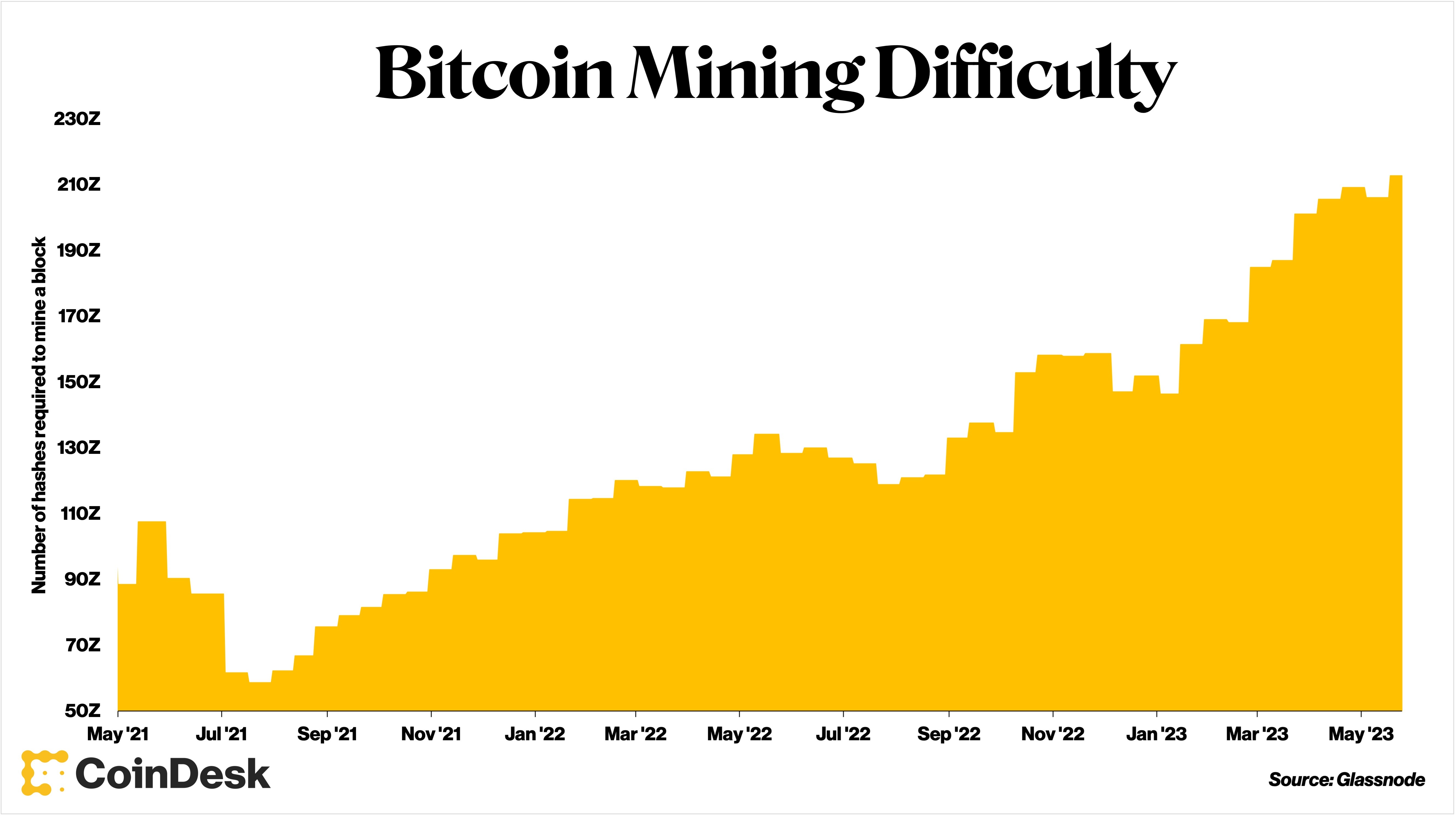

The bitcoin mining difficulty – a measure of how easily miners can discover a block of bitcoin – is set to surpass the 50T mark on Wednesday, setting a new all-time high, and it’s could continue to grow further.

The rally in bitcoin prices this year and rise in popularity for the Ordinals protocol has led to better profitability for the miners, and miners are continuously deploying more mining machines, as planned. These factors contribute to more computing power, which leads to record difficulty levels.

The bitcoin mining difficulty adjusts automatically as the more computing power, or hashrate, gets added to the network, in order to keep the time required to mine a block stable at about 10 minutes.

“New-generation machines will continue to get plugged in as rack space is made available,” said Ethan Vera, chief operating officer at mining services firm Luxor Technologies.

Meanwhile, the popularity of the ordinals protocol has led to transaction fees three times higher than normal, adding to miners’ revenue, Vera said.

Ordinals enable additional functionality on the bitcoin blockchain, such as non-fungible tokens and other coins, which in turn increase the number of transactions, making mining a block more profitable.

The difficulty of mining a bitcoin block is set to hit 50T on Wednesday, doubling in two years. (CoinDesk/Sage D. Young)

An increase in difficulty means a decline in profitability for miners because their chances to win any single block, and bring in revenue, becomes slimmer. Marathon Digital Holdings (MARA), one of the biggest miners, noted that its monthly mined bitcoin was lower, month-on-month, as difficulty rose in April. Similarly, Canadian miner Bitfarms (BITF)’s fourth quarter slid to a loss due to higher difficulty.

However, a few events could dampen the growth of the hashrate.

The lack of positive bitcoin price movement and constraints in available infrastructure could be some of those catalysts, according to Tim Rainey, Treasurer at Greenidge Generation Holdings (GREE).

Uncertainty around the next Bitcoin halving event could also slow down the increase of mining difficulty, according to Charles Chong, senior manager of business development at Foundry.

Foundry is owned by CoinDesk’s parent company, Digital Currency Group.

Meanwhile, having too much hashrate in one region could also affect the growth of the bitcoin mining difficulty as it may change how mining rigs are deployed.

“Given the concentration of hashrate in North America, we are seeing new seasonal trends,” said Colin Harper, head of content and research at Luxor Technologies. Previously, the hashrate would increase during China’s rainy season, when cheap hydropower was plentiful.

Instead, now, when summer heatwaves sweep through the U.S., miners power off their machines to save the energy required for cooling.