Analysts note that a Bitcoin futures trader on Binance has been accumulating for days. In line with that, they say the result can be quite ‘squeeze’.

Binance futures giant absorbs spent Bitcoin (BTC)

According to TradingView data, BTC is below $20,000 for the fourth day in a row. This shows that the bulls have not been able to break the resistance. Many investors and traders are wondering when and how the latest consolidation phase will end. Two popular social media traders noticed an ongoing accumulation trend of an unknown large-scale Binance futures trader.

While individual investors were selling, this establishment worked for several days to absorb liquidity. The result is probably obvious. In part of an update on the phenomenon, Crypto of Capo described the asset’s long BTC position as ‘large’ and ‘comfortably’ worth 30,000 BTC or more. After that, he predicted ‘Leap is coming’.

And even more. Big long position there. Massive.

Bounce incoming. https://t.co/ENOo2HLCXv pic.twitter.com/OiaTagLzZP

— il Capo Of Crypto (@CryptoCapo_) September 6, 2022

“There is quite a bit of interest in Binance futures at $19,650,” the other trader account JACKIS continued. In this context, the analyst made the following statement:

We see that the positions are filled, the price is rising, and then a new selling wave comes. We also witness it hitting and repeating new orders again and again. Sounds like someone is saving too much.

“Be careful about this!”

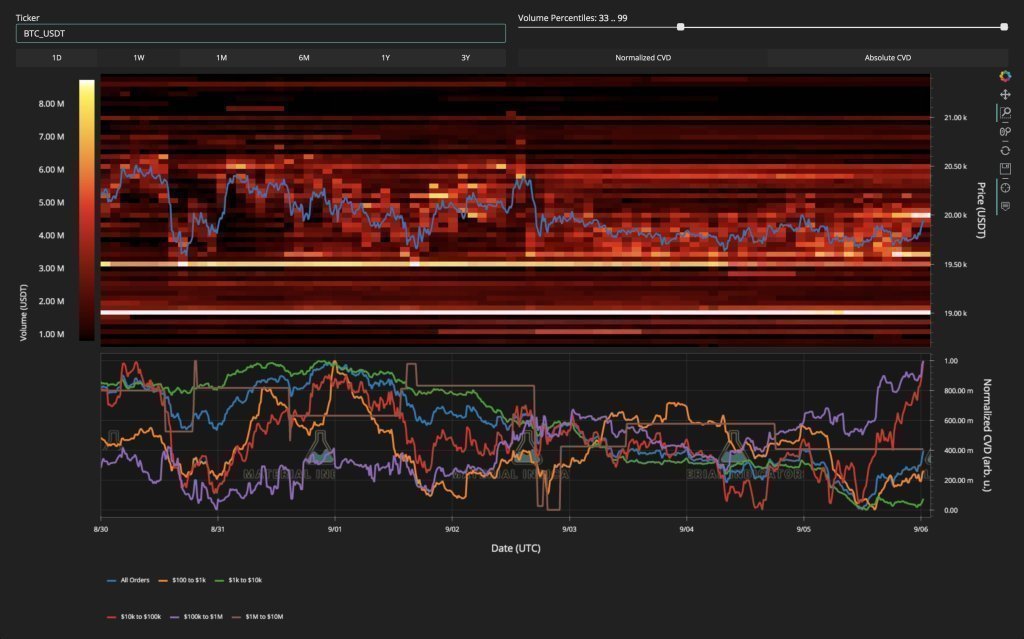

Meanwhile, Binance’s on-chain tracking resource Material Indicators has shared order book data. Accordingly, the data showed that the resistance increased until 6 September.

Binance order book chart / Source: Material Indicators / Twitter

Binance order book chart / Source: Material Indicators / TwitterElsewhere, trader Crypto Tony warned that altcoins are outpacing Bitcoin’s intraday gains. Because, according to the trader, this is something to be careful about. Ethereum (ETH) spiked ahead of the September 15th Merge event. However, the press slipped down at the time. Crypto Tony says:

While Ethereum and altcoins are moving, Bitcoin is not. Which makes sense as people try to get the most out of the upcoming Merge. But these moves often end in a dump when this event happens. So be careful.

ETH 1-hour candlestick chart (Binance) / Source: TradingView

ETH 1-hour candlestick chart (Binance) / Source: TradingViewDollar continues to press

cryptocoin.com In macro terms, as you can see from , the US dollar index (DXY) has reached the highest levels of the last two decades. So once again it became the main focus. DXY crossed 110.55 the day before returning to consolidation. This move caused more losses for the euro and yen in the process.

GM fam. ☕️

This week is all about the $DXY.

If this rising wedge breaks down, we should get short-term relief for #stocks and #crypto.

Testing resistance now. 👀$BTC $ETH pic.twitter.com/AUoQGaL14f

— Justin Bennett (@JustinBennettFX) September 6, 2022

In a clear outlook for the coming year, popular macro analytical account Fejau predicts that DXY strength will continue as the European energy crisis unfolds. In an extensive Twitter thread released on Sept. 5, he summarized:

The Fed will be faced with such strength of the dollar that it will have to be tamed artificially. We are about to experience a sovereign debt crisis caused by the European energy crisis. It’s all a touchstone for the end of 100 years of fiat money.