Bitcoin dropped below $22,000 after U.S. Federal Reserve Chair Jerome Powell said in prepared remarks in his two-day semiannual monetary policy testimony before Congress that inflation had remained unexpectedly high. But the largest cryptocurrency by market capitalization quickly recovered to trade above the threshold for much of Tuesday.

BTC was recently trading at about $22,060, down about 1.6% from Monday, same time. Bitcoin has been largely holding over $22,000, even as a flurry of jobs and price indicators have raised inflationary concerns anew.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said Tuesday before the Senate Banking Committee. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Ether (ETH), the second-largest cryptocurrency, slid 1% in the past 24 hours to trade around $1,550. The CoinDesk Market Index, which measures overall crypto market performance, was down 1.3% for the day.

Most other major cryptos were largely in the red, aligning with equities markets, which also wrestled with Powell’s remarks. The S&P 500, Wall Street’s benchmark equity index, closed down 1.5% and the Dow Jones Industrial Average (DJIA) and tech-heavy Nasdaq Composite dropped by 1.7% and 1.2%, respectively. The prospect of a 50 basis point (bps) interest rate hike instead of a more dovish 25 bps now rests at over 70%, roughly the reverse of the probability last week, according to the CME FedWatch Tool.

Rates are currently “the missing piece of the puzzle,” David Brickell, director of institutional sales at crypto liquidity network Paradigm, wrote in a weekly newsletter. “Should they continue to reverse lower, conditions look ripe for a push higher, which would be painful for a market that remains under-positioned risk.”

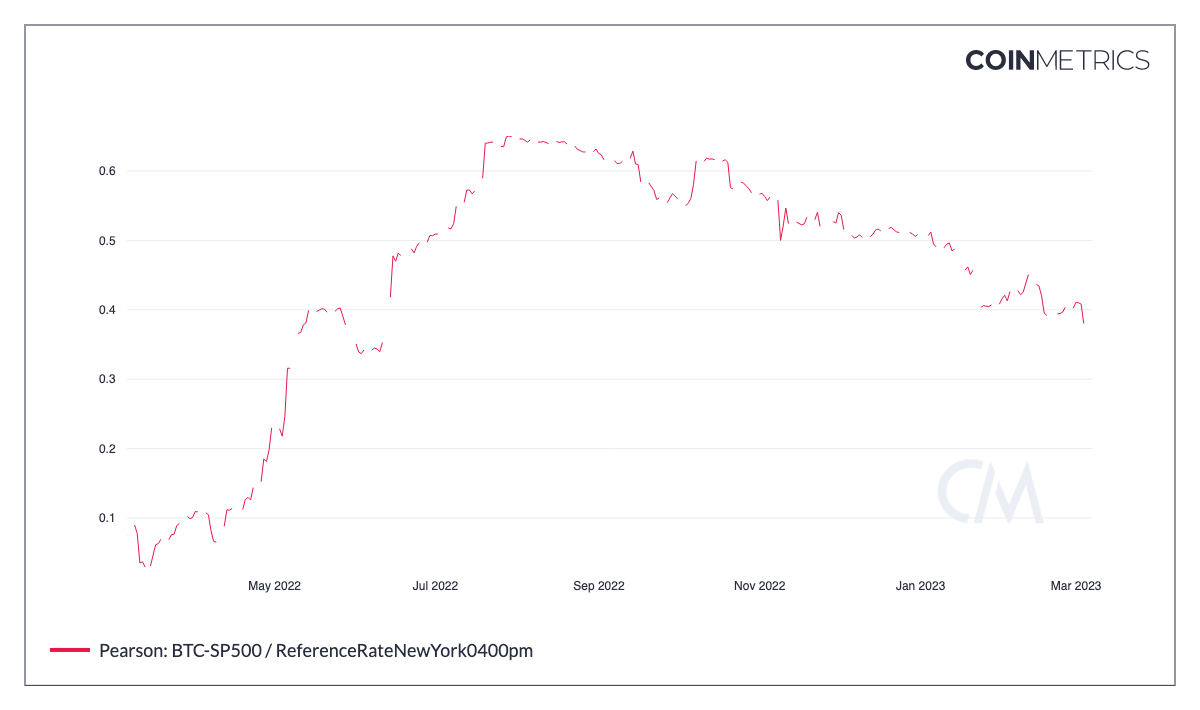

The correlation between crypto and stocks, however, has been declining since late 2022, with the 90-day correlation coefficient of bitcoin and the S&P 500 currently reaching 0.38 – the lowest level since June 2022, Coin Metrics’ data showed. A coefficient of 1 means the movements are perfectly synchronized, whereas negative 1 indicates they are moving in opposite directions.

The correlation between crypto and stocks has been declining since late 2022. (Coin Metrics)

Samir Kerbage, chief investment officer at the crypto asset manager Hashdex, told CoinDesk in an interview that “a big movement” in crypto prices could still occur if the Fed’s interest rates hike turns out “much different” than the consensus expectation. The 50-basis point hike for March is “still painful” for markets, he added.

Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in a Tuesday note that while BTC was able to hold onto the lower boundaries of its key trading range following Powell’s testimony, risk appetite across the board is “very vulnerable.”

“If this wave of risk aversion does not pass, cryptos may struggle to make fresh 2023 lows,” he wrote.