Bitcoin price has seen a huge sell-off in the past four days. It has been trying to consolidate and recover ever since. Some altcoins are much better at recovery than Ethereum and Ripple. Analysts are discussing how a recovery rally will be possible for the crypto market.

New Australian government’s stance on Bitcoin regulations

The Australian government has estimated that over a million users have interacted with cryptocurrencies since 2018. As a result, the country is taking a different approach to regulating the cryptocurrency market. In this effort, the Australian federal government is said to have created a “token map” for cryptocurrencies. This move is to protect investors and protect them from themselves. As Treasurer Jim Chalmers of the Australian Labor Party put it:

Currently, the crypto industry is largely unregulated and we need to do some work to strike the balance so that we can embrace new and innovative technologies while protecting consumers.

As different countries take different approaches to regulating the crypto market, Bitcoin is poised to recover before its next leg. In the rest of the article, let’s take a look at the current technical analysis of analsin Akash Girimath.

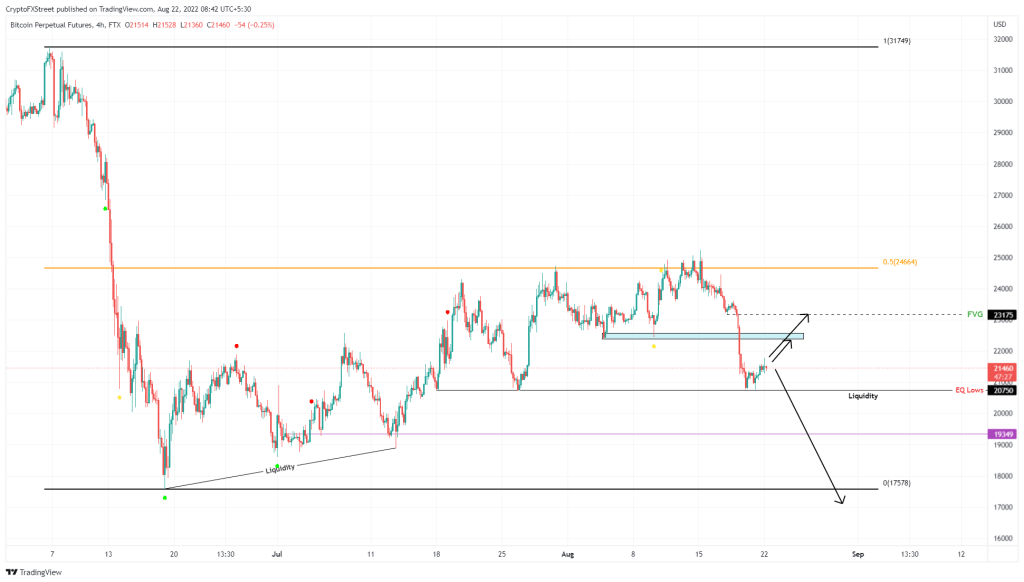

Bitcoin price first sign of recovery signs

Bitcoin price lost 12% between August 18 and August 20. It then hit $20,750, the fourth equally low since July 18. Although the recovery pushed BTC to $21,500, the upside movement is limited at $22,600. A possible rejection at $22,600 followed by a correction to $20,750 seems reasonable, according to analyst Akash Girimath. Therefore, investors should be wary of an early recovery rally.

With things at stake for bitcoin price, a break of the $20,750 support level will delay the rally. In such a case, BTC will head up to $17,578 to gather liquidity. It will then spend time between the bottom formed between June 18 and July 13.

