Bitcoin (BTC) chalked up a dramatic rebound late Thursday, defying consensus for a continued slide in the wake of a hotter-than-expected U.S. consumer price index (CPI) data

The leading cryptocurrency fell to a four-month low of $18,140 on major exchanges in a knee-jerk reaction to the data, only to climb all the way back to $19,500, mimicking the drop and pop in the U.S. stocks. Prices nearly tested $20,000 a couple of hours before press time.

The unexpected post-data surge supposedly fueled by the unwinding of shorts or bearish trades has brought back the “rocket emojis”on Crypto Twitter, a sign of renewed bullish sentiment.

Industry experts, however, aren’t sure if the overnight recovery has legs.

“I see no fundamental change in the state of the world to suggest a sustainable recovery just yet,” Ilan Solot, a partner at the Tagus Capital Multi-Strategy Fund, said. “Both the macroeconomic and geopolitical outlook remain very unfavorable, and there are no signs that the Fed might ease off tightening in the near term.”

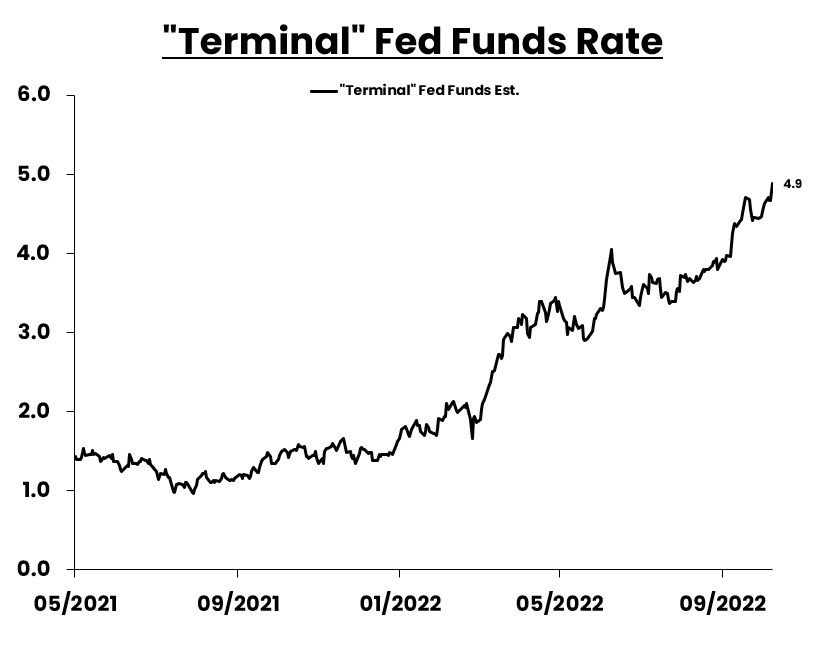

Money markets now expect the Federal Reserve’s (Fed) ongoing interest rate hike cycle to peak near 5%, a significant upward revision from the terminal rate of 4.65% priced ahead of the inflation data.

Markets have pushed up the estimate for the terminal rate to 4.9%. (Daily Shot, Wall Street Journal) (Daily Shot, Wall Street Journal)

