Concerns about the upcoming debt ceiling vote in the US have affected the stock markets as well as the cryptocurrency market. After recovering for a while before Bitcoin price lost $27,000 again. Technical analysts are split on upcoming levels.

Kevin Svenson remains bullish about Bitcoin price

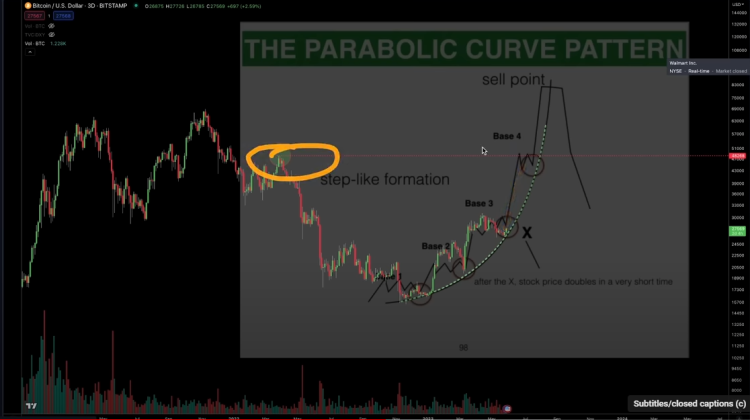

The popular crypto analyst said in his latest analysis that Bitcoin is poised for a parabolic surge. Svenson reports that Bitcoin’s moving average convergence divergence (MACD) indicator has passed on the daily chart.

MACD is a momentum indicator that traders use to monitor possible trend reversals. According to Svenson, Bitcoin has risen sharply the last two times the MACD has been bullish on the daily chart. As the analyst put it, “We went from about $16,000 to over $20,000, $23,000, and $24,000.”

As for the next Bitcoin price action, Svenson says he is looking at the parabolic setup of the leading crypto. According to the analyst, Bitcoin follows a parabolic curve. He says that according to his estimations, “the next move will really get us to $48,000.”

Luke Gromen says Bitcoin and gold prices will skyrocket with this development

Macro investor Gromen names a pivotal moment that will make both gold and Bitcoin fly. In a recent interview, he says he believes the duo will win “in the end either way.”

According to the investment strategist, Bitcoin and gold will likely rise as soon as the market realizes that the US government is preparing to print more dollars to finance its national debt.

Gromen says that if the Fed continues its tight monetary policies, gold and Bitcoin will likely take a hit in the short term. However, he argues that rising national debt will eventually force the Fed to reverse its stance. The macro investor predicts that this will be bullish for both store-of-value assets.

Steven Lubka highlights interest from institutional investors

According to Steven Lubka, managing director of Swan Bitcoin, wealthy investors and the private investment offices that serve them are starting to converge on Bitcoin.

“Since the collapse of Silicon Valley Bank, we’ve seen a massive upswing,” Lubka said. We’ve always had a group of family office clients using the platform. But since the SVB this has increased drastically. “These people are taking large Bitcoin positions,” he says.

Lubka predicts that Bitcoin will be widely adopted as a global store of value. He also states that once this happens, it will be used by the world for a very, very long time. In the interview, he said, “There will be a generational time frame, multiple generations of people. Your grandchildren and children will use Bitcoin.”

