As the US presidential elections approached, “whales”, especially large cryptocurrency investors, began to increase their Bitcoin savings. Projections that Donald Trump will win the 2024 elections are directing these large investors to risky assets. In recent days, 1,806 BTC, or approximately $132 million worth of Bitcoin, were purchased through 11 newly created crypto wallets.

There are large Bitcoin withdrawals from Binance

These large amounts of Bitcoin purchases were made from Binance, the world-famous cryptocurrency exchange. Crypto intelligence platform Lookonchain pointed out these withdrawals in its post on November 6 and reported that investors made an intense Bitcoin outflow. This situation points to large withdrawals, especially from centralized exchanges. This shows that investors tend to store their Bitcoins in cold wallets rather than leaving them on the exchange. In the US presidential elections held on November 5, according to many sources, Donald Trump won in important states such as Pennsylvania, North Carolina and Georgia. It is stated that Trump, who reportedly gained the majority by receiving the votes in these states, won the election race. Following this news, Bitcoin price rose rapidly to over $75,000.

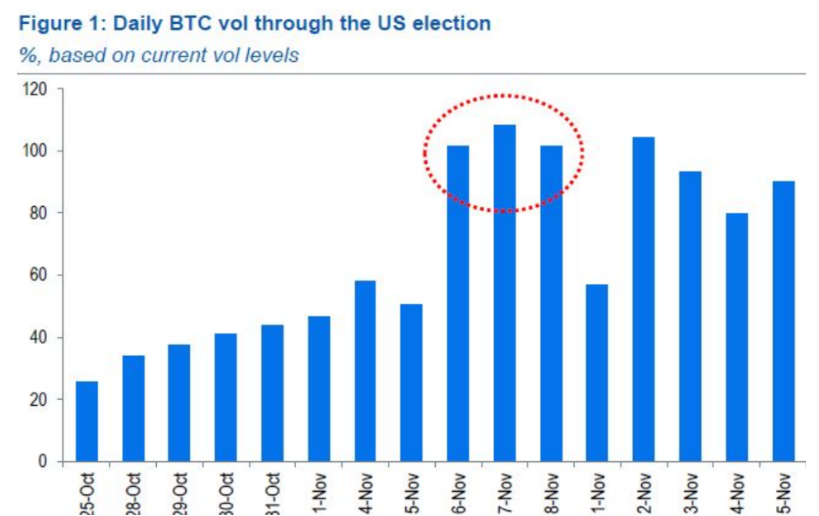

While analysts expect an increase in the volatility of the market after the election, they also believe that this situation will start a new phase in Bitcoin’s bull cycle. Bitfinex analysts predict that Bitcoin could reach $80,000 by the end of 2024. Especially the latest positioning in the options market and the positive expectations of investors about the Bitcoin price by the end of the year support these predictions. The increase in interest at the $80,000 price level of options dated December 27 further strengthens this bullish expectation.

What is the latest situation in the market?

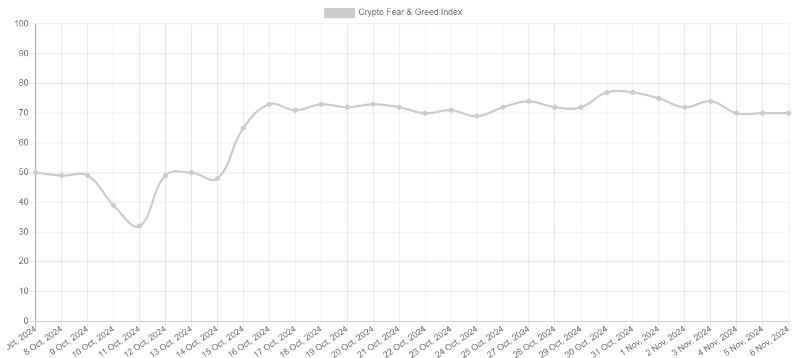

With the impact of the election results, Bitcoin passed the $ 70,000 level, which was previously seen as a major resistance, and turned this level into a support position. Overcoming a significant hurdle in long-term price movements increases investors’ confidence and points to the upside potential of the market. This optimism in the crypto market is also reflected in market sentiment measurements. The Crypto Fear & Greed Index managed to stay above the 70 level during this period. This indicator provides a multi-factor analysis that reflects investors’ appetite and confidence in the market.

This index, which was in the “fear” zone on October 11, quickly rose to the “greed” level after Trump took the lead on decentralized betting platforms such as Polymarket. These odds, which turned in favor of Trump on October 4, became even stronger in mid-October, with Trump gaining a 10-point lead over his opponent. The impact of the election result on the crypto market is due to investors’ increased appetite for risky assets with Trump’s victory. Investors hope that if a Republican administration is re-elected, it will take a less restrictive approach to cryptocurrencies.