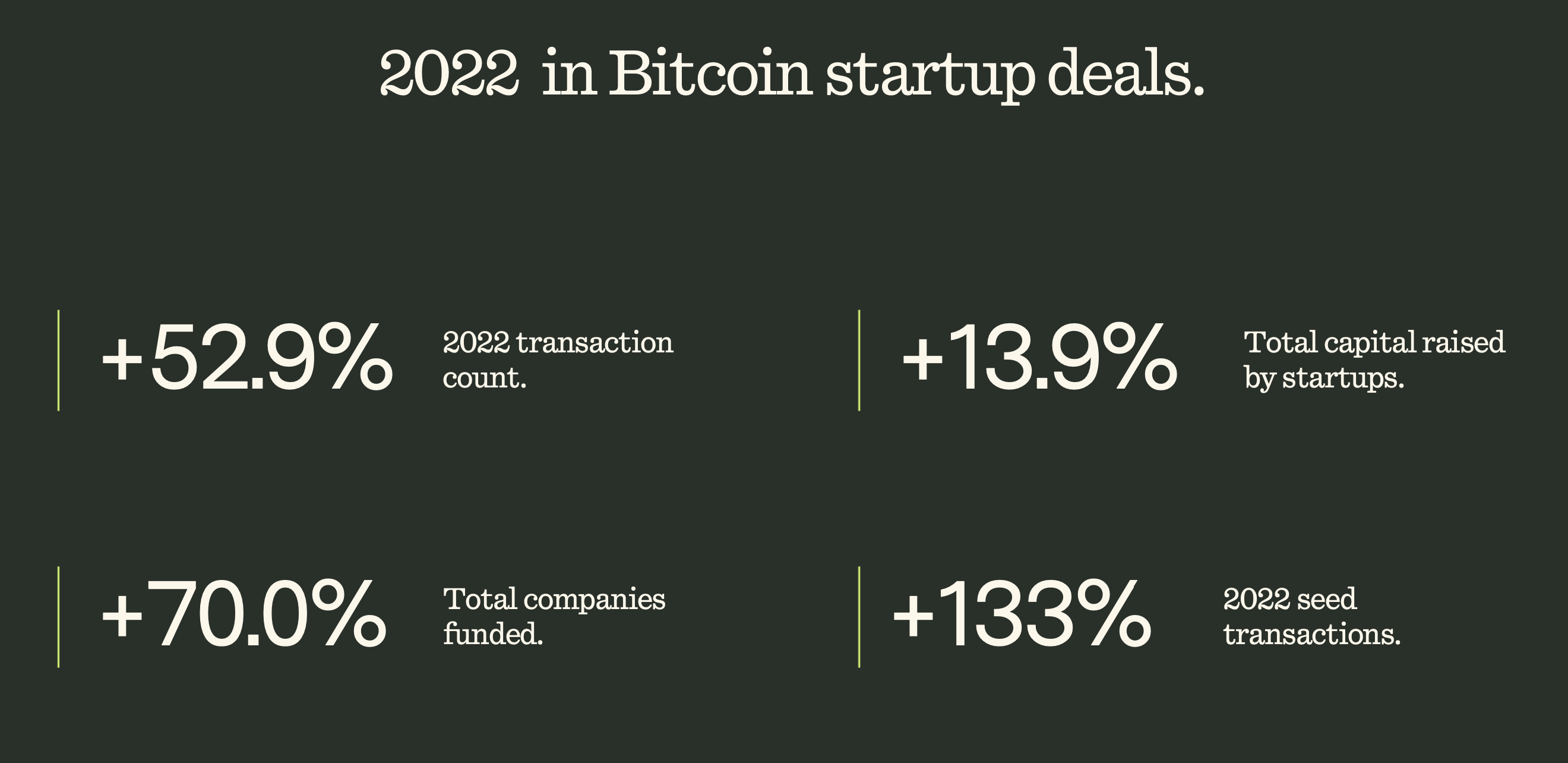

The Bitcoin ecosystem’s venture capital (VC) scene is more robust than you might realize, something we just reviewed at length in a research report. In fact, 2022 was a flagship year. Seed transactions were 133% higher last year versus 2021. There was 70% growth in total companies funded.

A select cohort of Bitcoin startups has “graduated” to the Series B stage or later, so the high growth in seed deals hints at potential early maturation of the ecosystem.

(Trammell Venture Partners)

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Bitcoin VC grew while crypto VC stagnated

Crypto spot markets declined significantly since the November 2021 peak. In the aftermath, the overall crypto VC deal count effectively stagnated. Meanwhile, in contrast to that, Bitcoin VC emerged as a growth category, with 52.9% year-over-year growth.

