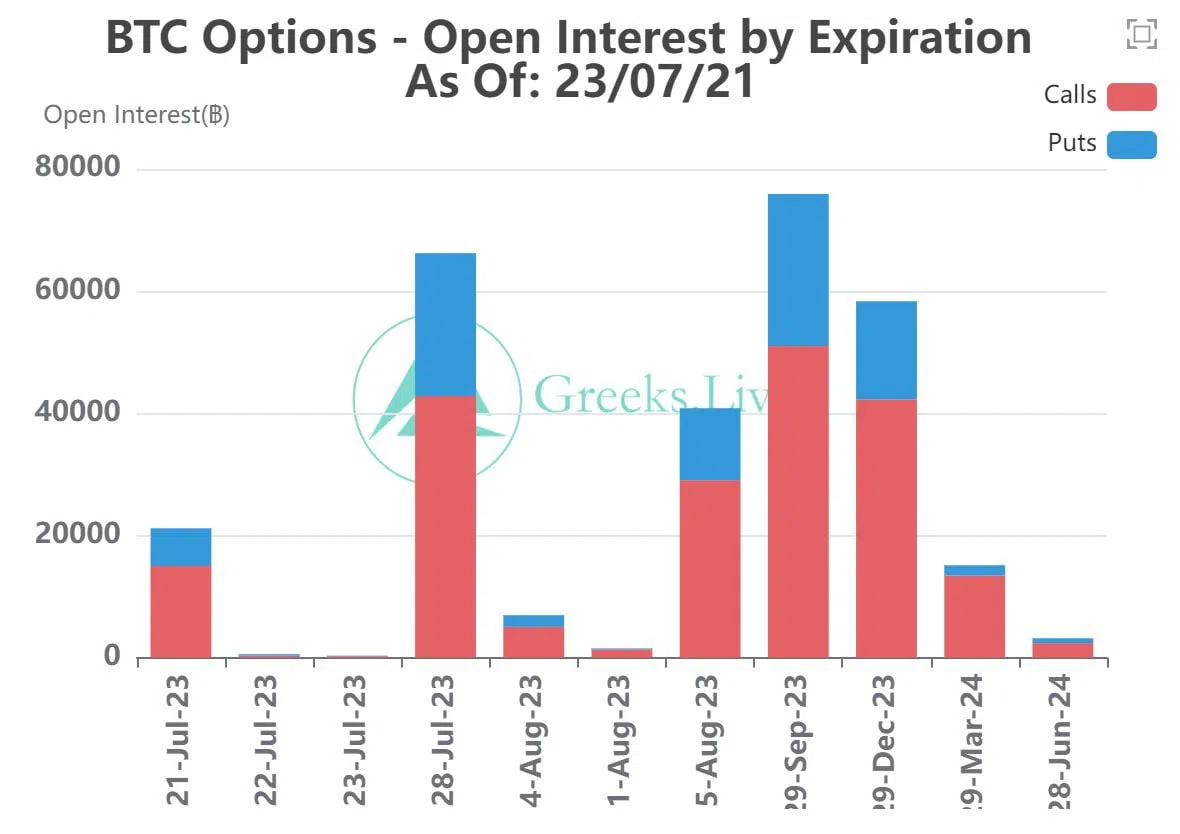

Today, approximately 21,000 Bitcoin options contracts with a face value of $630 million will expire. These may trigger additional selling pressure for BTC, which has fallen below $30,000 again.

$30,250 is the maximum pain point of Bitcoin options

The last batch has the maximum pain point of $30,250, which is slightly higher than the current spot price. The maximum pain point is the price level with the most open contracts. It is also the level at which the most damage will be incurred upon expiration of the contract.

Today’s tranche of expired BTC options contracts has a sell/buy ratio of 0.41, continuing the bullish trend. The ratio is obtained by dividing the number of short contracts (puts) by the number of long contracts (calls). Additionally, values below 1 mean there are more purchase contracts. This indicates a bullish trend for the underlying asset.

July 28 will see a much larger option expire with over 60,000 open positions. Open interest is the number of open contracts that have not yet been concluded. GreeksLive said at this point, “The market has been generally negative this week. “July sales calls almost monopolized market volume,” he says. He also adds that the Options data show that the rally is clearly unsustainable. Finally:

Existing market participants are not too optimistic about the ensuing bullishness, but there is no incentive for short-term trades, selling calls have become the only option.

Critical day in Ethereum

Around 180,000 Ethereum options contracts will also expire today. Their notional value is $340 million and the maximum pain point is $1,900. The buy/sell rate for ETH contracts is 0.43, similar to the Bitcoin options rate. This simply means that more than twice the sales contracts have been sold.

How is the Bitcoin price before the deadline?

Bitcoin failed to maintain momentum above $30,000. It’s down around 1.5% today. As a result, it is currently struggling to hold in the $29,800 region. BTC price remains firmly in a tight range. However, the longer it consolidates at resistance, the more likely it is to pull back.

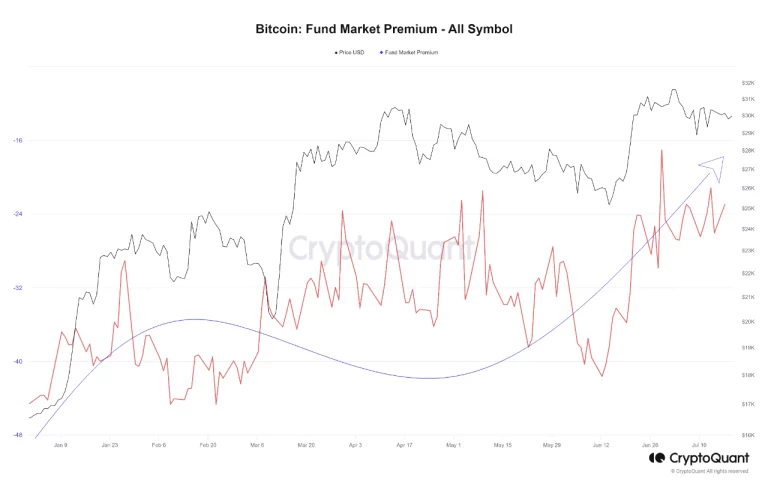

Institutional investors find new opportunities in Bitcoin accumulation

According to the latest data from CryptoQuant’s Woominkyu, the optimism of institutional investors was evident from the rising premium of Bitcoin Trust products. The premium represents the difference between the trust’s market price and its Net Asset Value (NAV), which indicates the demand for funds.

In terms of context, a Bitcoin trust is a financial product or investment vehicle that provides investors exposure to Bitcoin’s price movements without direct ownership of the cryptocurrency. Since January 2023, the premium for Bitcoin trust products has steadily increased. This shows that the investor’s desire to buy the fund has increased. As the premium rose, the gap between the market price of trust products and the actual market price of Bitcoin narrowed. This is an indication of the growing positivity towards Bitcoin among investors.

Meanwhile, various indicators are giving green signals for BTC. cryptocoin.comAs we have reported, analyst Ali Martinez predicts that we can reach $ 31,300 in the short term.