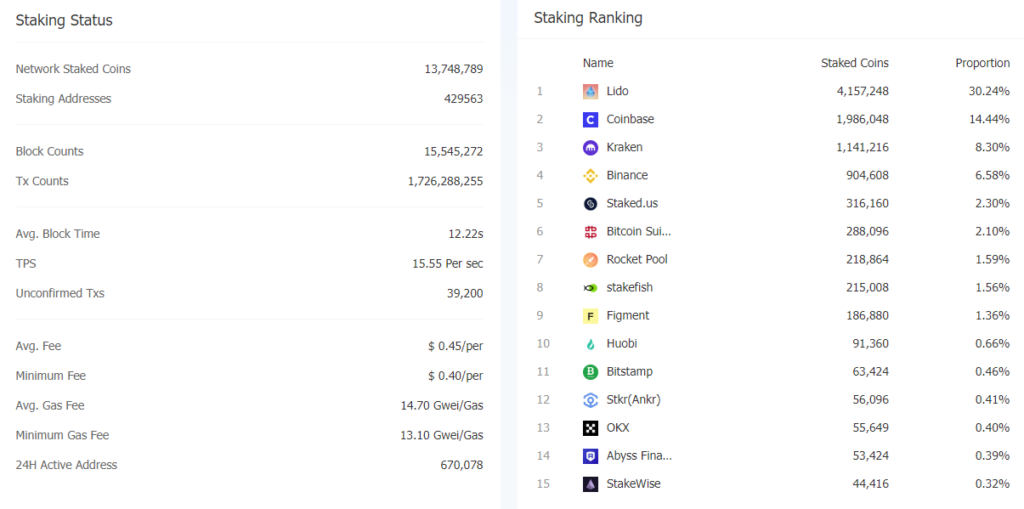

Second, after the merge is implemented, only two entities control about 50% of the Ethereum network. These are Lido and Coinbase. This is where around 50% of all staked ETH is kept. Lide and Coinbse hold 30.24% and 14.44% shares, respectively.

Censorship alarm on Ethereum network

Back in November when FTX went bankrupt, Ethereum had to execute OFAC instructions on more than 73% of its blocks at one point. OFAC compliance enables the US government agency to enforce economic and trade sanctions. The organization had previously imposed sanctions on Tornado Cash and some Ethereum addresses. Along with OFAC, Lido and Coinbase are other major controllers due to the stakes ETH in their stakes of Ethereum.

Coinbase and Lido control almost 50% of the entire network, according to the network’s staking rating. This means an unhealthy redistribution of staking power. The only positive thing in the ranking is that the largest Ethereum shareholder is Decentralized Autonomous Entity Lido.

Lido lets you join anyone to join their DAO. Thus, it technically makes the largest Ethereum holder a decentralized piece. The second largest owner is Coinbase with more than 14%. Technically 14% is enough to cause any serious localization issues on the network. However, the distribution of funds, especially among centralized exchanges, raises questions about the stability of the PoS model. cryptocoin.comAs you can follow, ETH price lost double-digit value several times in September due to these concerns.