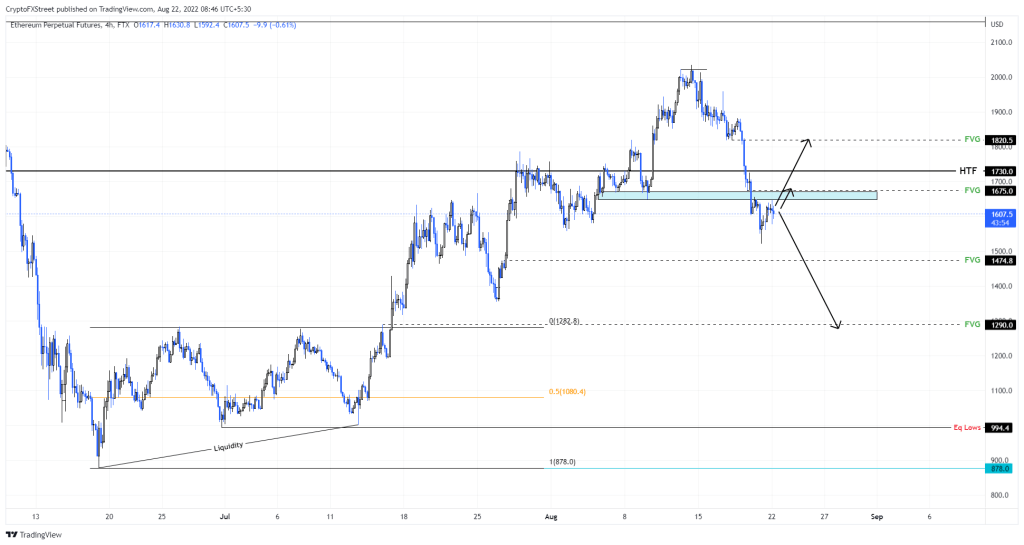

Ethereum price remains stable

After the Bitcoin cue between August 18 and 20, Ethereum price also dropped roughly 19%. However, the recovery looks much shorter as ETH has already pulled back. Investors can expect a minor increase to $1,675 to fill in the inefficiency and trigger a reversal here.

However, in some odd cases, there is a possibility that this move could extend to $1,730. It could also create a local top there before reversing and resuming the downtrend. Regardless of where the local top is formed, it is due to Ethereum retesting the imbalance to the downside at $1,474.

Recovery from the $1,730 resistance to support will indicate a resurgence of buyers, although recovery targets seem uncertain. However, $2,019, a higher high above the last swing point, will invalidate the bearish thesis for Ethereum price.

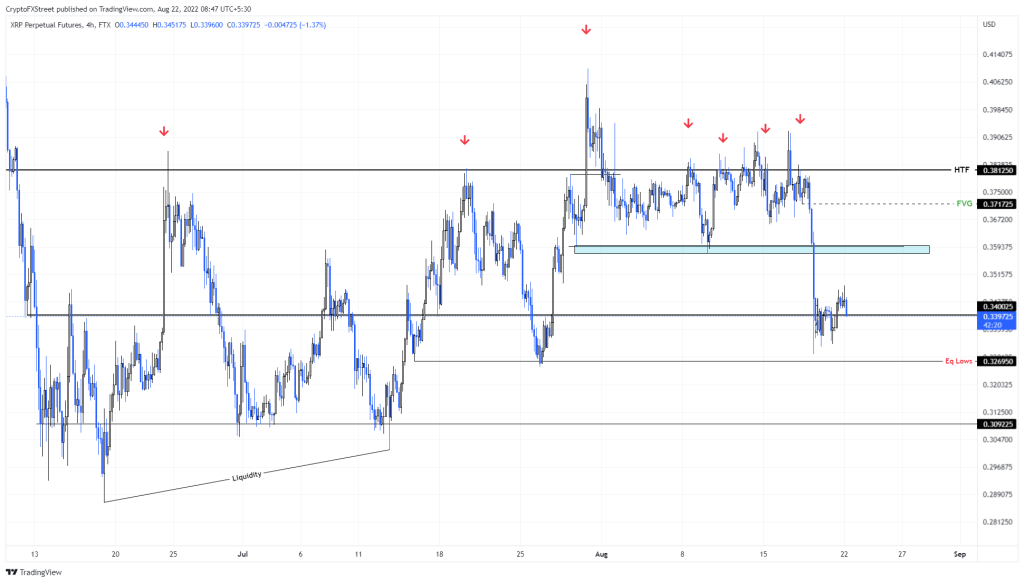

“Ripple price ready for some recovery”

XRP price is spending time around the $0.340 resistance without any directional bias. The recovery rally for Bitcoin is the only catalyst behind XRP. In such a case, traders can expect XRP price to run for the $0.360 resistance level. The recovery rally is likely to form a local top here before reversing and potentially replacing liquidity below the equal lows of $0.326.

On the other hand, if ripple price turns the $0.381 barrier into a support base, it will conquer a longstanding resistance level, invalidating the bearish thesis. In such a case, investors can expect XRP price to surpass the $0.439 resistance.