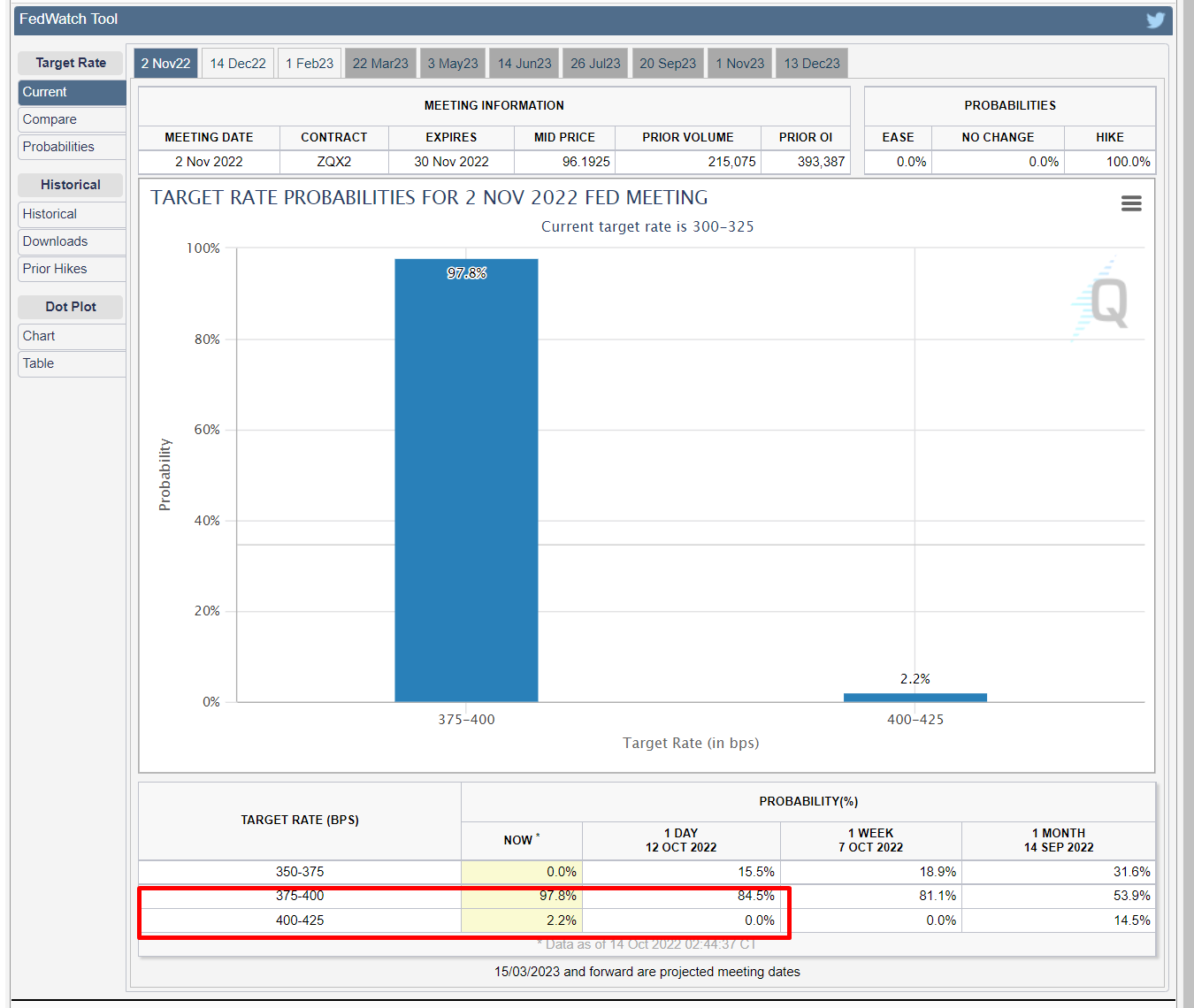

According to ING, Wells Fargo and other investment banks, Thursday’s inflation data has confirmed a 75 basis point (0.75 percentage point) rate increase at the Nov. 2 meeting.

“Broad-based price increases in core services categories, coupled with still-brisk labor market activity, suggest that the Fed could front load rate hikes by more than previously thought at the early November FOMC,” analysts at CIBC said in a note to clients.

Therefore, the bounce in both equities and bitcoin could be fleeting. The Fed has raised rates by 300 basis points this year, yet core inflation, which strips out the volatile food and energy component, rose to a 40-year high in September. However, the so-called liquidity tightening has wrecked risk assets, including cryptocurrencies.

“Fed now expected to hike more than pre-CPI, which certainly indicates this is another example of a bear market rally,” David Belle, founder of Macrodesiac.com and U.K. growth director at TradingView, said, adding that “buy the dip mentality remains ingrained.”

The Fed is now expected to hike rates more than pre-CPI. (David Belle, CME) (CME, David Belle)

Dip buyers have not had any success over the past three months, with the rising bond yields offering a reality check to risk assets occasionally buoyed by short covering or hopes of a Fed pivot.

And bonds may do so again. The yield on the two-year U.S. Treasury note, which is sensitive to rate hike expectations, rose nearly 20 basis points to 4.48% following Thursday’s CPI release and remained elevated near 4.43% at press time.

That’s a sign, the bond market doesn’t expect a significant change in the Fed policy or inflation anytime soon.

“I still can’t find a convincing case to buy into this [equity market] weakness and have no intention of trying to ‘catch a falling knife’ any time soon,” Michael Brown, head of market intelligence at Caxton, wrote in a daily market view, taking note of the post-CPI rise in bond yields.

“In contrast, I remain bullish on the USD,” Brown added. The dollar index one of the biggest nemesis of bitcoin.

Stack Funds’ COO and co-founder Matthew Dibb said bitcoin needs to clear higher resistance levels to confirm a change in the trend.

Bitcoin’s daily chart shows a break above the 100-day SMA and the Ichimoku cloud is needed to confirm a trend reversal. (TradingView) (TradingView)

Since mid-August, the bulls have repeatedly failed to secure a foothold above the 100-day simple moving average and the Ichimoku cloud.

“Resistance is defined by the daily cloud,” Katie Stockton, founder and managing partner at Fairlead Strategies, said in an email.

Therefore, it may be premature to call a bottom while these resistance levels are intact. Bitcoin changed hands at $19,590 at press time.