The U.S. Bureau of Labor Statistics released the Consumer Price Index for the month of June 2022. It turned out that the CPI, with 9.1%, was the highest inflation increase in the last 40 years in the USA. However, the markets were expecting a reading of 8.8%. For those who don’t know, the CPI is a powerful measure of inflation. It also determines the monetary policies of central banks, such as the FED, in response to inflation. CPI data, which came out above expectations, had an instant impact on the crypto money market. Accordingly, Bitcoin, SHIB and altcoin prices faced a sharp decline.

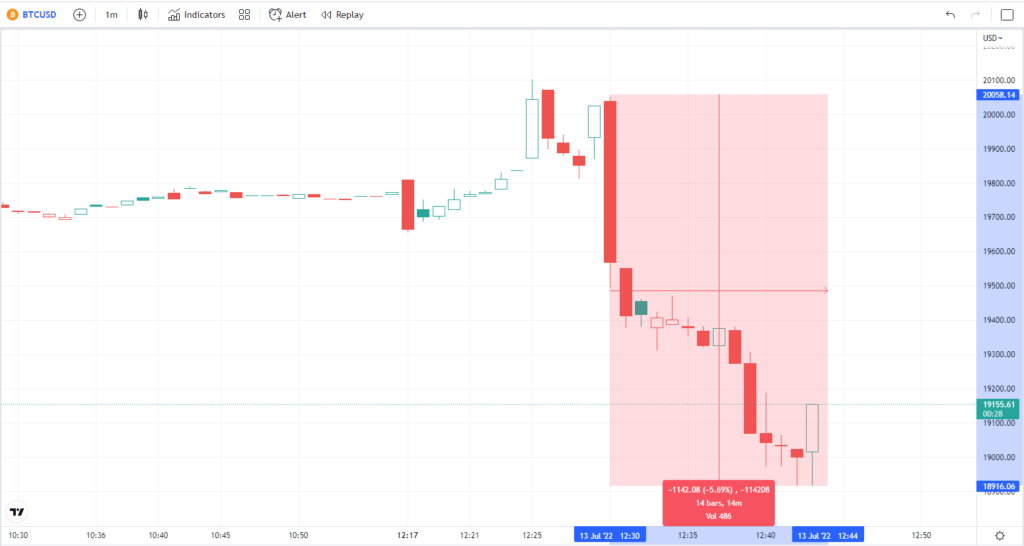

Bitcoin crashed momentarily

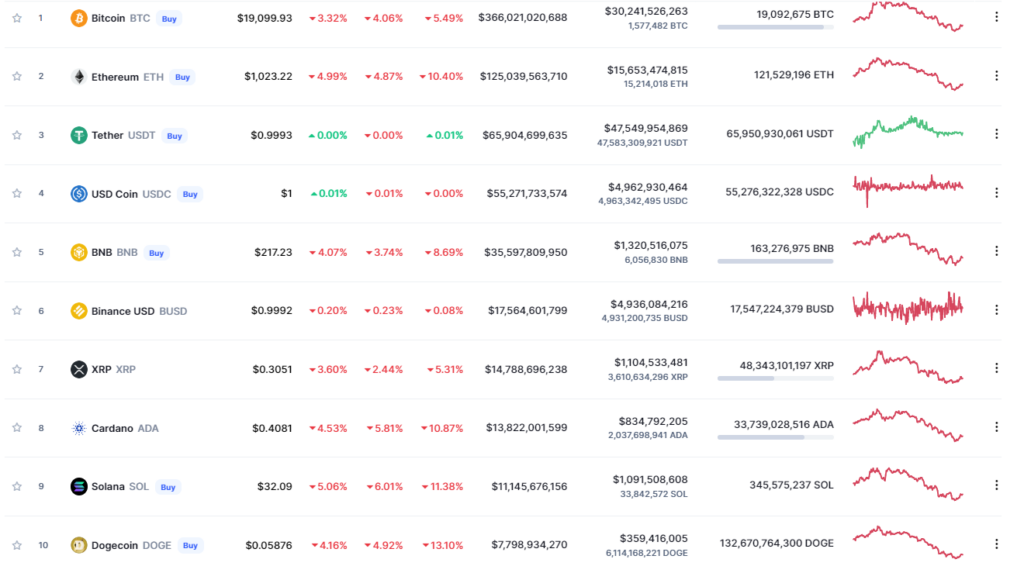

Minutes after the CPI was released, the cryptocurrency market took a hit. BTC is down about 4%, while ETH is down about 5%. Traditional market indicators such as the NASDAQ, Dow Jones and S&P 500 are also heavily bearish. Last month’s CPI showed inflation rising 8.6% year-over-year, the largest increase since 1981. The Fed responded to these data with tightening monetary policies. It also increased interest rates by 0.75 percentage points, its biggest increase since 1994. The FED’s hawkish monetary policies have caused a huge downturn for the entire crypto industry. Bitcoin witnessed the worst financial quarter of the decade. If what happened last month is any indication, the new data could spell disaster for the crypto markets. Bitcoin has dropped from $19,800 to $18,916 in the last 24 hours. However, it is possible that the decline will deepen further in the coming hours. BTC is currently trading down 72% year over year.

