Recently, Bitcoin whales have made a significant mobility in the market by selling approximately $ 800 million. According to instant data, the price of Bitcoin is traded at $ 96,153,51. Since this great profit realization coincides with the same period as the price rise, there is a possible change in market sensitivity.

The high rate of sales of long -term investors raises the possibility of withdrawing the price or the beginning of a new market phase.

Bitcoin investors’ profit/loss status

According to data, 82 %of Bitcoin addresses are currently profitable. The average cost price of these investors is around 51,086.23 dollars.

However, this ratio may increase if a 7.85 %segment loss zone and the price continues to decrease. In general, the increase in the number of investors in profit may increase sales pressure and affect the Bitcoin price trend.

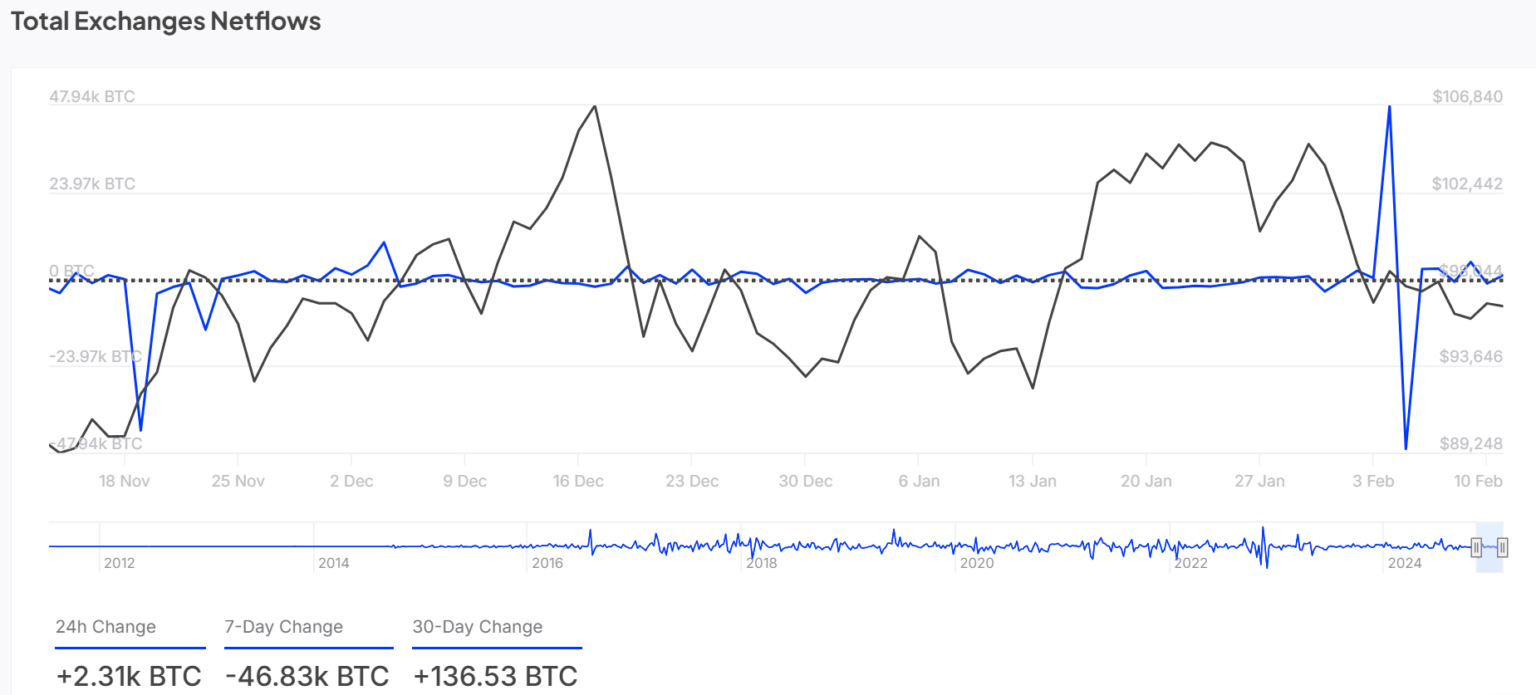

Bitcoin Stream to Stock Exchange: Is more fluctuations coming?

In the last 24 hours, net 2,310 BTC entered the stock exchanges. In the last 30 days, this figure has reached 136,530 BTC, that is, there is a high liquidity movement in the market.

These entrances may show that investors are preparing for sales. However, if the price exceeds significant levels of resistance, this flow may also be a movement that supports the rise.

What levels does technical analysis point to Bitcoin in the short term?

