Leading cryptocurrency Bitcoin (BTC) miners have started selling their holdings on the open market as the recent price drop in the market has put their financial situation under pressure. Read us for details…

Bitcoin miners sell their BTC

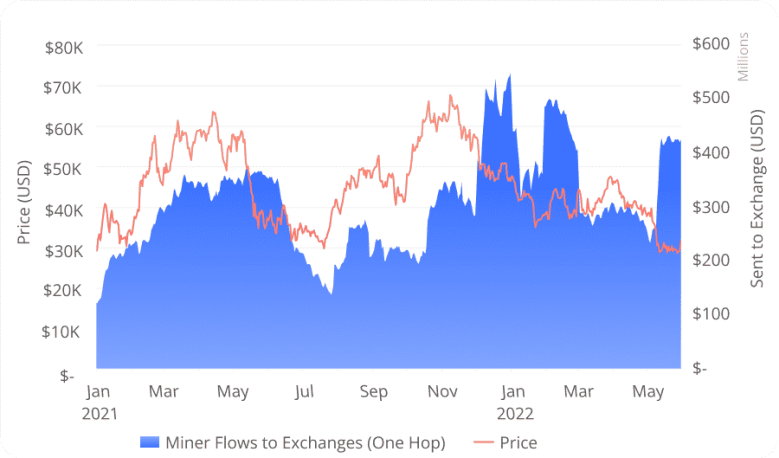

A report by Bitcoin miner Compass Mining shows that several US-based miners are starting to dump their holdings on the open market . Combined with the drop in Bitcoin prices on the verge of recent developments in the crypto market deepened by the LUNA collapse, miners are also dealing with increasing difficulties in mining. This significantly reduces the profitability of BTC miners. Data from

Bitinfo shows that Bitcoin mining profitability has fallen to its lowest level since mid-2020, with Bitcoin prices hovering at similar lows.

Why are miners dumping Bitcoin?

Citing Coinmetrics data, Compass Mining says miner flows to exchanges have reached their highest level since January. The sale preceded a massive drop in BTC prices next month, before easing some relief in March.

Canadian miner Cathedra became the latest miner to sell the token. In its latest earnings report, the miner revealed that it sold 235 tokens (almost all of its holdings) in May for a total gross of $8.8 million. The company says the purpose of the sales is to ‘insulate itself’ from additional price drops. It currently holds about 3.7 tokens.

Compass Mining analyst Mitch Klee comments on miner sales:

Miners can start selling hodl’d Bitcoin on the open market. At least they feel the pain after the last big drop in price. Combine this with a downward difficulty setting (indicating that miners are closing) it seems like miners are hitting a wall in profitability.

No improvement in sight for Bitcoin!

sentiment is largely shifting towards the crypto market as Bitcoin now erases a recent relief rally. As you can follow from Cryptokoin.com news, the token has struggled to exceed $30,000 for about a month.

While a recent report suggests markets may have hit a bottom, they will also face major challenges in recovery. However, some analysts also see Bitcoin facing a steep climb to previous highs with policy tightening by the Federal Reserve, rising inflation and the Russia-Ukraine war.

Still, according to analysts, BTC could see an influx of miners similar to its predecessor, with leading altcoin Ethereum moving to a Proff of Stake (PoS) consensus model this year.