Bitcoin Pizza Day has taken a negative turn, with meme coin issuers profiting over $200,000 from pizza-related rug pulls on the 13th anniversary of what’s thought to be the first commercial bitcoin transaction.

According to data from dextool’s “live new pairs” section, there has been 14 pizza-related meme coins issued in the past 24 hours. Four have been confirmed as rug pulls, or schemes in which money is stolen from investors through any of a number of techniques. And at least five others are suspected of being so-called honey pots, in which an asset can be sold only to the contract creator, and purchasers are left holding tokens they can’t get rid of.

Bitcoin Pizza Day is marked on May 22. It dates back to 2010, when computer developer Laszlo Hanyecz bought two pizzas for 10,000 bitcoin.

The first meme coin was pizza coin (PIZZA). It lasted for just eight minutes before developers altered the rate of sell tax so that investors were unable to divest their holdings. A total of 34 traders bought the token with a total loss of 0.9892 ETH ($1,800).

Seemingly unperturbed, investors then flocked to tokens named bitcoin pizza and pizza inu, ending up with losses of more than $12,000 in total.

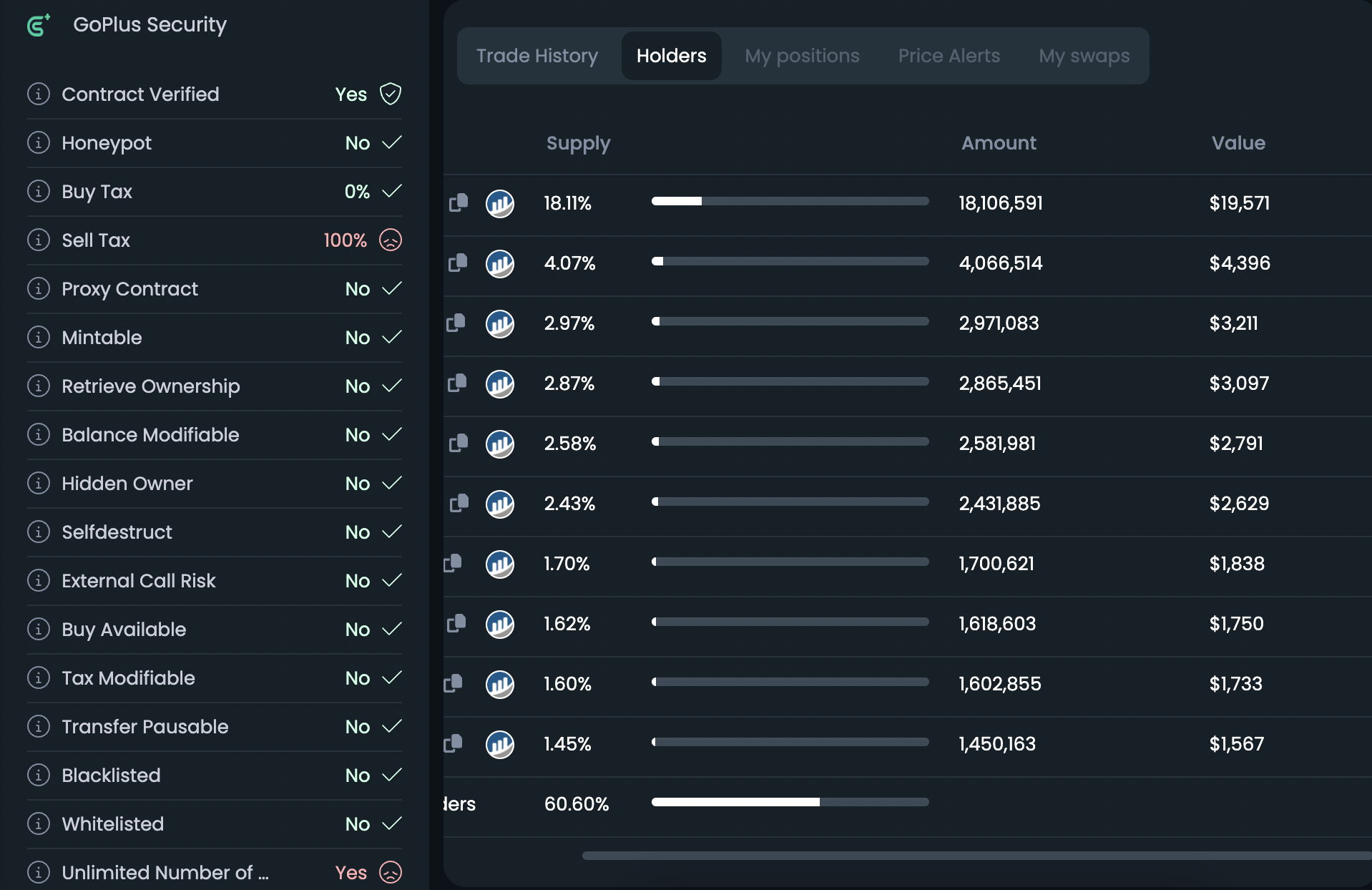

Image displaying 100% sell tax for BPIZZA (dextools)

Ethpizza and bpizza followed, with the former reaching a $40,000 market cap and the latter soaring to more than $100,000. Both tokens became unsellable after the contract owner paused transfer and sales.

There are multiple ways in which developers can “pull the rug” on projects, one of which is by adding a modifiable sell tax to the smart contract. That gives the contract owner the ability to raise the tax so high that it makes the tokens unsellable. An alternative – and more common – approach is for a smart contract owner to hold the vast majority of a token, waiting for the price to rise before selling the token into freshly formed liquidity from unsuspecting investors.

The appetite for investors to buy the tokens, all of which have no fundamental value, spawned out of the recent “meme coin mania” following pepe’s momentous rise to a $1 billion market cap. Investors seem to be hoping to catch the next hype-fueled token in a market that has unlimited downside risk.