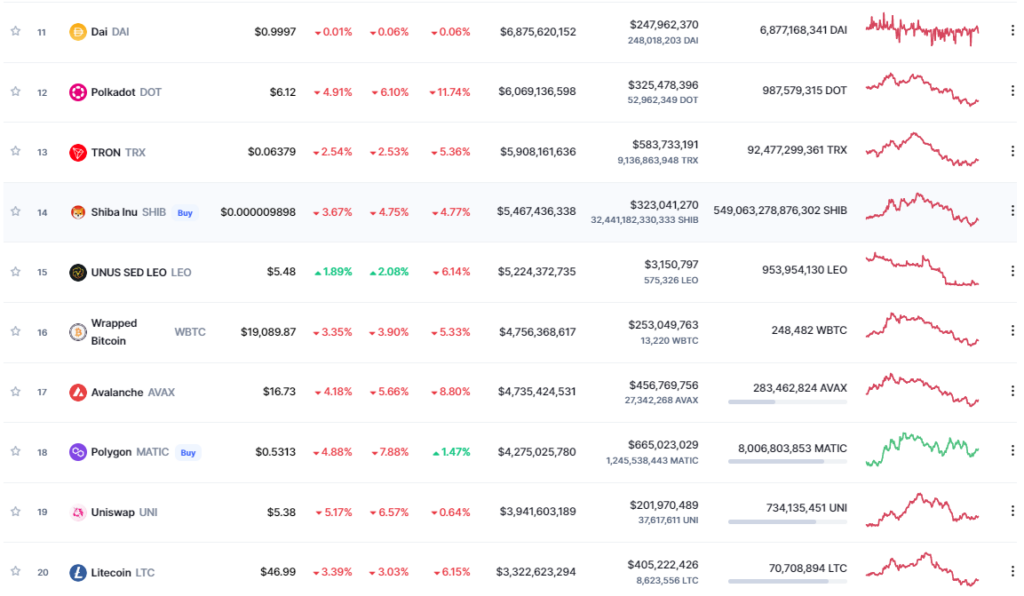

Bitcoin, SHIB and altcoins are bleeding

CPI data has not only lowered the price of Bitcoin. As usual, altcoins followed the price of BTC. Accordingly, Ethereum dropped 4%, SHIB 4%, DOGE 4.68%, Solana 5.24%, Cardano 5.15% and XRP 1.90%. Other major altcoin holdings, AVAX and MATIC, fell 5.66% and 6.16%, respectively. cryptocoin.comAs we reported, altcoin prices may bleed more as panic sales increase and BTC price drops.

What will the Fed do now?

The new inflation reading will put even more pressure on the Fed to raise interest rates. On Monday, the BLS was forced to issue a statement after a fake CPI report made waves on social media. The fake leak showed inflation jumping to 10.2%, well above analysts’ expectations.

While real CPI pressure is more than percentage points, it is still the highest level since November 1981. Markets are now pricing in an 80 basis point rate hike following the CPI pressure. This, of course, does not bode well for cryptocurrency prices. The data, which is above the analysts’ target of 8.8%, is highly likely to lead the Fed to adopt a more hawkish monetary policy. This will bring another major blow to speculative investments such as cryptocurrencies. If the reading was below 8.8%, it could give the markets a big boost. However, the FED will not abandon its tightening policies as inflation peaks.

What do analysts predict?

The new CPI data has caught the attention of the entire cryptocurrency market. Crypto analyst Lark Davis said the recent drop in commodity prices was not included in this month’s data. He then stated that this would lower inflation data. The analyst believes that crypto investors can expect a better CPI in August.

John, co-founder of The Rock Trading has provided a number of scenarios that are possible after the CPI release. According to him, if the CPI was below 8.6%, the market could expect a rally. Anything above that would cause a drop in crypto prices. According to John, CPI above 9.0 will cause a return to bear market. If this is true, a reversal to the bear market has begun. Finally, Michael van de Poppe explained that CPI will be a win-lose situation for Bitcoin. BTC has a major test at the $19.5K support level and the $19.8K resistance. Based on the CPI, BTC is expected to experience a big drop.