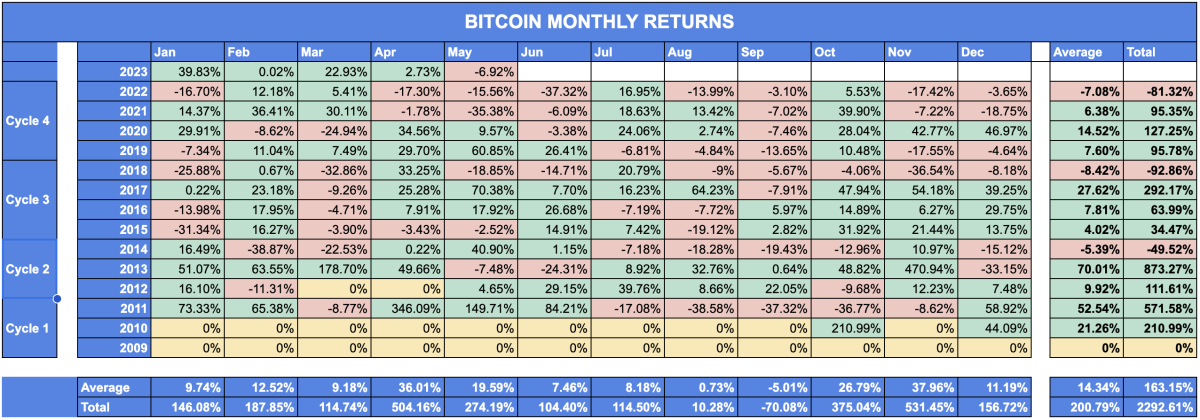

Bitcoin price and historical returns

Bitcoin price faced intense selling pressure in May. As bull run hopes fade, more investors join the selling spree. Historical data reveal interesting results when measured over a large enough time frame.

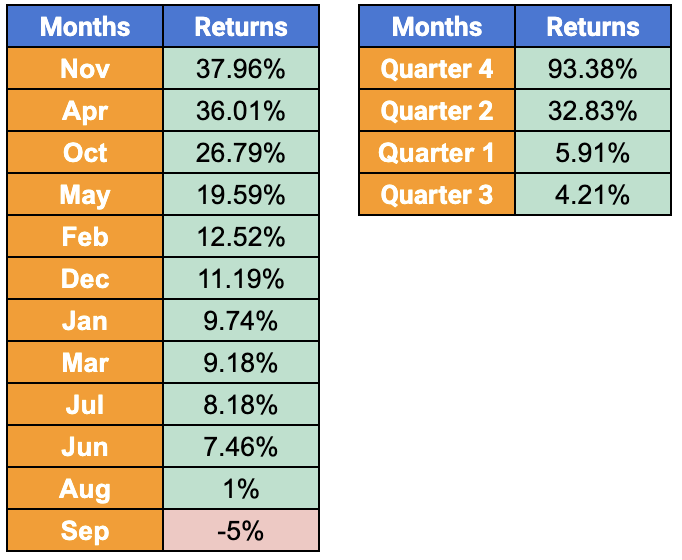

For example, in the last 14 years, the highest average return for Bitcoin price was roughly 38% in November. This was followed by April with 36% and October with 26%. Likewise, the first and fourth quarters show the best returns for Bitcoin price. A simple conclusion from this is that the first and third quarters are typically the best time to invest in BTC.

The monthly yield chart for bitcoin price doesn’t just show the big picture. It also adds structure to the chaos of everyday volatility. As the chart below shows, BTC’s average return drops from April to September. But in the last quarter, the average monthly return is gaining momentum.

A simple conclusion that can be drawn from this is that the next three months will likely be in the red.

Analysts identify critical supports for Bitcoin

Bitcoin price breaking $27,000 sharply splits analysts on future levels. According to Kitco senior technical analyst Jim Wyckoff, “bulls and bears are now back on a generally neutral short-term technical playing field.

Daan Foppen, an analyst at MN Trading, says the recent pullback “completely fills the CME gap that occurred over the weekend.” The analyst said, “We held support around the $26.3-26.6k region. Many people started to open short, waiting for the prices to fall further. “This resulted in a liquidation event that led to an upward acceleration.”

Looking forward, Foppen sees one of two scenarios happen. For short investors, “We saw a breakout where we took liquidity over the weekend. We saw divergence above the high range. Now we’re back in range. Returning to the higher range could provide opportunities for shorts to retest the decline.”

For Long investors, Foppen said, “I find the situation quite difficult for long investors. Because you’re basically meeting resistance again quickly. Definitely arguments to say it’s the right time to go long. After breaking the high level we finally have a build change. We are now seeing a jump in FVG (floating volume gap). “This is an area that needs to be protected if we want to see higher prices.” The analyst is referring to the region between $26,800 and $27,100.

Finally, according to the analysis of popular crypto analyst Michaël van de Poppe, “If this area continues as support and Bitcoin can retake $27,500, everything looks like we will continue the uptrend. If it drops below $26,600, we will see new lows.” cryptocoin.comAs you follow, BTC is about to break this level right now.