Bitcoin (BTC) miners or entities generating the cryptocurrency seem to be running down their coin stash amid the FTX-induced market panic.

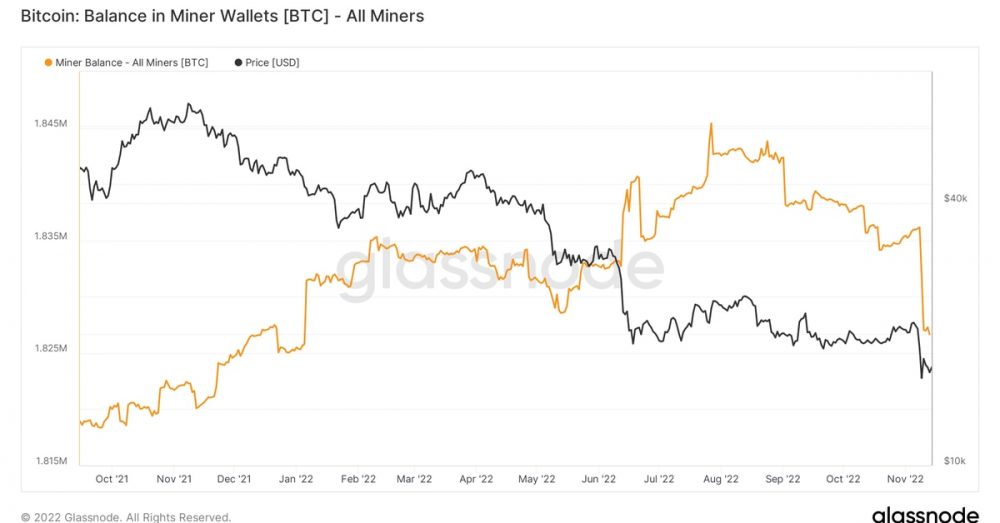

In the past seven days, the balance held in miner wallets has declined by 9,402 BTC to a ten-month low of 1.826 million BTC ($30.6 billion), according to data tracked by blockchain analytics firm Glassnode.

The miner net position change, or the 30-day change of BTC supply held in miner addresses, slipped to -10,972 BTC on Thursday, the lowest since early January.

Bitcoin miners solve complex algorithmic problems to mine blocks and verify transactions in return for rewards paid in BTC. In other words, the miner profitability is heavily dependent on the cryptocurrency’s price. Therefore, miners tend to run down their inventory in a bleeding market to stay afloat.

Bitcoin fell by 22% in the seven days to Nov. 13, its biggest decline since June, as the collapse of Sam Bankman Fried’s FTX exchange dented investor confidence and triggered contagion fears.

Chart shows miners are distributing coins at a fastest pace in nearly two years. (Glassnode)

The sell-off could continue in the days ahead, analysts told CoinDesk. That would worsen the situation for miners, who have been facing high operational costs.

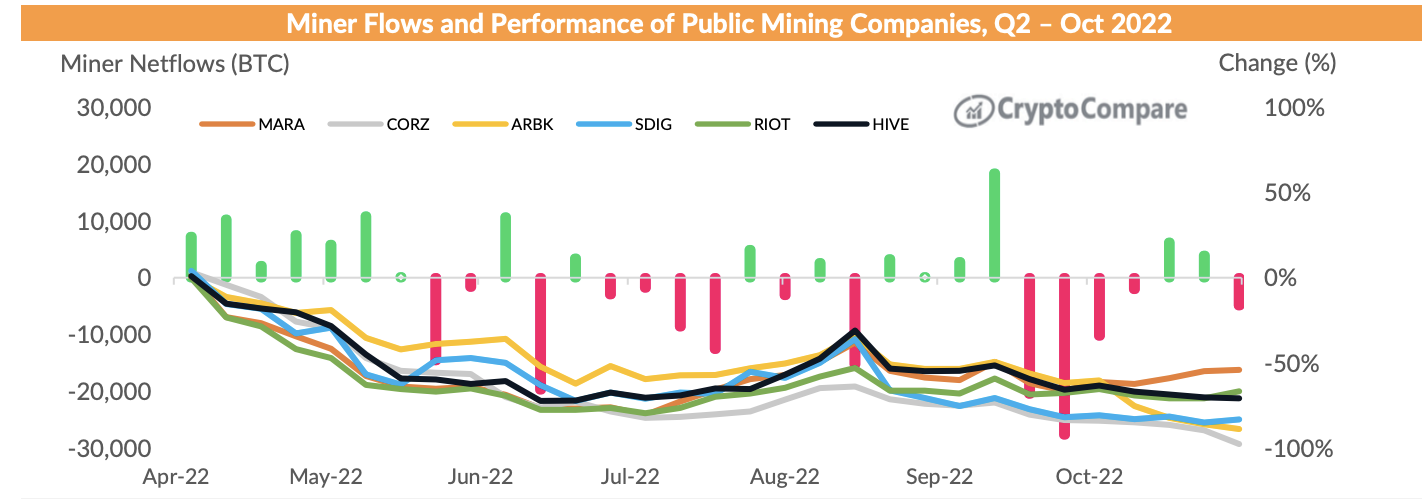

“Bitcoin mining companies have struggled this year, with the fall in the price of the largest cryptocurrency and rising energy prices (and operating costs) leading to a decline in revenue. As a result of this, mining firms have been heavily selling their underlying holdings, leading to significant net outflows over the last six months,” data provider CryptoCompare said in the October review.

Charles Edwards, CEO of asset manager Capriole, recently voiced a similar opinion on Twitter, saying, “bitcoin’s electrical cost has just been breached for the 2nd time only in 5 years. The electrical bill for the average miner is now greater than the income earnt.”

“Many Bitcoin miners are now turning their rigs off,” Edwards added.

Mining firms have been heavily selling their underlying holdings over the past six months. (CryptoCompare)

According to Blockware Solutions, a continued BTC price slide toward $15,000, would not necessarily see miners immediately turn of their machines.

“Many miners have PPAs [power purchase agreements] and hosting contracts that require them to consume energy or potentially pay an additional fee. Many miners will likely continue mining at a loss in the short term until either the price of BTC goes back up, or they exit their operation altogether,” Blockware’s latest weekly newsletter said.