The Psychology of Market Behavior: Breakouts and Retests

Think back to your last vacation. After locking your door and heading toward your car, it’s likely you paused to ensure the lock was secure before continuing your journey. This moment of hesitation mirrors the behavior seen in financial markets, which are often driven by a variety of human emotions.

When an asset convincingly surpasses a long-standing resistance level, it often revisits that level to confirm the validity of the breakout. This phenomenon serves as a crucial test of the strength of the former resistance, which has now become support. Following this retest, we frequently witness more significant rallies.

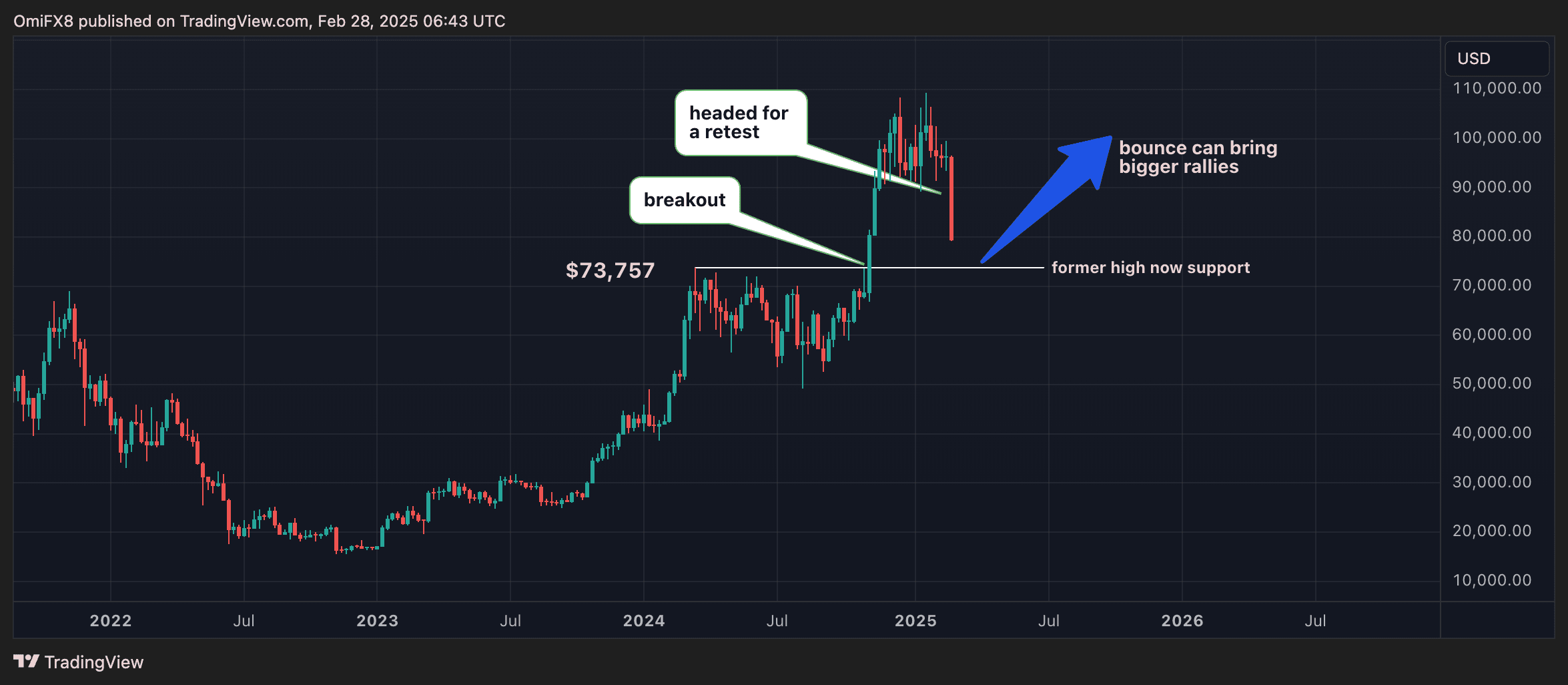

The concept of a “breakout and retest play” is well-documented across different asset classes. Take Bitcoin (BTC), for example; its current sell-off may represent a healthy retest of the breakout point, specifically the former resistance-turned-support level of $73,835 that was breached in November.

