Bitcoin Market Update: A Volatile Start to the Week

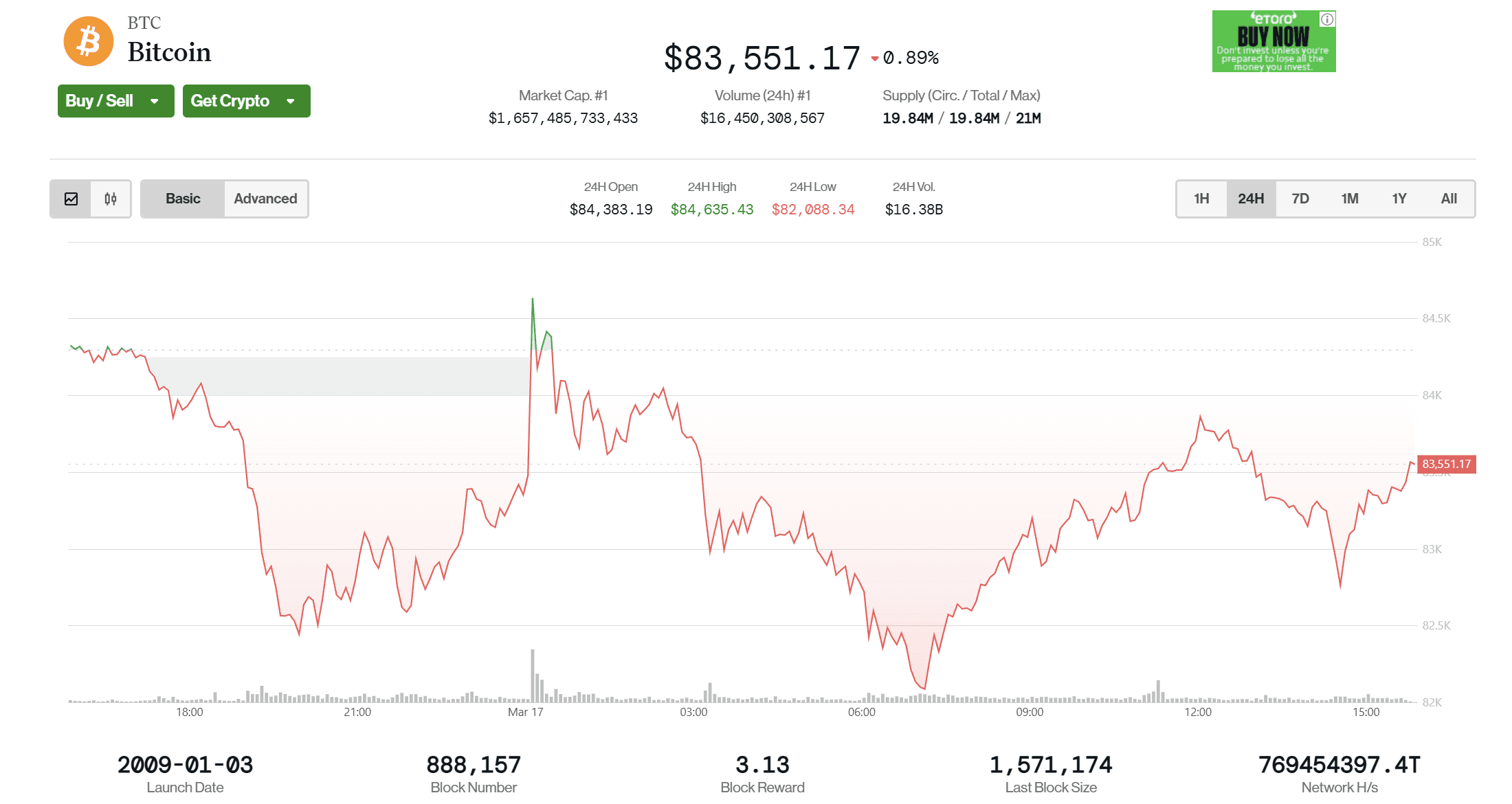

As the week begins, Bitcoin (BTC) finds itself in the red, experiencing a notable 2% decline over the past 24 hours, according to data from CoinDesk Indices. This downturn has caused a ripple effect throughout the broader cryptocurrency market, with major tokens witnessing drops of up to 5%.

On Sunday, Bitcoin approached a significant resistance level at $84,000, making this a critical threshold to surpass if there are hopes for an upward rally. As of Monday afternoon in Asia, BTC is trading just above $83,300. Other major cryptocurrencies, such as XRP, Solana (SOL), Cardano (ADA), and Dogecoin (DOGE), also saw declines of around 5%. In contrast, BNB Chain’s (BNB) emerged as an outlier, showing a 3% increase amidst the market downturn.

The cryptocurrency market has been largely stagnant since last week’s sell-off, which was triggered by newly imposed U.S. tariffs and the prevailing macroeconomic uncertainties. There is growing concern among traders regarding a potential recession in the U.S. due to Trump’s tariffs, leading to expectations of continued market volatility as correlations with U.S. equities remain strong.

Despite these challenges, some analysts predict an upcoming wave of volatility specifically in altcoins and memecoins, even within this flat market environment. “We’ve observed an uptick in trading volume for altcoins following Trump’s World Liberty Financial acquisition of MNT and AVAX, the latter also being part of an ETF application by VanEck,” stated Nick Ruck, director at LVRG Research, in a recent Telegram message. “This could indicate that traders and investors are shifting their focus toward altcoins for potentially better short-term gains compared to established large-cap coins like Bitcoin or Ethereum.”

Traders suggest that the recent sell-off may have been exacerbated by an unwinding of both ETF and spot-linked trading positions. Interestingly, equity valuations outside of the major large-cap stocks remain relatively contained compared to historical averages. Consequently, there is a prevailing market sentiment that this is a ‘buy the dip’ scenario as participants navigate through the turbulence caused by tariff-related news.

According to Augustine Fan, Head of Insights at SignalPlus, “The current sell-off appears to be largely driven by the substantial ‘multi-strategy’ hedge fund tactics that have dominated the macroeconomic landscape.” Multi-strategy (multi-strat) trading involves hedge funds employing a variety of methods—such as arbitrage, long-short positions, and leverage—to maximize returns across different asset classes. In the case of Bitcoin, one popular multi-strat strategy is the basis trade, where funds purchase spot BTC (often through ETFs) while simultaneously shorting BTC futures to capitalize on price discrepancies. This strategy allows for low-risk gains when market spreads are favorable.

However, when profits from basis trades diminish due to tighter spreads or shifts in the market landscape, funds may exit their positions, leading to mass sell-offs of Bitcoin and ETF shares. This liquidation pressure likely intensified the recent market downturn, particularly in the wake of tariff-induced volatility earlier this month.

Nevertheless, a persistent ‘buy-the-dip’ mentality remains among bullish investors. “With equity valuations outside of the major large caps being relatively stable compared to historical averages, and with hard economic data expected to outperform the rapid decline in softer data, the prevailing market consensus is that this is still a ‘buy the dip’ environment as we work through the challenges posed by tariff volatility,” Fan concluded.