Bitcoin price is on the verge of a 25% drop, according to analysis by CryptoSlate analyst James Straten. Forecast based on SLRV Ratio is back to FTX collapse levels.

SLRV Rate points to $23,000 for Bitcoin

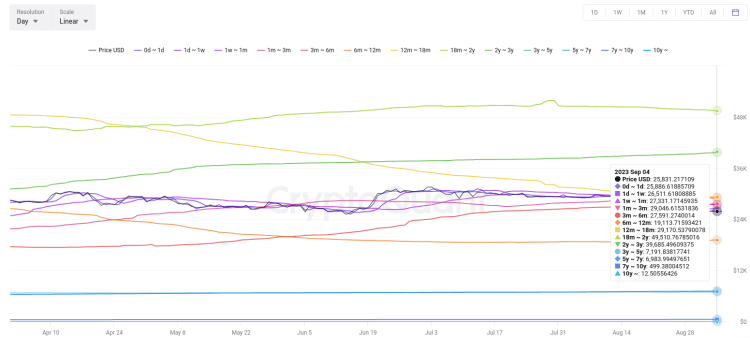

As analyst James Straten noted on Sept. 5, the SLRV Rate has “returned” for the first time since November 2022. The previous exchange came on August 13, before the Bitcoin price bottomed out at $25,000. Prior to that, it had been neutral since November 2022, when FTX went bankrupt.

Developed by renowned analyst David Puell and ARK Invest, SLRV uses the popular HODL Waves metric to track the speed of Bitcoin on the Blockchain. HODL Waves divides the circulating supply of BTC by the age of the cryptocurrencies used in the transactions. SLRV takes coins that have previously moved in the last 24 hours and divides them by those that have already moved six to 12 months ago. According to Straten’s analysis, the SLRV Ratio has now reversed again.

SLRV ribbons inverted on August 13, three days before #Bitcoin drops to $25k. Last time the metric inverted was just before the FTX collapse.

The SLRV Ratio shows the percentage of #Bitcoin in existence, that was last moved within 24 hours, divided by the percentage that was… pic.twitter.com/hHsfjINo45

— James V. Straten (@jimmyvs24) September 5, 2023

The metric also includes two moving averages (30-day and 150-day trend lines). Transitions between these coincide with major Bitcoin price events. For example, just before the FTX crash, the 150-day line crossed the 30-day line. At the same time, in mid-August, this event was repeated for the first time since then. According to Staten’s analysis:

The SLRV lanes reversed on August 13, three days before Bitcoin dropped to $25,000. The most recent reversal of the metric was just before the FTX crash.

Bitcoin investors go into abstaining mode

At the same time, previous analyzes have focused closely on the behavior of Bitcoin investor groups. Short-term traders build a strong support wall to keep the price stable. However, this has not been the case lately. Previously, it was seen that short-term investors provided price support based on their share of the BTC supply offsetting the overall price.

The short-term cost basis of ownership is currently above the spot price as speculators have reportedly been selling at large losses since late August. Data from CryptoQuant shows the last price at which various cryptocurrencies were moved.

Despite the sharp bearish warnings for Bitcoin, most analysts continue to set the bar high. cryptocoin.comAs we reported, the halving, which will coincide with April 2024, is the main catalyst that analysts point out.