In other words, the downward pressure may soon lose momentum as it approaches these critical levels, potentially setting the stage for an upward movement. Looking at BTC’s weekly chart, the breakout and retest play becomes evident.

This month, BTC has experienced a drop of over 15%, falling below $80,000 and exposing the former resistance-turned-support at $73,835. Prices surged above this level in early November, marking the end of a prolonged consolidation period following pro-crypto Donald Trump’s victory in the U.S. Presidential election.

The tendency for markets to retrace or revisit breakout points before embarking on more substantial rallies can be attributed to the behavioral aspects of investing. Investors generally exhibit risk aversion when it comes to securing their gains. Consequently, traders often opt to book profits quickly rather than allowing a winning trade to run its course. This behavior aligns with the principles of prospect theory, explaining why post-breakout rallies can abruptly lose steam, leading to a retest of the breakout point. BTC holders have consistently taken profits around the $100K mark since December.

Now, as prices decline and approach the breakout point of $73,835, market participants who missed the initial surge are likely to step in, ensuring that this level holds. The resulting rebound from the former resistance-turned-support can attract even more buyers, potentially paving the way for a more substantial rally.

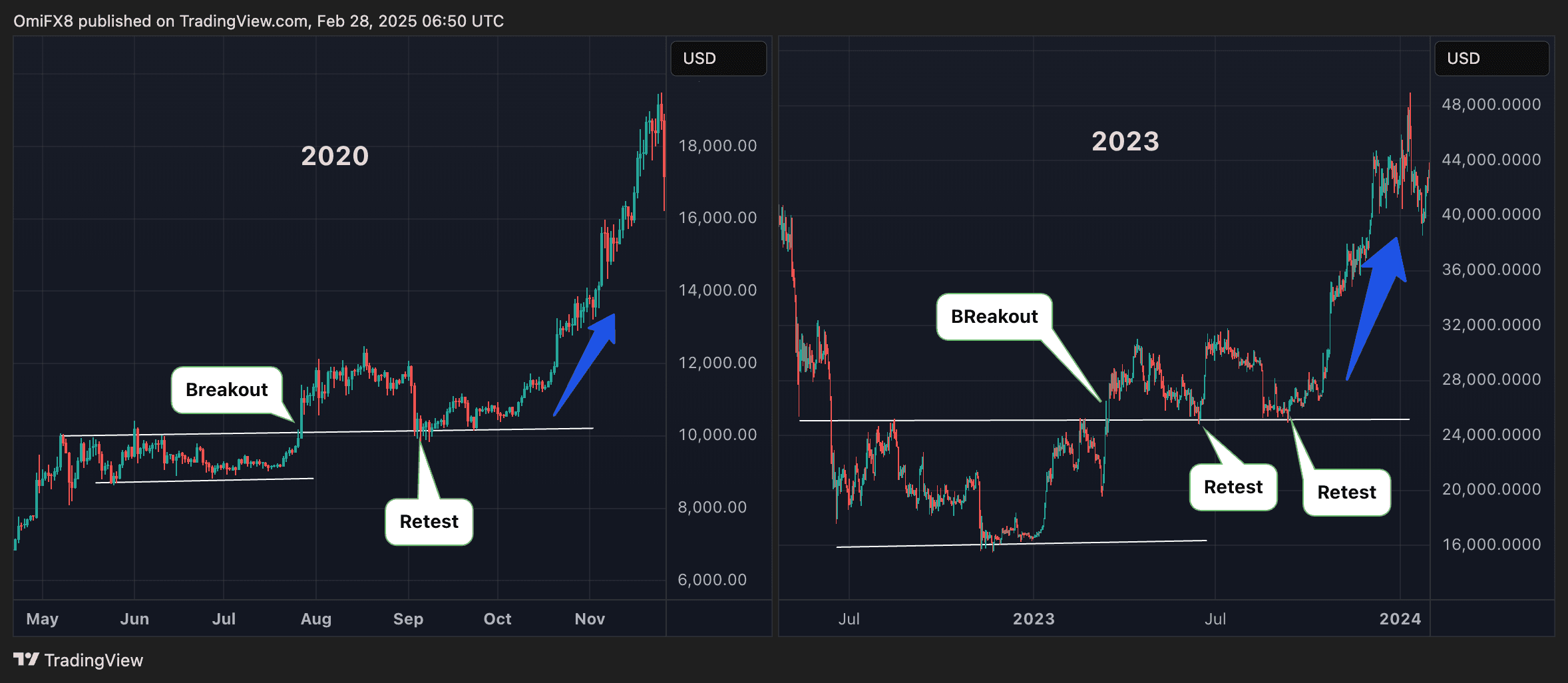

This pattern is not new; it occurred in the third quarter of 2023 and again in August-September of 2020. On both occasions, the breakout and retest resulted in more significant rallies that led to new record highs.

However, traders should be cautious; a failed retest or a lack of a meaningful bounce can indicate underlying weakness, possibly evolving into a full-blown downtrend. Over the years, I have observed numerous instances of retests of breakouts and breakdowns leading to more considerable moves in traditional markets.

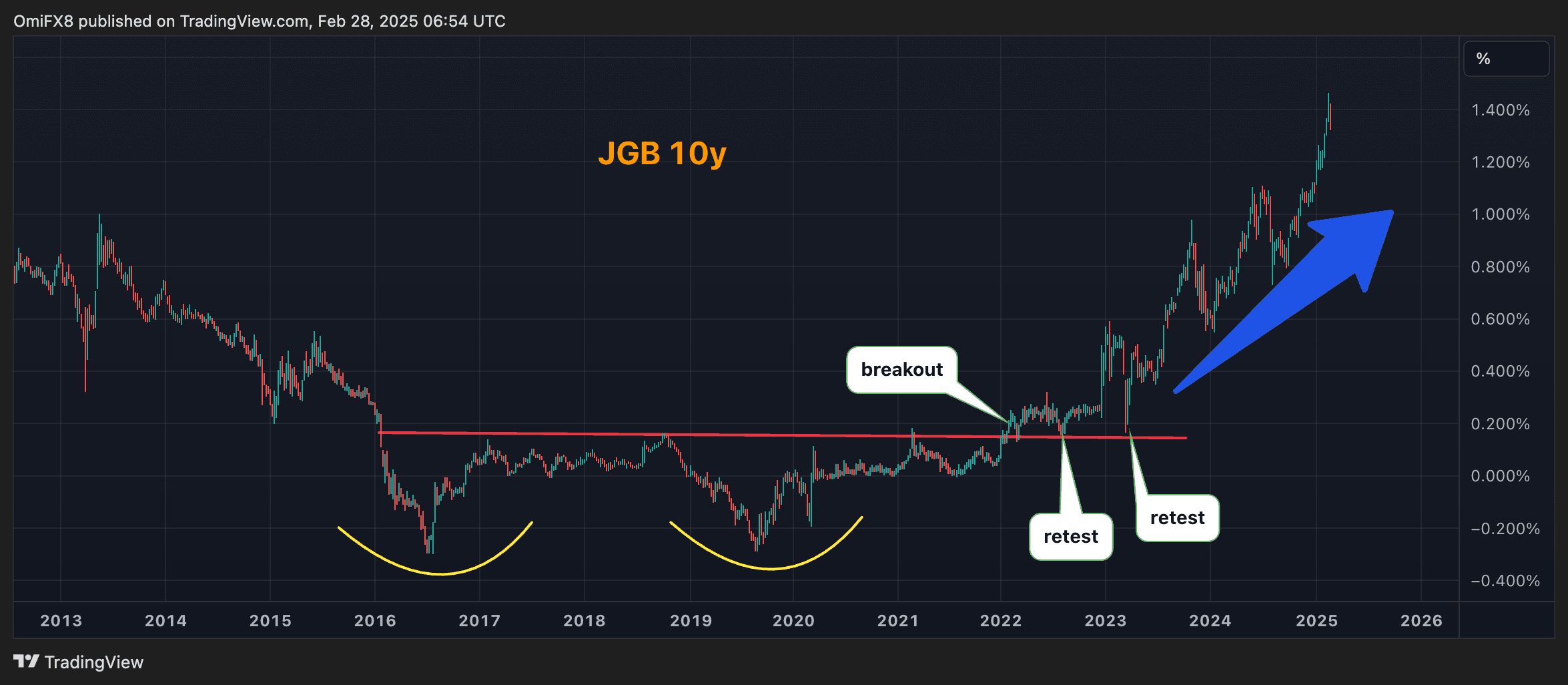

For instance, consider the yield on the 10-year Japanese government bond. It triggered a double-bottom breakout in January 2024 and revisited the breakout level multiple times before climbing to multi-year highs.

