Foretelling market crashes, crypto analyst DonAlt updates his Bitcoin, XRP and LTC forecasts after the latest correction.

DonAlt reveals the level at which he will buy Bitcoin

The popular crypto analyst bought BTC at $16,000 when FTX went bankrupt in November 2022. He then made his first profitable purchase at $25,000. You can check out DonAlt’s other accurate price predictions in this article.

In current analysis, he says he expects $27,000 to buy Bitcoin. He shared that he will also evaluate new opportunities to buy altcoins at this level. The crypto analyst said, “If you show that Bitcoin is trading above $27,500, I am ready to trade again. I will buy altcoins again,” he says. His statements came during his live broadcast on Youtube channel yesterday.

XRP and LTC forecasts

DonAlt also says that the next levels of XRP price will depend on several factors. One of them will be the price movements of Bitcoin after the last drop. According to the analyst, developments from the SEC and Ripple case or in a final decision will have an impact on XRP. DonAlt has this to say about XRP at this point:

Even if XRP wins the case, there is a good chance that the XRP candle will basically look like this if Bitcoin is just on the edge of a cliff. It could fluctuate a bit without breaking below the same resistance by breaking above the current resistance level at $0.55. If Bitcoin falls, then its chances of rising will double.

Finally, looking at Litecoin, the analyst predicted that the price of LTC will fluctuate for a while:

I do not take positions in Litecoin. However, in such turbulent times it outperforms almost any other cryptocurrency. However, there is a very short time left for the halving cycle. That’s why we prefer to wait for a while right now.

Litecoin investors, beware of this date

Litecoin has seen two halvings since its inception in 2011. It will experience its third halving on August 2, 2023.

Prior to that, as of June 14, 2023, it managed to process 25 million transactions. However, this did not bring much good news for investors as the price action of LTC was not affected.

https://twitter.com/litecoin/status/16690327221220517888

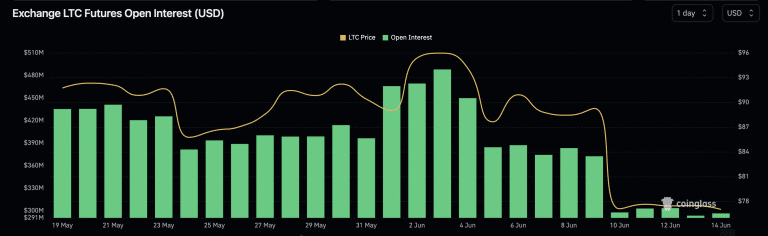

At the time of writing, LTC bulls were also not in sight. The altcoin has been moving relatively sideways since its opening price during the day. In addition to the downward trend, LTC’s Futures Open Rate has witnessed a significant drop since June 9th. A falling open interest rate can be taken as a bearish signal as it indicates that there is no new money in the market.

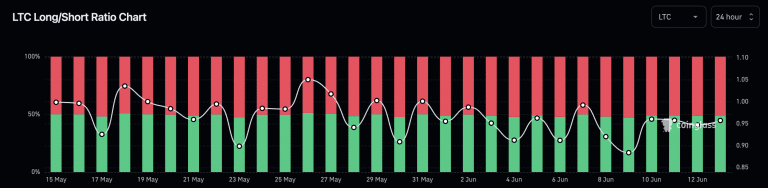

Additionally, LTC’s long/short ratio also favored short positions over long positions. Recently, LTC’s long/short ratio stood at 0.9124 with 52.29% short-term and 47.71% long-term holders. The fact that shorter positions dominated longer positions was also not a great sign for the altcoin.

What does on-chain data say about LTC?

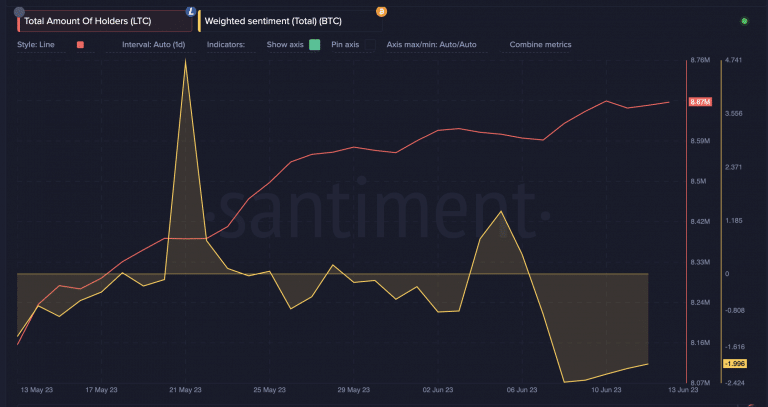

Data from Santiment also shows that LTC’s metrics are not in the best shape. LTC’s weighted sentiment has moved in the opposite direction, although the total number of investors is as high as 8.67 million. As of June 14, LTC’s weighted sentiment is at -1,996. This is a strong indication that the market and investors do not have a positive outlook.

However, an update posted by Litecoin on Twitter may play in favor of the altcoin. According to a tweet posted on June 13, a video emerged of SEC Chairman Gary Gensler stating that LTC is not a security. Given the ongoing turmoil with the position of cryptocurrencies, LTC can only be a spectator.

A video has surfaced showing future SEC Chairman Gensler telling an audience of institutional investors that four cryptocurrencies, including Litecoin, are not securities. https://t.co/gUBKrbBlrA

— Litecoin (@litecoin) June 14, 2023

cryptocoin.comAs we have reported, Litecoin was one of the altcoins declared as securities within the scope of Binance and Coinbase lawsuits last week.