While we started October with a week in which Chinese stock markets were on holiday, the new fiscal season began on the US side.

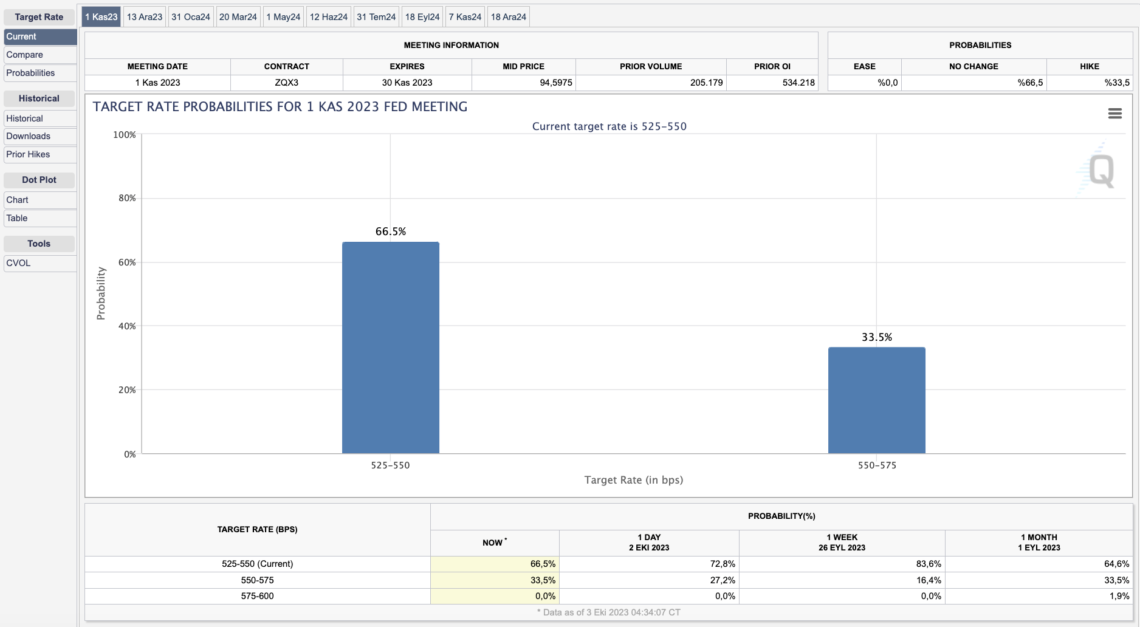

At its September 20 meeting, the US Federal Reserve (Fed) signaled that another interest rate increase might occur by keeping the federal funds rate target range at 5.25%-5.5%, the highest level in 22 years. On the other hand, when we look at the CME interest rate increase forecast for the Fed’s November meeting, it is expected to remain constant at 66%. Although the interest rate obstacle continues before us, economists say that the Fed has increased interest rates without causing excessive damage to the country’s economy, and now they call on people to be ‘patient’ and wait.

On Friday, we will receive employment data from the USA. This data is important because while the Fed emphasizes that inflation should reach the 2% target at every meeting, it also underlines the strong employment markets. In the September meeting text, it was also stated that employment growth had slowed down recently but maintained its strength. In the economic projection, 2023 unemployment expectation was reduced from 4.1% to 3.8%. Unemployment expectation for 2024 and 2025 was reduced from 4.5% to 4.1%.

In line with expectations, future employment data will be one of the most important factors that the Fed will consider when making its next interest rate decision.

Good news came in the cryptocurrency markets on Thursday last week, as we saw that the US Securities and Exchange Commission (SEC) approved ETH futures ETF offerings from companies such as VanEck, ProShares, Valkyrie and Bitwise. Following the news, Bitcoin rose to $28,500 as of October 2. ETH futures trading was opened on Monday, but the volume remained at $ 800,000 and underperformed. Spot ETF offers that cryptocurrency markets have been waiting for have been postponed by the SEC. As you know, a possible spot BTC ETF approval could ignite the bull’s wick, and this is the kind of development that Gary Gensler does not want.

On October 3, the US 10-year Treasury bond yield rose to the highest level of the last 16 years at 4.75%. It led to pressure on Bitcoin price. The high bond interest rate is a strong reason that attracts investors. Therefore, it was inevitable to trigger an exit from risky assets. We still have a long road ahead of us, but these developments should not discourage us because our fight continues until the end.