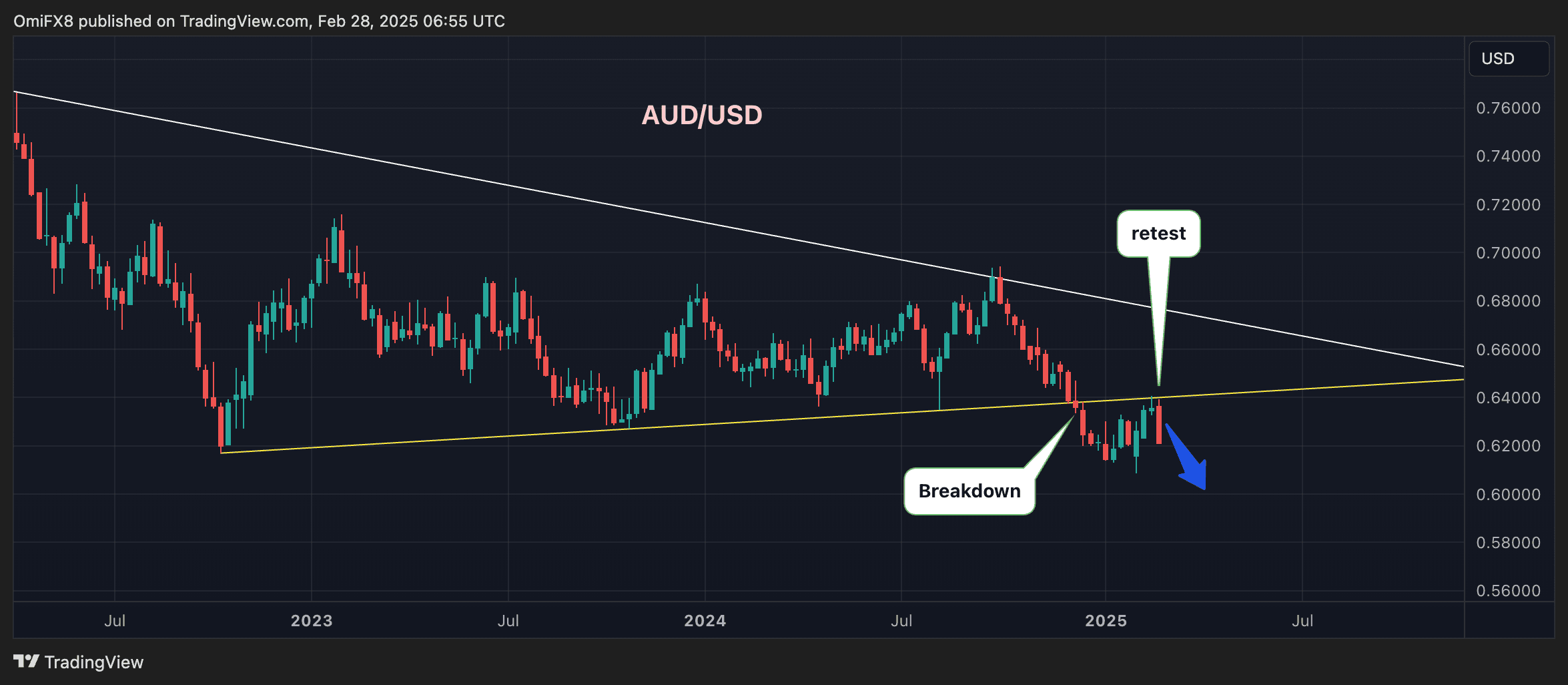

Another example is the AUD/USD pair, which broke down from a significant support trendline in December, signaling a potential deeper decline. The pair bounced back to the trendline resistance early this month but has since experienced sharp losses this week.

In summary, the dynamics of breakouts and retests are essential to understanding market behavior, and they can offer valuable insights for traders navigating the complex landscape of financial assets.