Bitcoin (BTC) is leaving behind one of the most turbulent years in its history in general. In this article, you will have a detailed overview of 2022, the environmental impact of developments, and the predictions for 2023 for Bitcoin price.

Bitcoin roadmap and nine predictions

In 2022, there were many interesting developments in the cryptocurrency market. So let’s quickly recap the three main events that caused the Bitcoin price to plummet throughout the year. The three main events that caught investors off guard in 2022 are:

- Bitcoin price signals the end of the bull run. BTC reached its ATH level of $68,997.75 on November 8, 2021. However, it radically changed the market structure, dropping to $32,995 on the weekly timeframe on January 24. This move confirmed the start of a bear market.

- Terra-Luna-3AC crash. While the Bitcoin price fell, it was followed by the collapse of the algorithmic stablecoin Terra in May. This move caused BTC to lose 30% of its market value in less than two weeks. As a result of this sudden market crash, over-leveraged crypto hedge fund Three Arrows Capital (3AC) faced an untimely drop. That brought the market down from roughly $30,000 to $17,600.

- FTX debacle: The freshest wound in the crypto market is the FTX bankruptcy. The collapse of Sam Bankman-Fried’s empire occurred at the hands of his rival, CZ, the founder of Binance.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

As a result of these three events, BTC price dropped 77.57% from the ATH level of $68,997.75. Despite these important results, it started to show an upward trend on November 9. So, let’s take a quick look at what the leading crypto techniques look like.

Bitcoin price points to short-term bullish outlook

Bitcoin price showed a bullish divergence on the three-day chart on Nov. Since then it has been on the rise in this time frame. From this setup, its price has increased by 19%. It then made a local top at $18,400. Looking forward, there are three views of Bitcoin price:

- A local top of roughly $19,300. Then return to a lower level to create a macro bottom.

- Breaking the $19,000 – $20,000 hurdle to reach the $25,000 and $28,000 resistances.

- The decline continues and we see a macro bottom between $11,898 and $9,453.

Status of Bitcoin miners

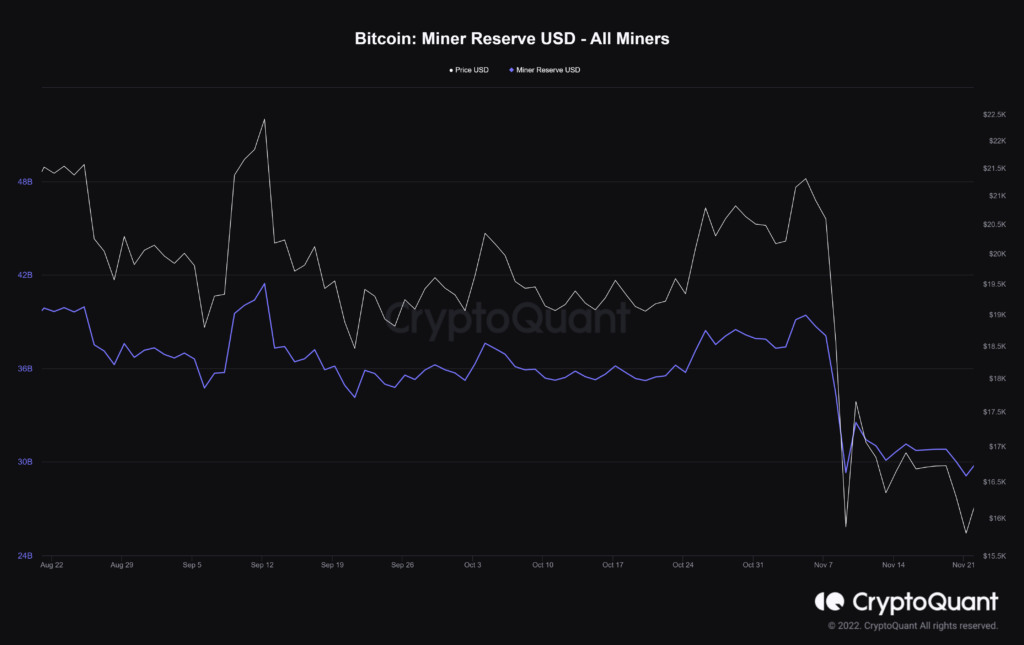

Before we get too deep into the techniques, let’s take a quick look at miners, who are essentially the backbone of the Bitcoin network. Due to the crypto winter, miners have already faced two major capitulations. The first was from June to August. The second started at the end of November and still continues. Judging by the historical miner capitulations and Bitcoin price dips, the bottom of the current cycle should be just around the corner.

