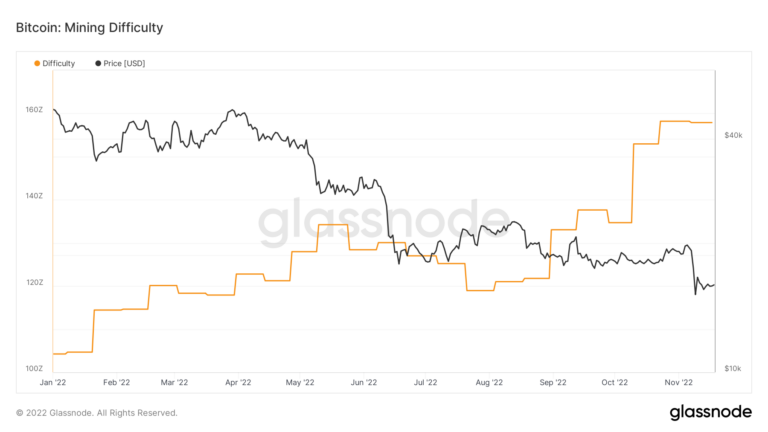

Bitcoin miners expect the difficulty to drop as the computational hash rate slows. Miners, who have been covering their costs by selling BTC since the beginning of the year, were even more difficult with the bankruptcy of FTX.

Difficulty readjusts as Bitcoin miners sell at a loss

Bitcoin’s mining difficulty is expected to be adjusted on Sunday night/Monday, November 21st. Currently, over 100% of the mined supply of Bitcoin is spent at the fifth most significant rate ever. After consecutive negative or neutral difficulty adjustments, Bitcoin hash rate and difficulty peaked. However, difficulty should come down again over the weekend, bolstering expectations that the hash rate has peaked.

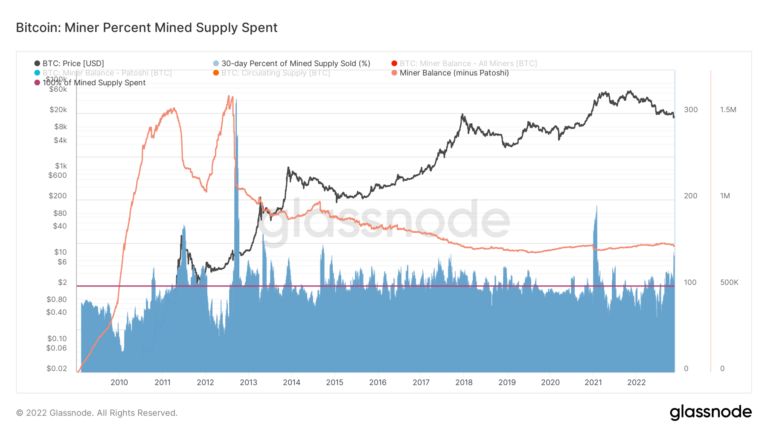

The following highlights the percentage of Bitcoin spent from miners over the 30-day window. The blue section, which saw its highest level since 2021, shows the number of coins miners have sold. The volume of Bitcoin sold by miners in the past 30 days was the fifth largest outflow in Bitcoin history.

Miners’ balances are also showing a downward trend. But not at an alarming pace at the moment. The discrepancy between spent Bitcoins and Miner balance shows that mining companies are selling newly mined BTCs to cover costs.

Bitcoin miners are in trouble due to rising energy costs

In a recent earnings call, top Bitcoin mining company Marathon Digital revealed that it expects Bitcoin to trade between $18,000 and $21,000 for some time. He also stated that he is “comfortable” in this range and is ready to “get through the storm”. However, as the repercussions of the FTX collapse continue to reverberate across the industry, Bitcoin continues to trade below $17,000 for the eighth consecutive day. Some analysts predict that it will find buyers from new lows before rebounding.

These bottoms just got clearer after the FTX crash

Bitcoin price has been predominantly bearish over the past year due to the collapse of crypto companies. This wave of bankruptcies ended with FTX at $ 15,800. In the process, the BTC price recorded two prominent LHs and triple LLs from July 2021 to November 2022. Connecting these dots creates a falling wedge formation. The formation first predicts a 54% rise to $32,191. The target gets there by adding the distance between the first top and bottom to the breakout point at $20.561.

Conversely, if Bitcoin price produces a macro bottom of $13,575, it would mean a 71% drop from $48,100. The midpoint of this pattern is $32,191, which is the target the falling wedge predicted. If BTC manages to surpass the 2022 peak volume level of $19,150, the first confirmation of an uptrend will come. However, a three-day candle close above $20,560 is needed for a potential 54% rise.

Pay attention to these

Looking at the above case, investors who expect a flat transition to macro lows from $13,575 to $11,898 should be cautious. A bullish divergence will trigger a 16% rally to critical hurdles at 18,784 or 19,150. Analyst Akash Girimath awaits confirmation for an ideal investment

- If bitcoin price breaks below the lower trendline of the falling wedge of $15,500, investors should start averaging the dollar cost. In other words, he must buy the falls with small and fixed amounts of capital. Significant levels include $13,575 and $11,898. While a drastic correction is unlikely, a revisit of the $10,000 psychological level should not catch investors off guard.

- Due to the bullish divergence, impatient investors may start accumulating BTC at these levels. However, increasing the investment size or capital allocation should only be considered after the 2022 POC is converted to $19,150. Failure to overcome this hurdle will be a signal for market participants to start dumping their holdings.