The cryptocurrency market experienced a significant development following the announcement made by the US Federal Reserve at Tuesday’s Federal Open Market Committee (FOMC) meeting. The central bank’s decision to leave the interest rate unchanged for the third consecutive time sparked reactions from various crypto assets. This decision not only affected Bitcoin (BTC), but also led to a rally in the altcoin market. Here are the details…

Altcoin market is on the rise

The cryptocurrency market, which faced some selling pressure at the beginning of the week, witnessed a revival following the positive comment from the Fed. Bitcoin (BTC) rose sharply by 4.5% to $43,000. The rise also spread to altcoins; Ethereum (ETH) traded at $2,250, up 3.75%. Other altcoins such as Solana (SOL), Avalanche (AVAX), and Cardano (ADA) also experienced notable price increases.

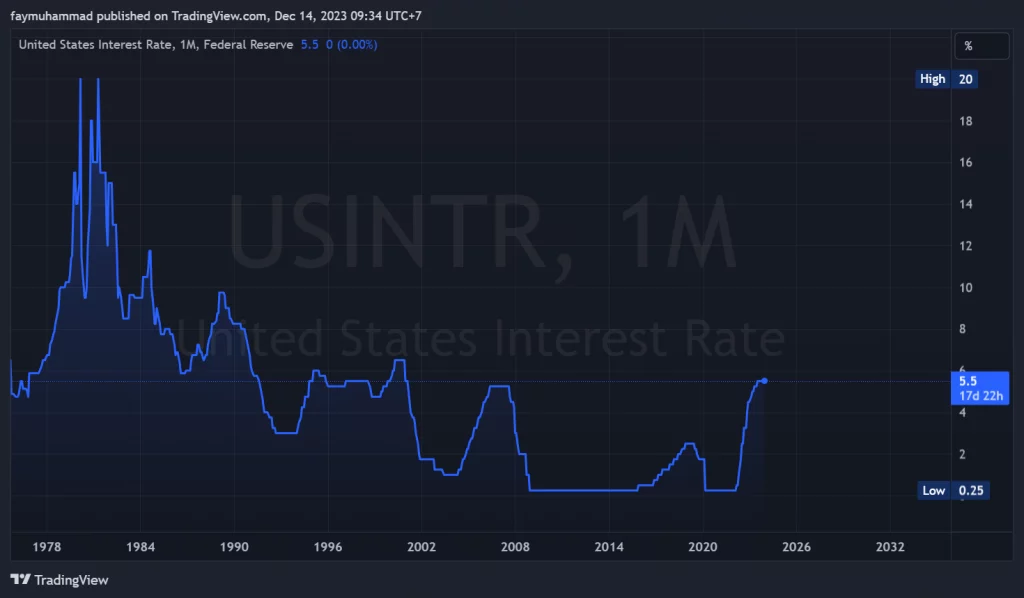

Given the unexpected drop in inflation this year, the Fed’s decision to maintain current interest rates surprised many. Although authorities acknowledge a slowdown in economic growth and the employment market, they foresee three rate cuts in 2024 to bring inflation in line with the 2% target. But analysts on Wall Street were expecting more cuts, indicating a belief that borrowing rates will need to be raised over the next year.

Is the Santa Claus rally coming?

Analysts predict that the Santa Claus rally will continue in the cryptocurrency market due to the FOMC’s dovish stance and the possibility of future interest rate cuts. Cryptocurrency analyst Michael van de Poppe suggests a target range for Bitcoin between $47,000 and $50,000, emphasizing that the recovery follows the risk-off sentiment ahead of the FOMC event. Van de Poppe recommends considering buying dips for both altcoins and Bitcoin, noting the undervalued nature of the market.

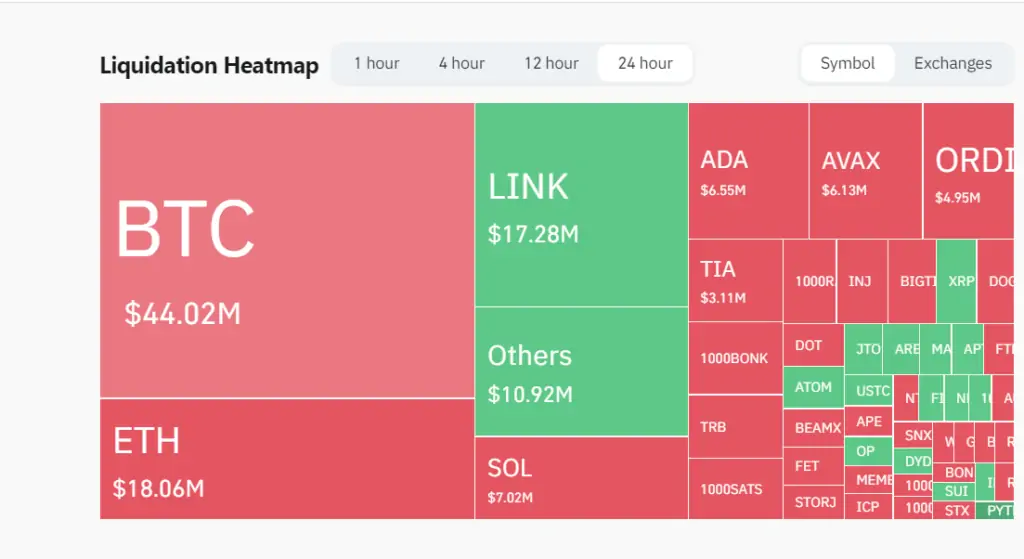

There was a large liquidation in Bitcoin and altcoins

The Fed’s decision had a profound impact on Bitcoin, pushing its value above $42,000. Anticipation of potential Bitcoin exchange-traded fund (ETF) approvals contributed to the rise, signaling a more accessible and regulated market. Broader financial markets also received a positive jolt, with investors interpreting possible interest rate cuts as a green light for riskier ventures, including Bitcoin.

Following the FOMC’s decision, over $160 million worth of cryptocurrency futures were liquidated. The decision to keep interest rates constant signaled possible interest rate cuts in the coming years, causing serious reactions in the markets. Data from CoinGlass revealed that more than $159 million in liquidations occurred, affecting both short and long positions. However, Bitcoin showed resilience, recovered and broke the $43,000 mark after a sudden crash.