The last drop in difficulty coincides with the crash of Argo Blockchain, one of the big names in the Bitcoin mining industry. As a result, ARBK trading was suspended on the UK and AND exchanges on December 9, coinciding with a major drop in mining difficulty.

This decrease in mining difficulty has slightly relieved the pressure on the miners. But it also marked the continuation of waves of surrender. Thus, a rapid downtrend is not outside the area of possibility for Bitcoin price.

The miner reserve indicator provides an estimate of the number of BTC held by these participants. It is currently hovering around 1.84 million BTC worth about $30 billion. Therefore, the continuation of the hardship faced by miners could create further selling pressure, causing the Bitcoin price to drop further.

On-chain metrics signal relief for Bitcoin

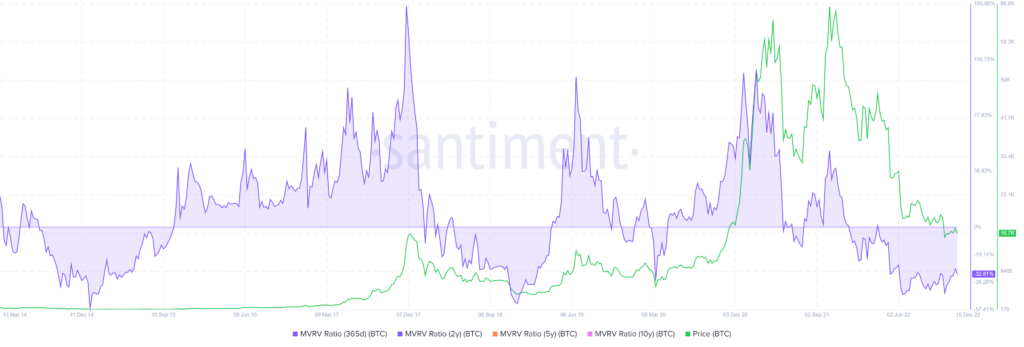

The first and perhaps most important on-chain metric that determines the probability of capitulation is the 365-day Market Value to Realized Value (MVRV) indicator. This metric is used to determine the average profit/loss of investors who bought BTC in the past year. According to historical data, the bottom for BTC occurred when the MVRV value fell below -40%.

The free fall in June and the sudden crash in November caused the 365-day MVRV to reach -45%, corresponding to the -2020 level. However, the on-chain metric is still a long way from 2018 and 2014 levels. These data suggest that a minor downtrend for Bitcoin price is likely in the future.

Whales and accumulation patterns are important for determining whether the Bitcoin price has bottomed out. Historical data shows that addresses holding 100 to 10,000 BTC have an impact on the price of Bitcoin. The number of these addresses increased from 15,662 to 15,989 last month. Thus, 327 new addresses joined the network. In February, when these investors were most active, the number of addresses increased by 274 from 15,870 to 15,596. This move was followed by a $10,000 increase in Bitcoin price from roughly $37,400 to $47,050.

Another interesting data point was between September and November 2021, when these addresses increased from 15,777 to 16,150 and 373 new addresses were added. After this rise, Bitcoin price surged from $40,700 to 66,971. Then it reached the ATH level. If history repeats itself, this latest accumulation of whales will trigger a rapid bear market rally in Bitcoin price. This move means a retest of $28,000, assuming BTC inflation is $10,000 as it was in February.

