Bitcoin (BTC) price, Ethereum (ETH) and other cryptocurrencies are in perfect balance, price action consolidates and creates higher and lower highs in the process. Buyers and sellers are experiencing price squeeze as all three cryptocurrencies complete the bearish triangle, ready for a possible breakout in the next week or the week after that. As Cryptokoin.com reported, the catalyst for this breakout will be either a central bank surprise or a geopolitical event. That’s why watching the headlines will be crucial to timing the exact moment for the right investment.

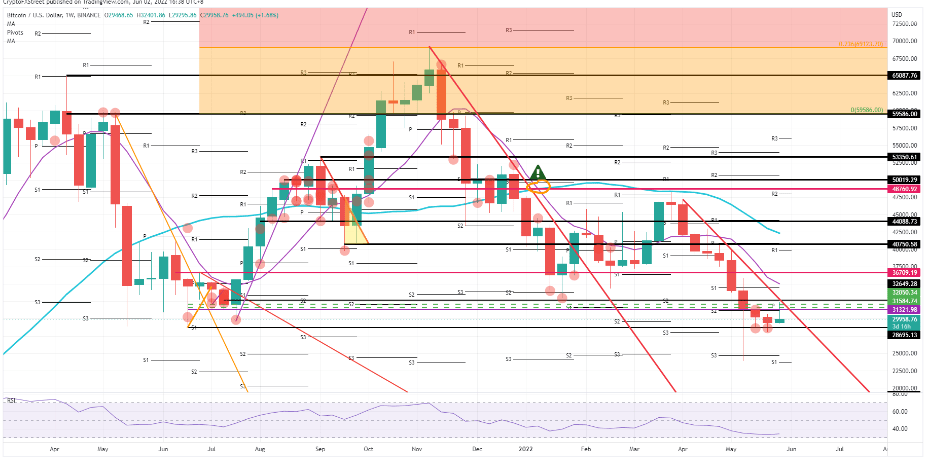

Bitcoin price could rise to these levels

Bitcoin (BTC) price seemed to be in a downtrend so far after prices got a firm rejection against the red descending trendline. As the price action pulled back in search of support, the bulls did not let the Bitcoin price drop to $28,695.13 and instead sought to push the price towards the $30,000 levels. From here, BTC price will likely bounce back and forth above and below $30,000, waiting for a major catalyst for a breakout. BTC price saw the Relative Strength Index trade up, showing signs that the bulls are buying massively and preparing for the summer rally, which was previewed two weeks ago. Risk appetite is present, but it is all within a narrow window of opportunity as it will all depend on central banks and how they steer global economies around inflation concerns.

BTC price rises above $31,321.98 and buyers break the downtrend, enter a distribution zone where they can have a chance to rise to $32.649.28, and in the process Expect it to test the 55-day Simple Moving Average while making 15 gains. Alternatively, risks to Bitcoin price may stem from the current background in global markets where investors are pulling and pushing EUR and USD rates. This spreads to cryptocurrencies priced in dollars and creates similar wave charts there. A bounce in favor of the strength of the dollar could spread to BTC price, forcing it to drop below $28,695.13 and reach $25,000.

