Bitcoin is currently trading on Binance.US at a “heavy discount” compared to other major exchanges such as Coinbase, Kraken and BitStamp. Let’s look at the details together.

BTC traded at a discounted price

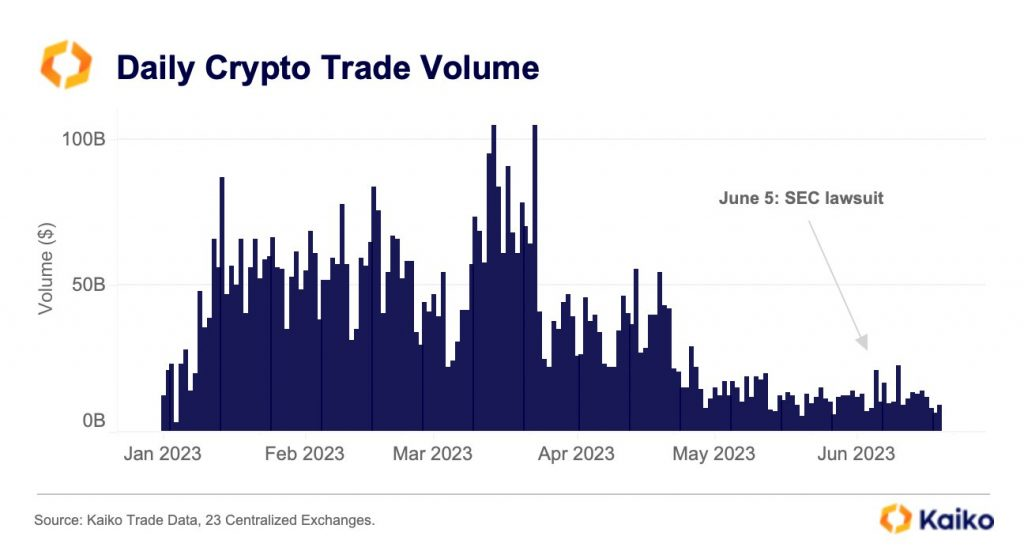

According to Cryptocompare data, Bitcoin is currently trading at $29,523 on Binance.US. This figure is about 500 lower than its counterparts on other major exchanges. However, it is important to note that, as reported by Coinecko, this discount only applies to Bitcoin paired with USD, while Bitcoin paired with stablecoins such as USDT and USDC are traded at normal prices. Binance.US faced difficulties after a lawsuit filed by the US Securities and Exchange Commission (SEC) on June 5th. This legal action contributed to the price volatility for BTC transactions on the platform.

There are currently lawsuits from both the SEC and the U.S. Commodity Futures Trading Commission (CFTC). Therefore, it should be noted that this situation is related to the problems faced by its parent company, Binance. On the other hand, American software company MicroStrategy is known for a significant Bitcoin investment. In recent days, it has experienced profitability in its $4 billion cryptocurrency investment. Bitcoin’s value has exceeded $29,803, which is an important milestone for the firm. This figure is MicroStrategy’s average purchase cost per coin.

Bitcoin and corporate interest

Bitcoin’s positive price performance can be attributed to the growing interest in spot Bitcoin exchange-traded funds (ETFs) by traditional financial institutional players. Established companies include BlackRock, WisdomTree and Invesco. These companies have applied to launch spot Bitcoin ETFs. This situation stimulates investor sentiment in the market.

MicroStrategy’s success story is a testament to Bitcoin’s long-term viability and potential profitability as an investment. The company struggles with volatility and legal hurdles. However, it paid off with his strategic decision to dedicate a significant portion of his treasury to Bitcoin. CEO Michael Saylor has vocal advocacy for Bitcoin. This has cemented the company’s position as a leading player in the crypto space.

cryptocoin.com As institutional attention and regulatory clarity improve, more traditional financial players are expected to follow in MicroStrategy’s footsteps, further legitimizing and adopting cryptocurrencies. The future of the crypto market is still uncertain. However, MicroStrategy’s lucrative Bitcoin investment is wreaking havoc. On the other hand, there are those who look at cryptocurrencies with a long-term perspective. Accordingly, this situation gives hope for investors and enthusiasts who approach with a risk appetite.