Bitcoin is currently trading in a key price range:

- Support Level: 92,450,82 dollars

- Resistance levels: 101,441,81 dollars and 109.260.07 dollars

The movements above or below these levels can determine the direction of BTC.

- If Bitcoin can exceed the levels of resistance, it may maintain the acceleration of the rise.

- However, if it does not break these levels, consolidation or price correction may be experienced.

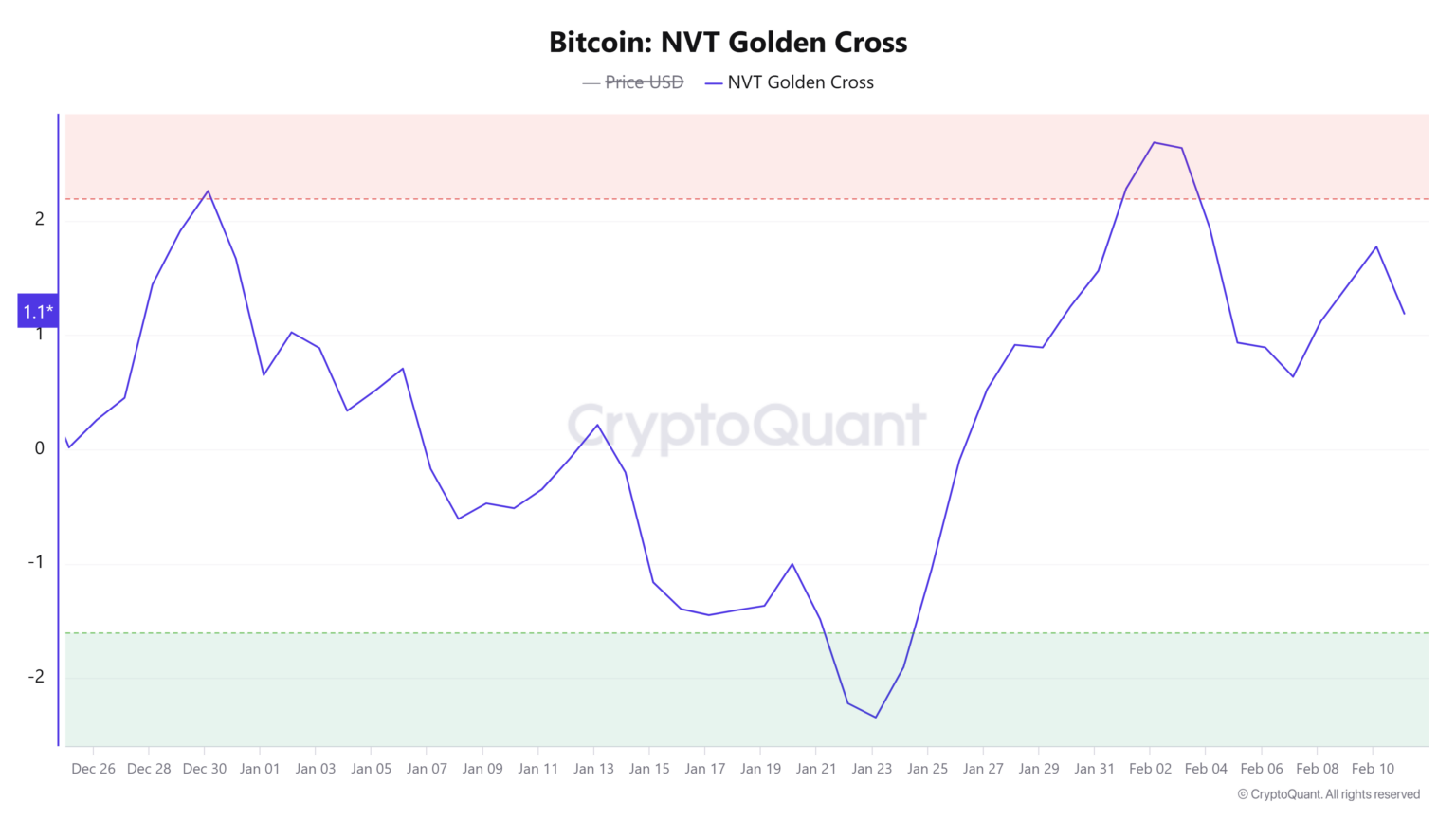

Stock-to-Flow ratio and NVT Golden Cross: Bear signals?

The Stock-to-Flow ratio fell to 1.268,600 in the last 24 hours with a 20 %decrease in the last 24 hours. This shows that Bitcoin’s scarcity may be reduced and may affect the long -term value. NVT Golden Cross fell by 29.22 %in the last 24 hours. This decrease may be indicating a market summit or correction.

These two indicators show that Bitcoin may be under pressure in the short term and that there may be a decrease in demand.