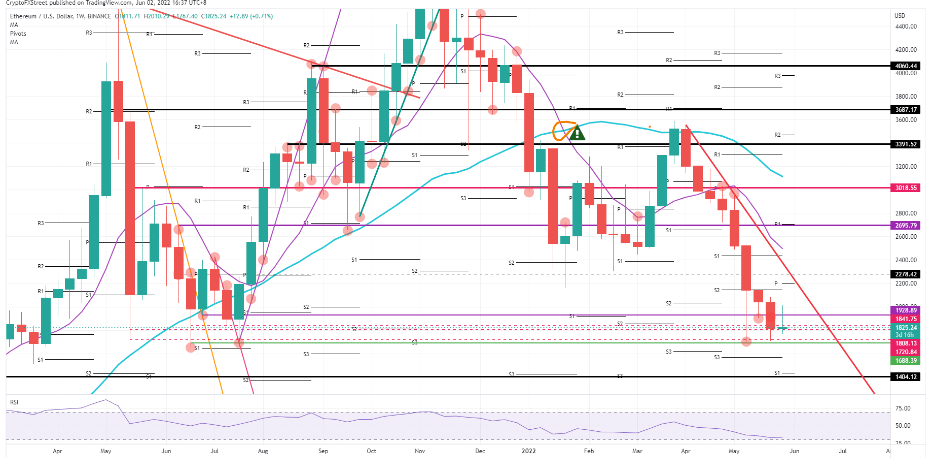

Ethereum selling pressure may increase

Ethereum (ETH) price has been trading nicely along a marked distribution region as of July last year. Since entering the zone in mid-May, the RSI indicator has been shooting higher and moving away from the oversold zone. The bulls have gotten hints of how a breakout would feel with over 10 percent gains in the last week of May alone. Even though the price fell back, it wasn’t enough to trigger the bulls to repeat the same trade. Ethereum price is set to fall back into a range of $1,688 to $1,928 as buy-side demand rises. Once back above the scatter zone, a bounce to the new monthly pivot at $2,200 will coincide with a test against the red descending trendline.

Once this breaks up, we can expect to see a massive bull and investor inflow that will dry up demand supply and make a massive rally towards $3k. Still, bearish signals should not be ignored as they are still technically valid. The bears are unlikely to lose their positions that easily. They can wait for the right moment to catch the bulls and push them out of their positions through a bull trap or another quick reversal at a crucial level. When the bulls then switch sides and have to sell their holdings, selling pressure can increase, causing the ETH price to drop to $1,404, a 22 percent loss from today’s price.

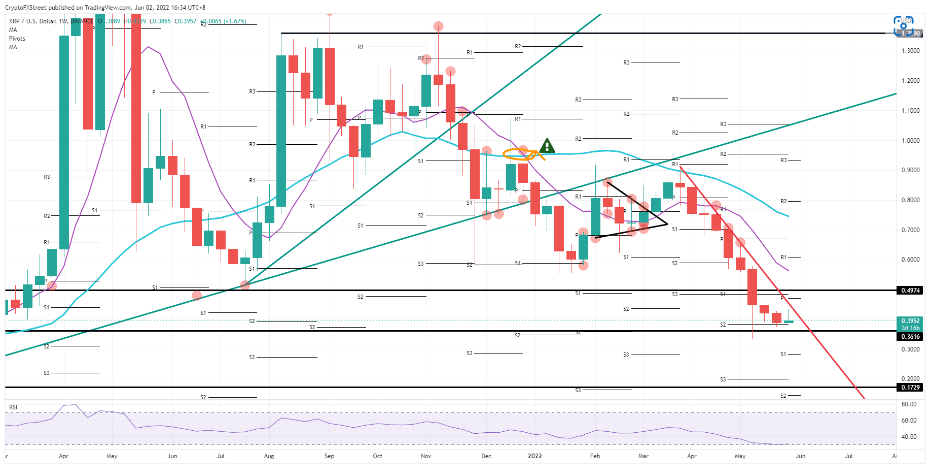

XRP

Ripple (XRP) price surprises investors, monthly pivots have also changed positions again. After a highly volatile month, this month’s pivots are further away, leaving the current price action at the mercy of either the red descending trendline or the low ($0.3616). Before a catalyst emerges that could create a rally towards $0.50. The XRP price can be expected to drop a little more. XRP price has been very dependent on monthly pivots every time the price touches a pivot level, as evidenced by the price action in April and May. The closest pivot is now at $0.47, above the descending trendline, thus signaling a possible breakout.

Such a break could come from several titles that point to the ongoing negotiations between Russia and Ukraine, implying a possible breakthrough at any moment; which could see a burst in XRP price towards $0.50. There is also the risk of harmful news headlines. There is also the risk that OPEC+ will expel Russia, thereby further isolating the country. This will bring another wave of risk and may be enough to break the XRP price journey below $0.36. Towards $0.29 – below the $0.30 monthly support of S1. This means that the XRP price is at risk of losing another 30 percent of its value.