Whales and stablecoins

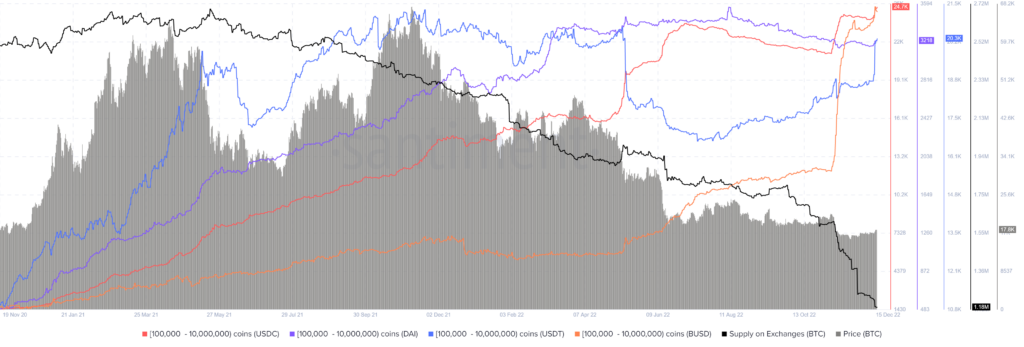

While BTC accumulation is significant, the presence of stablecoin holding whales is more important to determine the probability of a rally in Bitcoin price and add weight. To that end, let’s take a look at the number of addresses holding between $100,000 and $10,000,000 in stablecoins. The tokens in question include Tether US (USDT), DAI, USD Coin (USDC), and Binance USD (BUSD).

As the chart below shows, USDC and BUSD whale addresses holding $100,000-10,000,000 began raising holdings after FTX’s initial crash in the first week of November. These addresses for USDT and DAI started piling up in the first week of December. Obviously, these whales pile up for a rainy day. All in all, a possible drop of Bitcoin to $9,500 would be a perfect start for the new cycle.

Crypto mining offers an innovative way to hold BTC in 2023

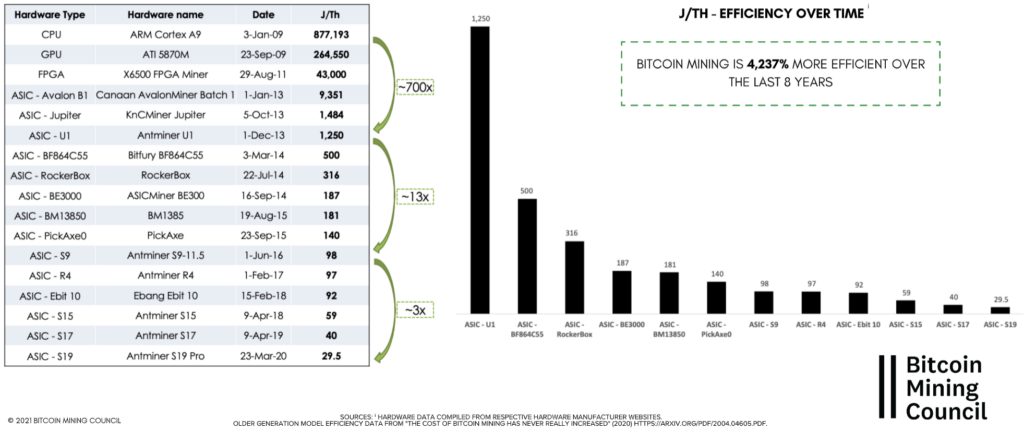

Cryptocurrency mining has skyrocketed explosively since mid-2016 with the S9 ASIC miner. The proof is Joule per Tera Hash improvement of mining rigs since 2009. Crypto mining equipment has become 4,237% more efficient over the past eight years.

The Bitcoin hash rate reached the ATH level of 272 million TH/s in November 2022. This is a 400% increase compared to the hash rate in October 2018.

Ethan Vera of Luxor pool stated that if there is another wave of miner capitulation, the price of Antminer S19XP will rise unreasonably. As more miners with older rigs become unprofitable, they will want to upgrade. This in turn will result in an influx of capital to purchase the latest S19XP. This will cause the price to increase.

Vera details that if the hash price, a metric used to determine the dollar revenue a miner earns per hash rate unit, drops 20%, it will create a demand. According to Blockware Intelligence, the hash price for S19XP calculated at $20,000 per BTC is $0.09. In addition to providing positive cash flow to the owner, the market value of the miner will increase. It will make it an innovative hedge should the Bitcoin price fall further from its current position.

With all these aspects in mind, let’s take another look at Bitcoin price and its 11-year history.

