Bitcoin Stalls Just Below Record Highs as Gold Shines Bright

As the sun rises this Friday morning, the narrative surrounding bitcoin (BTC) is one of anticipation and hesitation. The leading cryptocurrency by market capitalization has seen its price rally pause just a hair’s breadth away from its all-time highs, coinciding with a notable surge in gold (XAU) and other traditional risk assets, alongside crypto tokens linked to them.

Currently, BTC is trading close to $104,400, leaving it only 4.7% away from achieving a new lifetime peak, according to data from CoinDesk. The recent comments from former President Trump regarding potential tariffs seem to have dampened the momentum for bitcoin. While some market participants express concerns over a possible sell-off before the next substantial bullish wave, the activity in the on-chain derivatives market suggests a different outlook.

Nick Forster, the founder of the decentralized on-chain options platform Derive.xyz, mentioned, “While some crypto leaders are betting on BTC to fall before rallying towards $250K later this year, the Derive.xyz market remains skeptical.” He noted that there’s a 9.7% chance of BTC dipping below $75K before March, and an even slimmer 4.4% chance of it surpassing $250K before September 26. This sentiment reflects a cautious yet optimistic approach among traders.

Meanwhile, bullish activity on platforms like Deribit and the CME indicates that momentum is building towards state-level BTC reserves in the United States. In contrast, gold remains a traditional safe haven, with its prices rising significantly. Recent inflation data from Tokyo has further bolstered the case for the yen as an anti-risk currency.

Gold Hits Lifetime High

Gold prices soared to a record high of $2,799 per ounce early Friday, marking a month-to-date gain of 6.5%. This unprecedented peak is attributed to a rush in the London bullion market to borrow gold from central banks, driven by reports of increased gold deliveries to the U.S. The heightened activity has been linked to concerns over potential import tariffs, as reported by Reuters.

Jeroen Blokland, the founder of Blokland Smart Multi-Asset Fund, commented on the situation, stating that gold’s ascent to record highs against major fiat currencies signifies a trend of currency debasement. This intentional devaluation of traditional paper money could lead to a surge in demand for alternative investments, including cryptocurrencies.

Gold-backed tokens have also gained traction from the rising prices of gold, although they still trade at a discount compared to the physical metal. Tether gold (XAUT) reached its own lifetime high of $2,796 on Bitfinex this morning, according to TradingView data. Similarly, PAXG is nearing record highs, with prospects of surpassing $2,800.

Tokyo Inflation Surges, AUD/JPY Outlook Dims

In related news, consumer inflation in Tokyo has accelerated slightly, as indicated by government data released recently. Notably, the core inflation figure, which excludes volatile food and energy prices, increased by 2.5% in January compared to the previous year, up from a 2.4% rise in December. This swift annual increase could prompt further rate hikes from the Bank of Japan (BOJ), which recently raised the policy rate to 0.5%, the highest level seen in over 16 years.

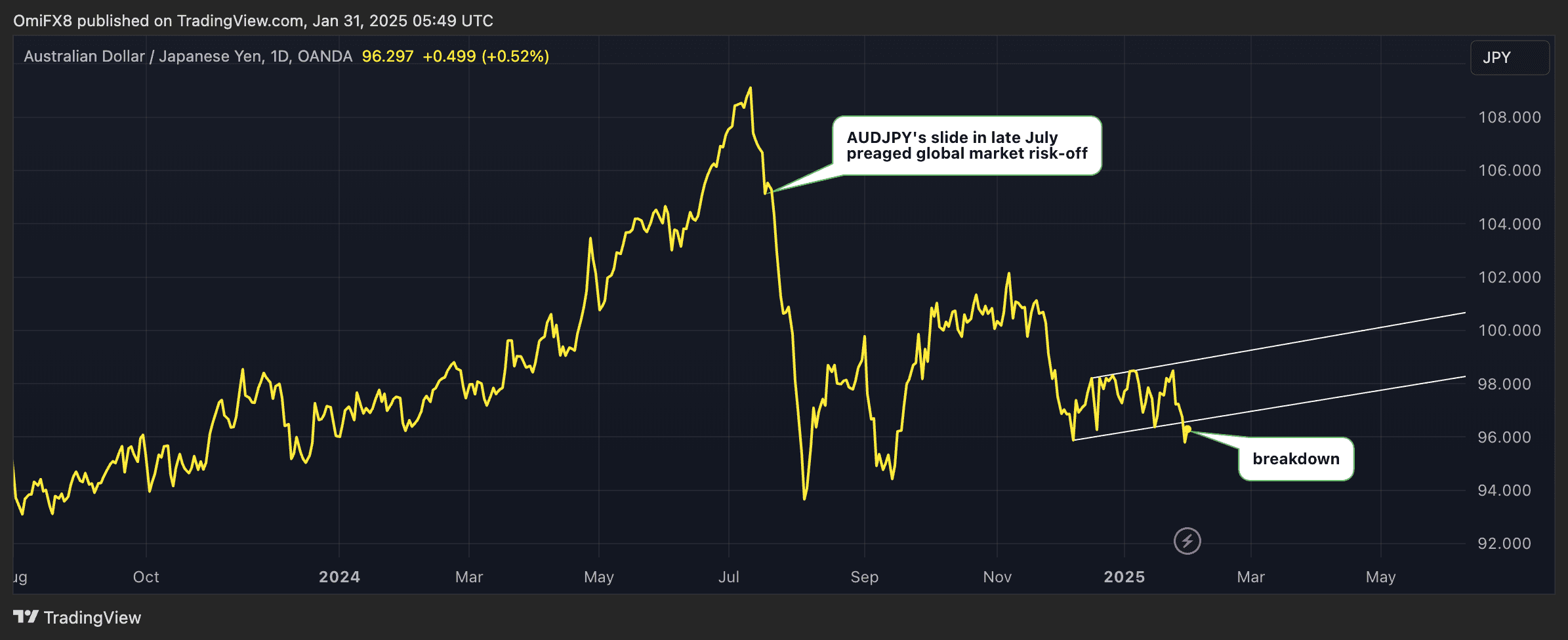

A potential strengthening of the yen could create instability for riskier assets, reminiscent of market dynamics observed in August of last year. The AUD/JPY currency pair, often viewed as a risk barometer in the foreign exchange market, has broken out of a consolidation pattern, signaling further losses and a likely shift towards a risk-averse environment.

Overall, the intersection of bitcoin’s potential, gold’s impressive performance, and economic indicators from Tokyo paints a complex picture of the current financial landscape, leaving investors and analysts to ponder the next moves in this evolving market.