The crypto market and Bitcoin price await the US FOMC meeting and Fed Chairman Jerome Powell’s speech. Meanwhile, as optimism increases after Donald Trump’s presidential victory, investors are taking positions in anticipation of a 25 basis point interest rate cut to be announced today. Although it is predicted that the developments may push the Bitcoin price to $100,000 in a short time, some experts warn that the market may be volatile.

US FOMC expectation for Bitcoin price!

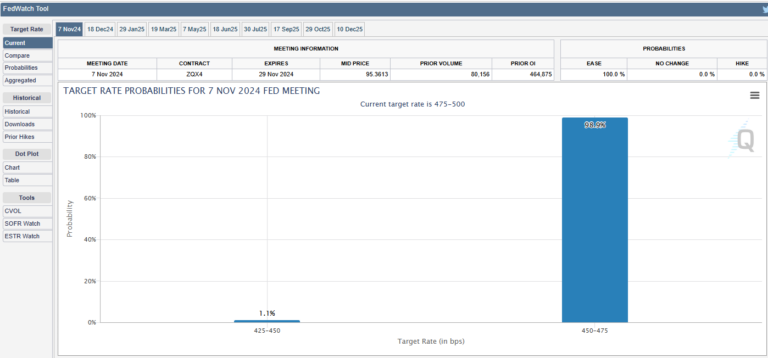

Market participants expect the economic outlook to brighten ahead of the US FOMC meeting. In addition, the interest rate cut decision may also affect market sentiment. The US Federal Reserve is expected to make a 0.25% point cut, and according to the CME FedWatch Tool, this probability is evaluated as 99%; It is also estimated that a similar announcement will be made in December. But despite this positive outlook, some investors remain cautious, seeking more clarity on market trends. For example, crypto experts predict that the market could be volatile following Jerome Powell’s speech.

In this context, crypto expert and Bitcoin advocate AlphaBTC remained cautiously optimistic as it awaited the Fed to cut a quarter point. Stating that Powell’s statements will shape market sentiment, AlphaBTC stated that a hawkish tone could trigger recession concerns, while a dovish attitude could support “TrumpRally”. Additionally, Powell’s views on newly elected US President Donald Trump will be closely monitored. Considering Trump’s past criticisms of the central bank, Elon Musk’s DOGE initiative is also increasing market optimism and it is said that it could trigger a strong rally in the price of Dogecoin.

Will the BTC price reach 100 thousand dollars?

Although the market expects short-term volatility following the FOMC meeting and Fed Chairman Powell’s speech, many crypto experts are optimistic about a rapid recovery in BTC price. Analysts are sharing their bullish predictions, stating that they expect clear crypto regulation under Trump’s presidency. At the time of writing, Bitcoin price was at $74,828, up 1.5% after reaching its ATH level of $76,460.15 in the last 24 hours. BTC Futures Open Interest has increased by approximately 4% since yesterday, indicating an optimistic atmosphere in the market.

In addition, the prospect of Bitcoin Strategic Reserve in the US creates optimism in the market. Wyoming Senator Cynthia Lummis reiterated her stance of making BTC a strategic reserve, while Trump also promised this in his presidential campaign, so bullish expectations are increasingly rising. Meanwhile, a recent report from Matrixport indicates that BTC could stage a rally towards $100,000. The report suggests that the possible departure of US SEC Chairman Gary Gensler and the expectation of Bitcoin US Strategic Reserve could set the stage for the crypto to reach $100,000 soon.

The US FOMC is likely to create some volatility in the market and suppress the Bitcoin price rally. Apart from this, concerns are increasing in the market as recent developments have turned many investors’ attention to altcoins such as Ethereum. This increased interest in altcoins is affecting the sentiment of some traders.

Bitcoin sale expectation

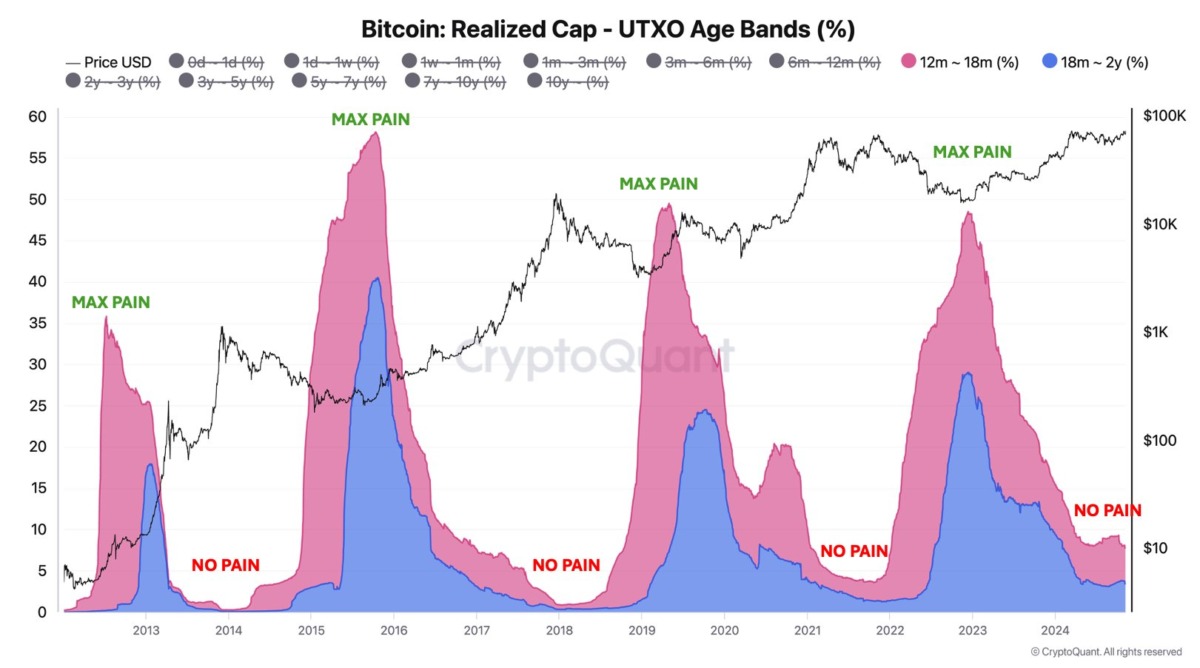

Additionally, CryptoQuant Founder and CEO Ki Young Ju predicted a BTC sell-off in the coming days in a recent X post. Ki Young Ju stated that new investors may see this rally as an opportunity to realize profits, which may prevent a strong rally in the crypto price. Ki Young Ju stated:

New investors often hold BTC during bear markets and suffer losses. After about two years, when the pain subsides, BTC changes hands. Then now. It could go up 30-40% from here, but not like the 368% increase we saw from $16,000. I think it’s time to sell gradually rather than buying with everything.