Bitcoin price, logarithmic regression, market bottoms and 2023 target levels

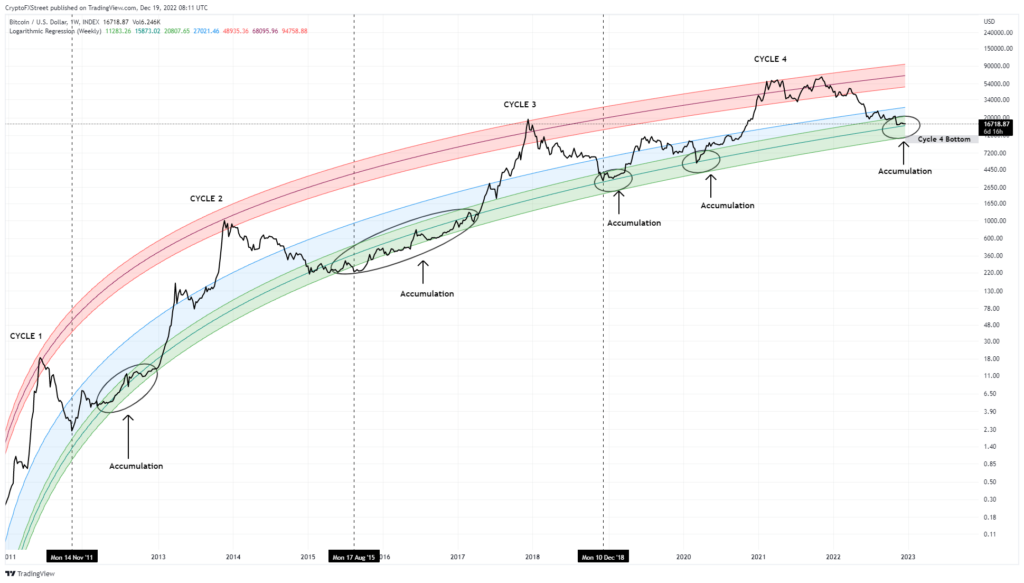

If logarithmic regression is applied to the last 11 years of Bitcoin price history, an interesting pattern emerges. As the chart shows, BTC is bottoming out as it enters the green bands, which started with an accumulation and then trend reversal.

So far, all cycles for BTC have bottomed out above or around the green bands, except for cycle 3. Currently, Bitcoin price is in the middle band of the regression line. This indicates that it may be close to the bottom. However, there is also the possibility that the major crypto will slide further down and label the third band of the regression.

A closer look at the regression lines shows that the lower band is present at roughly $11,898, which is in line with the technically seen forecast. To predict targets for the next run in 2023, let’s assume this cycle reverses after forming a local bottom at $11,898. Using the Fibonacci Retracement tool from the all-time high to the aforementioned low reveals several important goals:

The midpoint of the Bitcoin bear market correction, $28,092, also coincides with the technically predicted levels at the beginning of the article. A $28,000 to $30,000 range is likely to form in mid-2023 for bitcoin price. Potential all-time highs of $112,090.32 and $210,252.31 are the result of negative 27% and 62% retracement levels. The time frame for these targets is late 2023 and 2024.

So, the 5th cycle Bitcoin price has already started to show an impressive upward trend. cryptocoin.comGoldman Sachs giants, which we quote as, keep their $100,000 price predictions up to date, despite their opposition.

Nine Bitcoin predictions for 2023

FXStreet analyst Akash Girimath compiles his predictions for the new year with 9 headings after the 2022 outlook he provided above:

- Expect a final wave of capitulations caused by miners or the fallout from the traditional finance space.

- This downside move will push Bitcoin price below $9,500. But as the techniques and on-chain metrics are starting to look very positive, the small deviation won’t matter in the long run.

- The average dollar cost of $9,500 from the current level (if BTC drops further) is the best way to go to it rather than trying to catch the bottom.

- We expect a further slowdown in interest rate hikes as inflation declines.

- The US Federal Reserve can stimulate the economy by printing money. This development could trigger another rally in equities and crypto markets by attracting more investors to borrow money.

- Russia-Ukraine will reach a conclusion or ceasefire. The next step may involve making mining more politically acceptable by reversing policies regarding Bitcoin mining.

- Brazil and other South American countries will implement crypto-friendly regulations and become a safe haven for the growth of the crypto market.

- As the market gains momentum, it will attract more investors and more capital, bringing the total crypto market capitalization to $6 trillion and higher.

- There will be great developments with Ethereum, ZK-snark technology and Web3 part of the crypto space.