(Trammell Venture Partners)

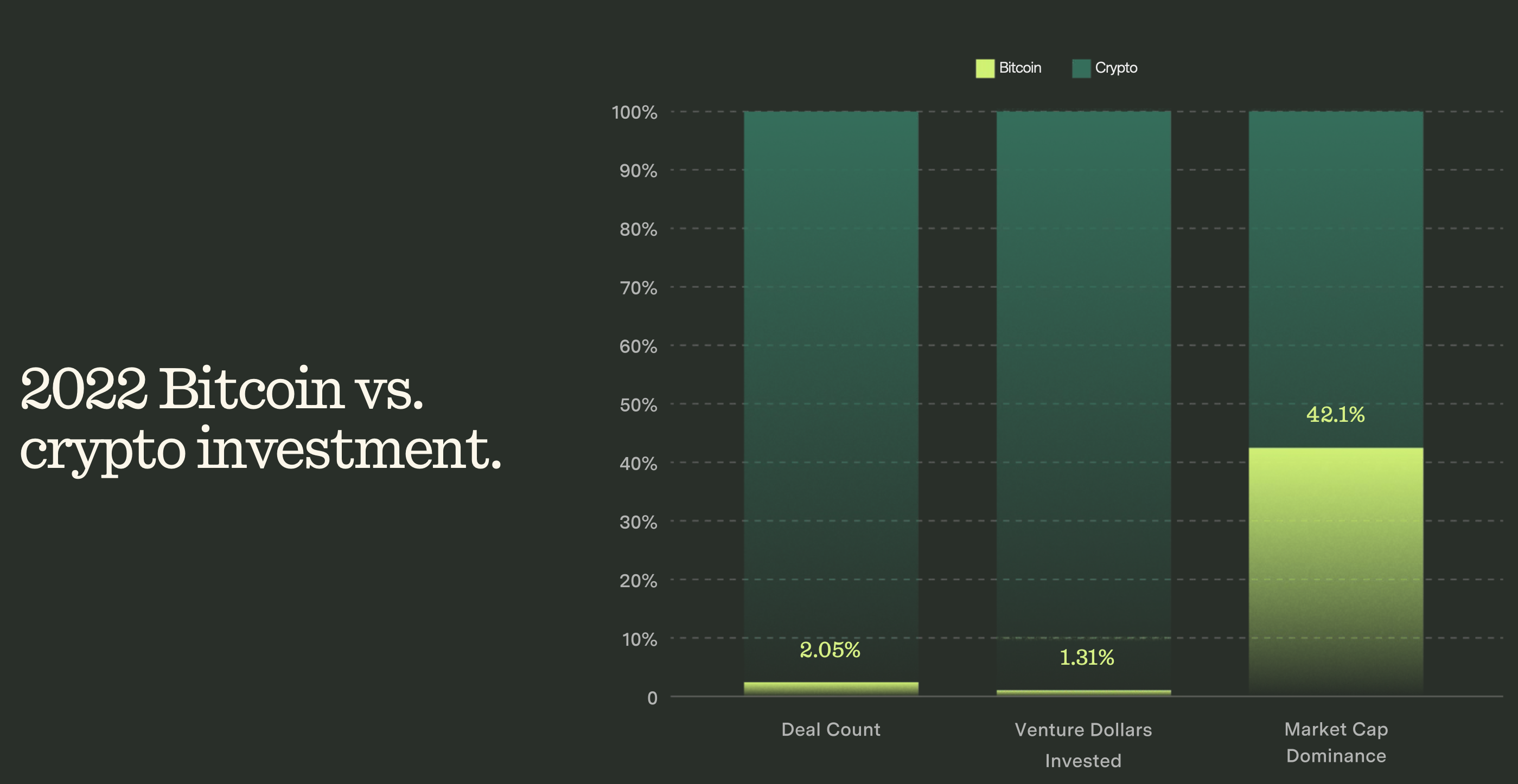

Yet, a severe misallocation of capital remains

The purposeful and conservative approach to making changes to Bitcoin Core has given rise to the narrative that “nothing is happening on Bitcoin,” but the data shows that innovation across the Bitcoin stack has begun to accelerate in recent years. We expect innovation to flourish in the years to come, but for now, the market gap is highly significant. Just 1.31% of total 2022 crypto venture funding was invested in Bitcoin startups.

(Trammell Venture Partners)

Building on the money: Methodical, but with step-function changes

Trammell Venture Partners (TVP) believes Bitcoin has “already won the battle to be the internet’s base monetary layer,” noting some key distinctions. Namely, the Mark Zuckerberg ethos of “move fast and break things” is unsuitable when building a decentralized, global monetary network. Bitcoin Core development is rightfully methodical. That doesn’t mean it’s stagnant.

The Segregated Witness soft-fork activated in 2017 was a technical prerequisite for the Lightning Network, which has in turn grown to a capacity that has unleashed a subsequent wave of innovation. Similarly, Taproot (activated in November 2021) sets the stage for another wave. Of note is Lightning Labs’ Taproot Assets Protocol (TAP), facilitating asset issuance directly on the Lightning Network. If successful, TAP would allow the multi-asset reality to not only exist natively on the Bitcoin stack but also inherit the Lightning Network’s speed, very low cost and settlement finality.

Bitcoin’s careful development has begun to pay dividends. As the composability on the Bitcoin stack expands, TVP believes entrepreneurs will increasingly choose to build their business on the most secure, decentralized, mature platform possible: Bitcoin. And for the readers who keep hearing that nothing is happening on Bitcoin … don’t sleep on the internet of money.